Pearler is a low-cost online broker that lets you trade shares on the Australian and US markets. What sets Pearler apart is that their platform was designed for long-term passive investing. So there are no gimmicky distractions to entice you to trade more frequently, and they were the first broker to offer automated ETF investing to help you achieve your goals more effectively.

This Pearler review will go through what you need to know so you can make the best decision in choosing a broker, including who is Pearler for, how does Pearler work, is Pearler safe, how to sign up, and alternative brokers depending on what you are looking for.

As per the disclaimer at the end of the page, all information on this website is for general information only and should not be taken as constituting professional advice.

In this Pearler review

- Pearler Pros and Cons

- What is Pearler?

- Who is Pearler for?

- How much does Pearler cost?

- How does Pearler Prepay work?

- Is Pearler safe?

- How does Pearler Autoinvest work?

- How does Pearler Micro (microinvesting) work?

- Is Pearler easy to use?

- Customer service

- Does Pearler offer live data and reporting?

- Criticisms of Pearler

- Frequently asked questions

- Pearler alternatives

- Online trading platforms comparison

- Pearler review — final thoughts

Pearler Pros and Cons

Pros

- Encourages long-term investing

- Low-cost $6.50 flat-fee trading fee

- Pre-pay your brokerage to get trades for $5.50

- CHESS sponsored

- Autoinvest

- US trading, inc. fractional investing

- Automated US tax form (W8-BEN) lodging

- Microinvesting

- Transparent (no hidden or disguised fees)

Cons

- Not for active/short-term traders

- No live data or research reports

- High FX fees (but lower than local brokers)

- Microinvesting is uneconomical at low balances

- Takes 1-4 days to start trading (sometimes more)

What is Pearler?

Pearler is an online broker established in Australia in 2018 by three friends from Sydney who wanted “to build a one-stop-shop for investments, savings, loans and insurance from multiple providers all in the one place“. For now, they are focusing on investing to help people reach their financial goals.

Who is Pearler for?

Pearler is for investors who want to manage their own share trading account and want to avoid the high fees of percentage-based platforms where the ongoing fees grow with your portfolio.

Unlike other trading platforms, Pearler was built with a focus on long-term passive investing, eschewing frequent trading. As a result, they have innovated to provide several features unavailable on other platforms such as autoinvest, prepaid brokerage fees to reduce the cost even further, and microinvesting with the lowest fees available.

How much does Pearler cost?

What is Pearler’s Australian share trading costs?

For Australian share trading, there is a flat fee of $6.50 (AUD) and no other fees such as account opening fees, inactivity fees, etc.

You can also reduce your share trading fees with Pearler Prepay, effectively making it $5.50 per trade.

What is Pearler’s international share trading costs?

For International share trading, the brokerage fee is a flat fee of $6.50 (AUD).

You can also reduce your share trading fees with Pearler Prepay, effectively making it AUD $5.50 per trade.

For international trading, you also need to convert your currency, so there is a foreign currency exchange (FX) fee.

How much is Pearler’s FX fee?

Like all local Australian brokers that offer US trading, there are high foreign currency exchange (FX) fees for US trading. The cost is 0.50% for moving money between your AUD and USD accounts. This cost comes to $50 per $10,000 exchanged.

Other local brokers are even higher.

SelfWealth charges about 0.85%. and Stake/Superhero about 1.0%.

Why am I using the word ‘about‘? Well, they actually charge in a misleading way.

SelfWealth charges 0.6%, but it is 60c USD vs $100 AUD, so it actually comes out to about 0.85% depending on the exchange rate.

Stake & Superhero charge 0.7%, but it is 70c USD vs $100 AUD, so it actually comes out to about 1% (or $100 per $10,000 exchanged) depending on the exchange rate.

Pearler’s fee is a transparent 0.5% as explained on their website (bold added by me):

We present the margin as 0.5% to ensure you have consistent pricing on each transaction, as a percentage of the actual money transferred.

Even though their FX fees are one of the lowest for Australian brokers, you want your costs of entering the market to be under 0.5% and ideally no more than 0.30% and this makes all local brokers too expensive.

Is there an alternative to the high FX fees?

For international share trading, Interactive Brokers (IBKR), along with very low-cost trading fees, has wholesale FX rates at 0.002%, which comes to $0.20 per $10,000 exchanged. That’s 250-500 times cheaper than local brokers. IBKR is a custodian-based broker rather than CHESS sponsored, but since CHESS sponsorship is only available for Australian shares, trading on exchanges outside Australia will be custodian-based anyway. Also, IBKR is the largest broker in the world and is listed on the US stock exchange.

Other fees

US shares transfers:

- US share transfers In from another broker: ACATS – Free, DTC – $15 per position. DRS – $130.00 per position.

