Stake is a low-cost online broker that lets you trade shares on the Australian and US markets. It has one of the lowest cost Australian CHESS sponsored trade fees at $3 (up to $30,000 trade size). You can also buy fractional shares with their US trading.

This Stake review will go through what you need to know so you can make the best decision in choosing a broker, including who is Stake for, how does Stake work, is Stake safe, how much does it really cost to trade with Stake, how to sign up, and alternative brokers depending on what you are looking for.

As per the disclaimer at the end of the page, all information on this website is for general information only and should not be taken as constituting professional advice.

In this Stake review

- Stake pros and Cons

- What is Stake?

- Who is Stake for?

- How much does Stake cost?

- Is Stake safe?

- Does Stake use stock lending?

- Is Stake easy to use?

- Transferring to Stake results in a new HIN

- Customer service

- Does Stake offer live data and reporting?

- The GameStop (GME) debacle

- Frequently asked questions

- Stake alternatives

- Online trading platforms comparison

- Stake review — final thoughts

Stake pros and Cons

Pros

- Very low-cost $3 flat-fee trading fee (up to $30,000)

- CHESS sponsored

- US trading, including fractional investing

- Automated US tax compliance (W8-BEN form lodging)

- Very quick and easy to set up (fully digital)

- Excellent easy to use mobile and web interface

- Prompt customer service via email

Cons

- Very high foreign exchange fees

- The free account is severely lacking in data & research

- No live customer service (phone or live chat). Email only.

- No autoinvest feature

What is Stake?

Stake is an online broker established in Australia in 2017 to offer zero-brokerage US trading to the Australian market and rapidly grew to become one of the largest stock trading platforms providing access to the US markets.

Stake has since added Australian share trading, becoming one of the lowest fee CHESS sponsored brokers on the Australian market.

Stake has launched in other countries to provide access to US trading, but Stake itself is based and regulated in Australia and was originally designed for Australian users.

Who is Stake for?

Stake is for investors who want to manage their own share trading account and want to avoid the high fees of percentage-based platforms where the ongoing fees grow with your portfolio. It is suited to those looking for access to a very low-cost Australian CHESS sponsored brokerage and access to US shares.

Setting up and trading through Stake is very easy, and if you have not traded before, it is very easy to learn how. However, I would recommend learning about investing before buying shares so you understand the nature of the stock market.

How much does Stake cost?

Ok, let’s get right to what you want to know — how much does Stake really cost?*

What is Stake’s Australian share trading costs?

For Australian share trading, there is a flat fee of $3 (AUD) up to $30,000 trade size and 0.01% above that, and no other fees such as account opening fees, inactivity fees, etc. Offering CHESS sponsored trading for this price is a game-changer and has resulted in other low-cost CHESS sponsored brokers trying to avoid losing market share by reducing their prices, including some like SelfWealth temporarily offering free trades.

What is Stake’s international share trading costs?

US trading fees were free, but from March 24, 2023, this is no longer the case.

Stake offers US share trading, also for a flat fee of $3 (USD) up to $30,000 trade size and 0.01% above that.

With such low fees, the obvious question here is —

How does Stake make money?

In a word — foreign exchange (FX) fees.

Stake’s advertising states $0 FX fees per trade, which will undoubtedly mislead many into thinking there are no FX fees. But at least they write beside it in the same large font 70bps on deposit and withdrawal only to distinguish that there is still an FX fee and that it is not on each individual trade, but rather only when you convert between your AUD and your USD accounts. Once you have converted, you can trade as much as you like, and there is no FX fee until you eventually convert back.

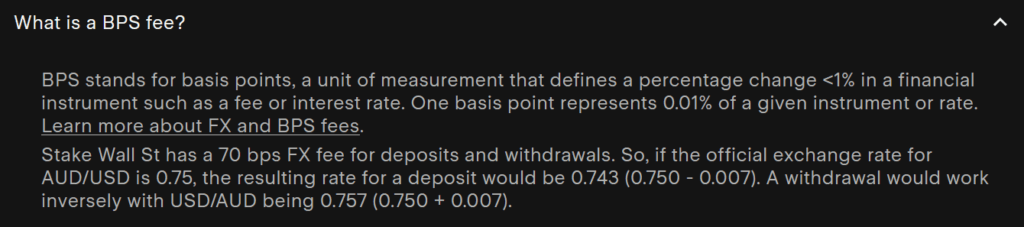

How much is Stake’s FX fee?

