A tale of two risks

Firstly, let’s understand that cash is really a zero-term bond.

There are actually two interest rate risks with bonds (and cash).

- Price risk – where interest rates go up, and the corresponding bond price goes down. If you need to sell them before the maturity date, the increased interest rate relative to the new lower price does not have time to compensate you for the loss.

- Reinvestment risk – where interest rates go down, and you roll over into a new bond at a lower coupon rate.

The shorter the duration, the lower the price risk since the value doesn’t go down much when rates rise, but when rates go down, you have a higher reinvestment risk since you will be getting the new lower interest rate sooner.

The longer the duration, the higher the price risk since the value goes down more when rates rise, but when rates go down, you have lower reinvestment risk since you will continue to get higher returns while everyone else is rolling over into the new lower interest rate.

At one extreme is cash, where you have zero price risk but maximum reinvestment risk.

At the other extreme is long term bonds, where you get maximum price risk but minimum reinvestment risk.

When we talk about risk in terms of investment, it generally refers to price risk, and unfortunately, few people consider reinvestment risk.

In the rest of the text, risk will refer to price risk, but keep in mind that there is another risk, which increases as duration shortens, and since cash is essentially a zero-duration bond, cash is effectively rolled over to the new lower rate immediately each time rates fall.

Risk and return

The fundamental difference between cash and bonds is that bonds are higher up the risk-reward spectrum. Cash has no risk of principal loss (provided it is below the government guarantee limit) and accordingly has a real total return of essentially zero. Bonds have interest rate risk, and for taking that risk, intermediate-term bonds have had a historical real return of around 1% (more over the last 40-year bull run from interest rates coming down from 18% to 1%).

The reason bonds are commonly recommended over cash is that over a decades-long investment timeframe, an extra 1% makes a difference, and despite having a higher risk than cash, they are still low risk compared to stocks.

Diversification

Due specifically to the higher risk, bonds do something that cash does not — they give you a diversification benefit.

During tough economic periods, unemployment rises, people have less money to spend, businesses have less earnings, and consequently, stocks take a hit. The result is a flight to safety as people sell down stocks and move into “safe” assets, specifically government bonds. On top of this, governments are more likely to lower interest rates to stimulate the economy during tough economic periods, resulting in rising bond prices.

Government bonds don’t always rise when stocks are falling, but that doesn’t remove the diversification benefit. It is the same way that emerging markets stocks are a great diversifier even though they don’t always move in different directions to developed market stocks.

It should be noted that only “safe” bonds (particularly government bonds of developed countries) give this diversification benefit. Lower quality corporate bonds tend to be more highly correlated with stocks, and they go down together in market declines. So on top of not providing safety, they also fail to provide a diversification benefit.

The degree of diversification will be based on the duration of the government bonds because an interest rate decrease in 1% will push 5-year bonds up 5%, 10-year bonds up 10%, and so on, so the longer the duration, the more diversification benefit you get due to the higher risk.

De-risking vs diversification

Diversification is the process of balancing exposures to different types of risk within a portfolio.

In William Bernstein’s book The Intelligent Asset Allocator, he tells a story. Let’s assume you have a weighted coin. When it flips heads, you get a 25% return, and when it flips tails, you get a -5% return. The average of these two outcomes is 10%, while the standard deviation (a measure of the amount of variation from the average) is 15%. It just so happens that these metrics are similar to the long-term average and standard deviation of the S&P500.

Now, let’s assume we have a second coin that produces the same +25%/-5% results and the outcome of this second coin is completely independent from the first. In order to spread your bets, you decide to split your investments between the outcome of both coins equally. The result is that you now have four potential outcomes instead of just two. If both coins flip heads, you get +25%. If the first is heads and the second is tails, you get 10%. Likewise, if the first is tails and the second is heads, you get 10%. Lastly, if both are tails, you get -5%. Overall, your average of the four outcomes is still 10%. However, the standard deviation (amount of variation from the average) is now reduced to only 10.6%.

In a nutshell, diversifying between two equal but uncorrelated asset classes lower your risk without lowering your expected return.

De-risking is the process of reducing the variance (magnitude of the ups and downs) of a portfolio.

In the above example, we invested half our money with one coin and half with the other coin whose outcome was independent of the first coin. The result was a lower variance (i.e. risk) without a corresponding lowering of expected return.

If we instead invested half our money with one coin and didn’t invest the other half, we would also be lowering our risk (de-risking), but unlike the above example, we would be reducing our expected return in direct proportion to the lower risk.

It’s possible to change a portfolio in ways that both diversify and de-risk, that do neither, or that do one but not the other.

Starting with a portfolio that is 100% developed countries large caps, for instance, and speaking in broad generalities:

- Adding a highly volatile emerging markets fund would diversify but not de-risk.

- Adding cash would de-risk but not diversify.

- Adding a government bond fund would de-risk and diversify.

Diversification comes from a combination of low correlation to stocks and variance (magnitude of the ups and downs), so long-term government bonds offer better diversification than intermediate-term bonds, which offers better diversification than cash which offers no diversification, only de-risking, because as you shorten the duration, you’re reducing the magnitude of the risk and expected return of the asset class.

What does it mean when the risk of bonds shows up?

The higher risk from bonds lowers overall portfolio volatility when bonds move up while stocks move down.

However, the portfolio risk of using bonds shows up when both stocks and bonds go down together. This is why it is a spectrum from cash being purely de-risking and then moving up the spectrum away from de-risking towards more diversification as the bond duration is extended.