The FX fees are quoted at 70bps (pronounced 70 basis points). A basis point means one-ten-thousandth, and 70 basis points is 0.70%, so you would presume it is 0.70% of how much you are transferring, but this is not the case with Stake.

First, let’s see if we can figure it out what it is from their explanation:

Now let’s explain it using language that is not designed to mislead.

You are charged 70c USD per $100 AUD, which, depending on the AUD/USD rate, comes out to approximately 1% or a whopping $100 per $10,000 exchanged. And this will be payable again when you transfer back.

To calculate, Google ‘AUD/USD’ and divide 0.7% by that number. E.g., AUD/USD of 0.73 would cost 0.7%/0.73 = 0.96%.

Most Australian brokers that offer international trading charge very high FX fees of between 0.50% and 0.70%, but this is high even compared to them.

Can you send USD in directly to avoid the high FX fees?

Previously, you could send your AUD to a cheaper currency converter like Wise or Revolut and send the converted USD directly into Stake’s US broker DriveWealth where your USD and US stocks are held to bypass the high FX fees, but they no longer allow that. Here is a response by Stake:

Thanks for reaching out.

Due to some changes in the AML policy of our broker (DriveWealth), unfortunately the Direct USD funding method has been removed from our funding options.

Having said this, you can still fund your account via our other funding options (please check your wallet).

We are also constantly looking at bringing new deposit methods to make your Stake experience even more positive.

Is there an alternative to the high FX fees?

For international share trading, Interactive Brokers (IBKR), along with very low-cost trading fees, has wholesale FX rates at 0.002%, which comes to $0.20 per $10,000 exchanged. That’s 250-500 times cheaper than local brokers. IBKR is a custodian-based broker rather than CHESS sponsored, but since CHESS sponsorship is only available for Australian shares, trading on exchanges outside Australia will be custodian-based anyway. Also, IBKR is the largest broker in the world and is listed on the US stock exchange.

Other fees

For Australian trades, there are no other fees, such as account opening fees, inactivity fees, transfers to or from other brokers, etc.

For US trading, there are some other fees:

- US Tax form fee: $5 flat fee for the automated W8-BEN form lodging (most brokers do this for free)

- Non-stake USD transfers: $5 fee applies to USD transfers into your account not initiated by Stake’s FX partner

- Express fee: 50 points (.5%) express deposit fee for next day fund clearing

- SEC Fee: $0.051 per US $10,000 of sale proceeds. An SEC Fee for regulator costs

- TAF Fee: $0.000119 per share capped at $5.95. A FINRA fee (a US regulatory body) fee

- ADR Fees: $0.01 – $0.03 per share per quarter. To compensate the agent bank providing custodial services

- Share Transfers In from another broker: Free for all brokers

- Share Transfers Out to another broker [1]: $200 per account on both ACATs or DTC. DTC transfer includes up to 4 positions. Additional positions on DTC are $50 per position.

[1] From Investopedia:

What Is an ACAT Out Fee?

Some brokers charge existing customers a fee to ACAT assets out of their account to a new brokerage. This fee can be as high as $100 or more per transfer. Brokerage firms charge this fee to make it more costly to close the account and move assets elsewhere. Not all brokerages charge these fees, so check with yours before initiating a transfer.

It is worth noting that Interactive Brokers has no ACAT out fee.

While you can trade with their free account using the above-mentioned fees, it does not have live data. For live data, they offer a premium trading account called Stake Black — more on this below.

Final thoughts on Stake’s fees

For CHESS sponsored Australian shares trading, Stake offers an extremely low fee. Combined with the ease of use, it makes for a great option for those wanting to manage their own investments.

If you want access to US trading, either for infrequent USD transfers relative to more frequent US trading or if you just want access to the occasional purchase of US shares, Stake may fit the bill. But if you are looking for long term wealth accumulation using US shares, the FX fee will eat into your returns (as will US trading by other Australian brokers offering US share trading). In that case, you may want to take a look at Interactive brokers to lower the FX fee.

What about those free stocks you get when you sign up?

You get a free stock when you deposit $50 AUD into your US wallet, and you get $10 AUD to trade with when you deposit $50 AUD into your AUD wallet – provided these are each within 24 hours of signing up.

Sounds great! Until you do it.

The AUD wallet is a nice $10 bonus, but when you deposit into the USD wallet, most people get the GoPro stock, valued at around $5 USD. But when you sell it and convert it back to AUD, you see that it has cost you:

$3 USD in brokerage to sell it

$2 USD in FX fees on the way in (they have a $2 minimum)

$2 USD in FX fees on the way back

$5 USD for their automated W8BEN form submission which most brokers do for free.

That’s $12 USD or about $17 AUD in exchange for a $5 USD stock.

These fees give you a little taste of how stake gets their money from you.

Is Stake safe?

Stake is licensed in Australia as a representative of Sanlam Private wealth, so it is subject to regulation by the Australian Securities and Investment Commission (ASIC).

Australian share trading

Australian shares bought through Stake are CHESS sponsored with individual holder numbers (HINs). This means they are not actually held by Stake, and instead, your ownership is listed (and viewable) independently of Stake through the share registry. This provides a layer of transparency unmatched by brokers who use a custodian model. Stake uses CHESS sponsored market participant Finclear to execute their trades. Finclear is a competitor of Openmarkets, which is used to execute trades for Pearler, Raiz, SixPark, Stockspot, and others.

US share trading

For US trading, Stake itself does not provide the stockbroking. They provide access to US financial markets by partnering with US broker DriveWeath LLC.

Unlike with Australian shares, CHESS sponsorship is not available for shares on other exchanges such as the US, so shares on other exchanges are held under a custodian, which means the broker appoints a separate company — a custodian — to hold the shares under trust on your behalf. When you purchase shares through a custodian-based broker, they hold the legal title for you, meaning they are the legal owner and you are the beneficial owner, so you receive the benefits of the asset without the legal ownership of it.

The two most important things to be aware of in determining if DriveWealth is safe are:

- Their FINRA registration status, which you can check here to validate their registration, licenses, and any arbitration cases or violations. FINRA is the Financial Industry Regulatory Authority. They monitor all registered broker dealers in the US.

- That they are listed with SIPC to provide another level of protection in case they go bankrupt. SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.

The AUD Wallet

While the AUD wallet is described as a digital bank account, and which has its own BSB & account number, it is neither a bank account nor is it a separate account from other individuals. The current Airwallex/Stake PDS (as of August 2022) says that “Funds represented by the Wallet will be collected and pooled with funds of other clients of Airwallex in one or more client trust accounts with a licensed bank in Australia.” It also states that “Airwallex is not a bank”. However, as of March 2023, the updated document states that the funds in your Wallet are protected under the Commonwealth guarantee by Global Loan Agency Services Australia Nominees (GLAS) in case Airwallex is found by APRA to be in breach if it’s legal obligation.

The PDS also states “This PDS has not been lodged with the Australian Securities and Investments Commission (ASIC) and is not required to be by the Corporations Act 2001 (Cth)”. This means there is no requirement for disclosure and auditing of accounts.

While the updated addition of the Commonwealth guarantee is a big step in the right direction, my suggestion would be not to keep cash in brokerage trust accounts for long periods and only move money into there when you are ready to trade as soon as it hits the wallet, and when selling, move it out as soon as it is settled. And this would also be my recommendation with other brokers.

Does Stake use stock lending?

From July 2022, Stake users were automatically opted-in to allow their US shares to be lent out to Stake’s underlying US broker, DriveWealth, and for DriveWealth to lend it out to other companies, where Stake account holders (you) receive a portion of the lending fee.