Imagine a scenario where interest rates rise 2% at a time when the stock market is falling. 10-year bonds would go down in value 20%, and as such, they have not “de-risked” your overall portfolio as well as cash would have.

This is the portfolio-level risk showing up in the decision between cash and bonds.

Essentially, the difference between cash and bonds is that you’re moving along a spectrum of no risk, no expected return, no diversification to higher risk, higher expected return, more diversification.

It bears repeating that:

- This “higher risk” of bonds over cash is still far smaller than that of equities.

- This higher risk within bonds improves the “overall” portfolio risk-return ratio due to the diversification effect.

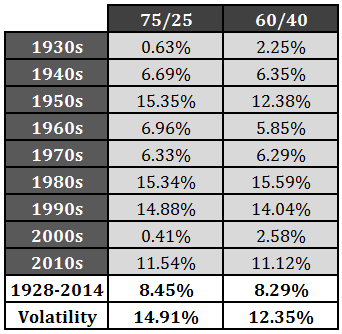

You can see the effect in this chart from A Wealth Of Common Sense.

Between 1928-2014, to get the same returns replacing bonds with cash in a portfolio of 60% stocks and 40% bonds required 75% stocks and 25% cash, but due to the loss of return and diversification benefit of bonds, for the same return, you had to take on higher volatility of 14.9% vs 12.35%

This article shows the diversification effect of adding 10% bonds to an all-stock portfolio. The benefit to cost at the end of the stock-to-bond spectrum is disproportionately large.

How can I use any of this?

Here are the common themes I see put forward regarding cash vs bonds, and you may be able to take something away from them.

- Cash has an expected return of nothing over inflation. It can hardly even be called an ‘investment’. Over decades of retirement investing, even a 1% real return makes a difference, which is why bonds are almost universally used over cash.

- Long-term government bonds have more risk than many want in their portfolio, particularly people who use bonds as their “safe” asset class, which they can draw upon during tough economic times such as recessions. Also, at the time of writing, there are no long-term government bond funds available in Australia.

- This often leads to intermediate-term government bonds as a kind of middle-ground, where you get a little higher return than cash and not much higher risk, especially due to the diversification effect.

- Some people separate these out into a longer and shorter duration investment, where the longer-term investment is intermediate-term or long-term bonds, and the shorter-duration investment is short-term bonds or cash. This way, if you need to draw on it, you can leave your longer-term bond fund to do its part as a diversifier and provide a higher expected return.

- Some would ask why you can’t just then use your short-term bonds (or cash) and invest the rest into stocks for a higher return. The reason is that intermediate-term government bonds are still FAR lower risk than stocks. You may find yourself in a long drawn out recession where your short-term bonds or cash run out, and you don’t want to draw on your stocks when they are low. Also, few people have the stomach to hold an all-equity portfolio seeing your portfolio lose half its value and not know if it will take a decade or more to recover (this has happened before, more than once).

Low interest rates – a spanner in the works?

Interest rates have come down from 18% around 40 years ago, down to 1%. With yields so low now, is it even worth it to invest in bonds? Wouldn’t I be better off waiting until interest rates go up?

Canadian Couch Potato provides a salient response –

The first thing to discuss is this idea that interest rates are highly likely to go up in the near future. I don’t think we can take people seriously anymore if they continue to beat this drum. We have been hearing this argument almost constantly for at least seven or eight years, and it has been spectacularly wrong. Bond yields have trended steadily downward since the end of the financial crisis of 2008-09, even as the economy has recovered. If nothing else, that should tell you that anyone who thinks they can forecast interest rates is delusional. So if you’re building a portfolio based on the idea that interest rates are certainly going to rise, you’re making a critical decision based on guesswork.

There are countries with negative interest rate bonds already, so it is quite conceivable that rates could continue to drop for many more years.

An important point that’s often missed is that while bonds can have negative returns in the event of rising interest rates, the reinvestment at a higher coupon and the benefit of compounding means that provided your investment time horizon is long term, you’re eventually better off holding bonds over cash.

Tyler from Portfolio Charts wrote a fascinating article on bond convexity explaining why, at low interest rates, the diversification effect is magnified (depending on the bond duration). So, unless we specifically expect interest rates to rise, the diversification benefit is still very much available even at low interest rates.

So, while it is true that interest rates are low, it isn’t such a compelling argument to avoid bonds.

Not only that, if you do go to cash, when exactly do you get back into bonds to get that higher expected return? You keep waiting and waiting. Meanwhile, interest rates keep falling, and you keep missing out on both the higher return and the diversification effect. Eventually, you give up waiting and get back in, only to find that rates start rising then (Murphy’s Law). Of course, you could stay in cash indefinitely, but then you either have to accept a lower return or the higher volatility from more risky assets, neither of which are particularly attractive.

Final thoughts

Bonds are not a short-term investment. They carry more risk than cash, but at a higher return than cash yet a much lower risk than equities, and without a specific date to use them, the higher return over multiple decades is why they’re generally recommended over cash. While they are higher risk than cash, due to the diversification benefit, around the edges at very high equity allocations, the improvement in risk is disproportionately higher than the cost. The fact that interest rates are low is not as convincing an argument as it appears on the surface.

Cash is money that you need to draw on in the short term and in case both bonds and stocks are down together. You want to be wary of overdoing the amount you keep in cash due to the lost opportunity cost of having it invested and producing a return.

Further reading

The risk-reward spectrum

Why bonds?

Bond funds

Low interest rates – should I move from HISA to Bonds?