The main risk with your stocks being lent out is if the borrower defaults. DriveWealth retains 102% of the value of your stocks, and if the price rises over 2%, the borrower defaults and has a contractual obligation to cover the market value. While it sounds fairly safe to hold 102% of your stock’s value at the time of borrowing, contracts aren’t always followed, and sometimes companies go bankrupt, and you could face a loss of the difference above the 102% held. Additionally, the borrower gets voting rights.

For taking on all the risks, you get 20% of the interest paid on the loan, while DriveWealth and Stake take get the rest, risk-free.

An important consideration is that the companies borrowing these stocks are doing so to short the stocks. Shorting is borrowing a stock (in this case, your stock) to sell it at the current market price, based on the idea that it’s going to go down, and they can repurchase it at a lower price and give it back to you, keeping the profit (minus the interest that is paid to Stake and DriveWealth, of which you get a small portion). The effect of shorting is that as more of those shares are on sale in the market, there is more supply, which drives down the price – of your stock. The question you have to ask is whether you want to lend out your stock, which will be used to push down the price of your stock.

If you don’t want this, you will have to actively go and opt out by going to your Wall St account, Account, Settings, Trade settings, Stock Lending settings, and turning it off.

It should be noted that Vanguard Australia also does this

Interactive Brokers (IBKR) also offers this but gives you 50% of the interest paid, and the IBKR account I saw had this off by default (i.e., opt-in instead of opt-out), but I am not sure if that is still the case.

Is Stake easy to use?

Yes! They have put the work in, and both their web and mobile app have one of the best interfaces of any Australian online broker. The interface is easy-to-use, has a great look and feel (without the cluttered social features of SelfWealth), is reliable, offers two-factor authentication, touch/face ID login on the app, excellent search functions, market, limit, and stop orders, and have ongoing improvements in the works. You can even initiate a portfolio transfer from your current broker through the Stake app. However, something to be aware of when transferring is that it results in a new HIN, as described below.

Transferring to Stake results in a new HIN

The reason Stake can do a transfer in record time is that Stake does not transfer your existing CHESS holder identification number (HIN) even though FinClear, who executes their trades support it. Instead, you get a new HIN, and your holdings are transferred to the new HIN.

The upside is that you can start trading almost instantly.

The downsides are:

- all your old trade information from your former HIN may be lost which will make tax time a pain, especially later on when one day you start selling down. If you don’t arleady keep a record of all transactions, you will want to download a copy of all your transactions from your old HIN beforehand. If you forget, you may have to pay the registry to reconstruct the history for you later for the former HIN.

- it will split the dividends up that you need to report in the financial year across multiple HINs.

- if you use a dividend reinvestment plan (DRP) and there was not enough for a full additinoal share, which is quite normal, the residual cash is held by the fund. When you no longer have your shares on a HIN, some funds will pay out the residual cash next time they’re due for a payment, but others will just keep them (yes, you read that correctly). This won’t be a life changing amount of money as it is less than a single share’s price, but if this amount is a concern, you can turn off DRP and wait for the next lot of dividends to be paid out, then move your holdings to Stake after that.

Update: It appears you can now transfer your existing HIN to Stake, but you need to email them rather than going through the regular transfer process.

Customer service

Stake’s customer support channels are limited. There is no live chat or phone support — only email support. I can imagine this being concerning if you at least want to know there is an option to call in some worst-case scenario. However, I’ve found that emails were answered promptly by Stake’s helpdesk.

Also, unlike some other brokers who make you make you print everything out, sign it, and scan it back, Stake has embraced the digitisation of everything, making things like transferring from another broker to them painless. This reduces the need to deal with customer services in many cases.

Does Stake offer live data and reporting?

Stake’s basic (free) account gives you only very basic data such as market cap, P/E ratio EPS and not much else — it doesn’t even provide live market depth (the open orders waiting to be executed if their price is met). To get this with Stake, they offer Stake Black, a paid subscription service that provides more extensive data and some other functionality.

For US $9/month, Stake Black gives you access to:

- Instant buying power — the ability to trade on unsettled funds in your USD account prior to the T+2 period (for Australian share trading, you get this with the free account)

- Full company financials — access to enhanced financial data on the stocks listed by Stake

- Buy-sell ratings — shows you what the sentiment is on US-listed stocks

- Price targets — allows you to see what price targets have been set by leading stock market traders

- OTC stocks

Most other brokers offer at least live market depth for free. Live market depth is essential for ETF investing because, unlike with individual shares, with ETFs, you should be using what is called marketable limit orders, which is where you use a limit order and place the price a few cents above the ask if buying or a few cents below the bid if selling. Due to the way orders are matched, it will act just like a market order, but you’ll never have any big surprises. Not seeing the market depth means you will need to open up another platform to see the live buy and sell orders.

In addition, some may prefer more data, and some other brokers offer extensive data for free.

Commsec, for example, offers:

- Real-time prices

- Stock screener and advanced charting including heat maps, graphs and comparison charts

- Data that goes back a very long way

- Pricing alerts (email or mobile notification)

- A news feed with technical analyses for your stocks (useful for traders, not so much for buy-and-holders)

- Personal watch lists.

What you can do, and what I would suggest, is to use your basic (free) Stake account for buying and selling, and open a Commsec account (which is free to open) for real-time pricing, research, watch lists, reporting and historical data.

The GameStop (GME) debacle

Some people may have heard about the GME short squeeze, which made big headlines. I don’t want to rehash it all. However, the relevant part to Stake is that several US brokers put limits on or ceased allowing their customers to buy GME stock altogether, which attracted criticism and accusations of market manipulation from prominent politicians and business people from across the political spectrum.

Stake was forced to suspend trading of GME and another couple of US short-squeezed stocks as a result of a decision by their US broker DriveWealth to disallow customers buying GME, AMC, and NOK stock. The reason given was increased capital requirements set by the DTC. Whether you believe that is for you to decide.

If you are an active trader of US stocks where something like this could potentially impact you, an account with an alternate broker may be an option to consider.

It is worth noting that this does not affect Australian share trading through Stake. That is because, while Stake uses DriveWealth to execute their US trades, they use FinClear to execute Australian share trades. FinClear is an Australian market participant and uses a substantially different clearing system (CHESS) to execute trades.

Frequently asked questions

Does Stake offer tax reporting?

Yes, they do. They include:

- Tax events (sale of stock triggers a tax event, dividend payments)

- Short term vs long term capital gains reporting

- Transactions reports offering beginning and end of period balances, official exchange rates displayed on your transaction log, and trade volumes to assist you or your accountant in determining your tax obligations with greater ease.

- They also have Sharesight integration.

Does Stake have autoinvest?

If you want a completely set-and-forget investment where part of your salary is automatically sent to your trading account and purchased regularly, so your wealth is growing in the background, you will need to seek out an alternate broker such as Pearler.

Besides removing one more thing to remember, automation has a behavioural benefit along the same lines as mentioned above. Automation removes the need to log in to your account, see the value of your portfolio fluctuate (which is entirely normal), and potentially result in you capitulating (abandoning your otherwise good plan).

Fidelity did a study between 2003 and 2013 and found that clients with the best returns belonged to people who had died or forgotten they had accounts! This shows how important it is not to touch your investment once your plan has been established. Autoinvest is the best way to leave your investment alone to do its thing.

Does Stake have kids accounts?

I searched high and low and only found references from years ago to minor trust accounts, and all the pages on Stake that were referenced are now showing as removed (page not found). So it looks like Stake does not support kids accounts.

To learn more about investing for kids, have a read of Investing for children – the ultimate guide

Does Stake allow non-residents?

No, they do not allow non-residents. The requirements to open an account are:

- Be 18 years or older

- Have a valid address in Australia

- Be an Australian resident, citizen or have a valid visa (student or work visa etc)

- Have any Australian government ID (licence or passport) or a bank account in your name.

Is Stake CHESS sponsored?

For ASX trading, Stake is CHESS sponsored with your own individual holder number (HIN).

For US trading, shares are held under custodian because CHESS sponsorship is only available for Australian listed securities.

Is Stake good for investing?

Stake offers ASX trading, has very low-cost CHESS sponsored brokerage and a great app interface. For US trading, they offer zero-fee brokerage. However, their FX fees are very high, which will eat into the returns of long term buy and hold investing.

Is Stake a good broker?

It is very easy to set up an account with Stake, and their web and app interface are just about the best around. They offer fractional US share purchasing, automated lodging of US tax compliance forms, have good customer service, and low fees.

How does Stake work?

When you sign up for AUD trading, you will be provided with a USD wallet and an AUD wallet.

You can fund your USD wallet either through a POLi bank transfer, which results in high FX fees or by transferring USD into your stake account from a USD bank account, where a flat $5 fee is charged. However, I asked not long ago, and they said they don’t allow USD transfers in or out, only AUD, so I’m not sure if that option is available when you read this.

The AUD wallet is a virtual bank account, and with its own BSB & Account Number. As explained above, it is not a real bank account, so be aware of what that means with regards to keeping money in there other than temporarily when buying or selling shares . If you want to deposit money into your Stake wallet, complete a bank transfer from your current bank account to the details of your Stake Wallet. You don’t need a specific reference on the transfer to your AUD balance as the BSB and Account number is uniquely yours.

Australian share trades are executed through Finclear, an ASX CHESS sponsored market participant with your own individual holder number (HIN), so you can see your ownership externally to Stake in the share registry.

US share trades are executed by DriveWealth (a US dealer-broker).

Trades can be set as market or limit orders. For ETFs, it is recommended to use what is known as marketable limit orders, which means using a limit order and placing your order a few cents above the ask if buying or a few cents below the bid if selling. You will still be matched with the best price, so it will act just like a market order, but you’ll never have any big surprises for those rare times when the ETF price deviates from the underlying value of the stocks it holds.

How do I sign up for Stake?

You can sign up online or through their mobile app.

- On the first screen, you will need to enter your email and password.

- You are then asked for your employment status — Employed/Self Employed, Student, Retired.

- You will also be asked some questions required by the US regulator, such as whether you are affiliated with a stock exchange, whether you are a director or own greater than 10% of a US publicly-traded company, whether you are a public official. Most people will answer no to these.

- You can optionally enter your TFN, but you can add that later if you prefer.

- And finally, you are asked if you are a US resident — again, required by the US regulator.

- You will then be asked to add photo ID information — either a licence or passport.

And you are ready to start investing!

Stake alternatives

For ASX trading, Stake is an excellent option due to being a very low-cost CHESS sponsored broker.

However, some reasons to consider Stake alternatives include:

- Autoinvest (Pearler, Vanguard Personal Investor) — LINK THEM

- Lower-cost US share trading and trading on other exchanges (Interactive Brokers)

- Purchasing smaller amounts more frequently (Superhero, Vanguard Personal Investor)

- Better reporting (Commsec)

Online trading platforms comparison

Online trading platforms comparison

Stake review — final thoughts

Stake is a very low-cost CHESS sponsored broker. It is super quick to set up an account (fully digital), the app and web interfaces are about the best on the market, and it offers US trading with free US brokerage once you have converted to USD. It lacks live data and reporting, but you can pair it with a free Commsec account and have the best of both worlds — super cheap brokerage and extensive data and reporting.

However, if you would like to avoid the high FX rates to trade US stocks, or if you would like to trade on other exchanges besides the US and Australia, Interactive Brokers (IBKR) has cheap trades and foreign currency exchange rates 500 times cheaper. Pairing IBKR for international share trading with Stake for Australian share trading will give you the cheapest trading available today.

Alternatively, if you would like the ability to set up autoinvest with your Australian shares, Pearler is a great option. And finally, if you would like to invest in ETFs with (even) smaller amounts, Superhero offers free purchases of Australian ETFs (although without being CHESS sponsored)