- US share transfers Out to another broker: $200 per account on both ACATs or DTC. DTC transfer includes up to 4 positions.Additional position on DTC will becharged at $50 per position. DRS Transfer is $130.00 per position.

Foreign residents

- For foreign residents, there is an account opening fee of $200. This is because you need a linked account that holds your funds and while there are two options (Macquarie & ANZ), only ANZ is available for non-residents, and the linked ANZ account has a setup fee of $200.

How much does Pearler Microinvesting cost?

$1.70/month to invest in one fund.

$2.30/month to invest in multiple funds.

No fees while your investment balance is under $100

No fees for opening an account, deposits/withdrawals, buying/selling, or transferring between funds.

How does Pearler Prepay work?

You can reduce your share trading fees by prepaying your brokerage. Just buy $55 of Pearler Credit and get an additional $10 for your buys. And it’s locked in from the moment you buy, so you’ll receive even more trades if they drop the prices.

This applies to trades on both Australian and US shares, effectively making it $5.50 per trade for both ASX and US trading, but does not apply to the FX fee for US trading.

Is Pearler safe?

Pearler is licensed in Australia as a representative of Sanlam Private wealth, so it is subject to regulation by the Australian Securities and Investment Commission (ASIC).

Australian share trading

Australian shares bought through Pearler are CHESS sponsored with individual holder numbers (HINs). This means they are legally owned by you in your own name and not by Pearler. Pearler just executes the trades on your behalf. Your direct ownership is listed (and viewable) independently of Pearler through the share registry. This provides a layer of transparency unmatched by brokers who use a custodian model. In fact, for trade execution, Pearler uses the same wholesale CHESS sponsored broker (Openmarkets) used by Raiz, SixPark, Stockspot, and others.

Unlike many online brokers where you have a cash management account (CMA) held in your own name with your own BSB and account number, Pearler has a client trust account (CTA) in a Zepto Payments Client Trust Account. The result is that they are the legal owner, and you are the beneficial owner with the cash held in trust for you. This is because their autoinvest feature does not work with a CMA. With a custodian model for your cash account, the money is segregated from Pearler’s company assets for asset protection. If you value holding your assets directly in your name, particularly for large amounts, you may like to keep additional cash in your personal bank account external to Pearler and only send money into the client trust account when you are ready to make a trade. More info on Pearer’s CTA can be found here.

US share trading

For US trading, Pearler itself does not provide the stockbroking. They provide access to US financial markets by partnering with US broker DriveWeath LLC.

Unlike with Australian shares, CHESS sponsorship is not available for shares on other exchanges such as the US, so shares on other exchanges are held under a custodian, which means the broker appoints a separate company — a custodian — to hold the shares under trust on your behalf. When you purchase shares through a custodian-based broker, they hold the legal title for you, meaning they are the legal owner and you are the beneficial owner, so you receive the benefits of the asset without the legal ownership of it.

The two most important things to be aware of in determining if DriveWealth is safe are:

- Their FINRA registration status, which you can check here to validate their registration, licenses, and any arbitration cases or violations. FINRA is the Financial Industry Regulatory Authority. They monitor all registered broker dealers in the US.

- That they are listed with SIPC to provide another level of protection in case they go bankrupt. SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.

How does Pearler Autoinvest work?

Fidelity did a study between 2003 and 2013 and found that clients with the best returns belonged to people who had died or forgotten they had accounts! This shows how important it is not to touch your investment once your plan has been established. Autoinvest is the best way to leave your investment alone to do its thing.

To use Autoinvest, you will need to set up Autodeposit. With Autodeposit, your funds are deposited automatically from your linked bank account via direct debit on a recurring interval that you choose. These funds are then used according to your autoinvest options explained below.

With Pearler Autoinvest, you choose:

- your asset allocation (e.g. VAS/VGS/VGE 20/70/10)

- how much you would like to autoinvest

- how often to autoinvest.

You then choose one of three autoinvest strategies:

- Lowest share — invests in the one share that is furthest below its target percentage in your asset allocation. I recommend this one to have it always rebalancing back towards your target asset allocation with inflows while saving on brokerage by only making a single purchase each time.

- Rebalance portfolio — invests in multiple shares to your target asset allocation. This allows you to rebalance more accurately without selling shares, but is recommended only for large investment amounts as it incurs multiple purchases and therefore multiple brokerage fees each time.

- Equal invest — invests equally across all shares within your pool. Personally, I don’t much see the point of this. It does not help maintain your target asset allocation and does not save on brokerage.

How does Pearler Micro (microinvesting) work?

What is microinvesting

The idea behind microinvesting is that since each purchase of shares has a fixed fee, it requires saving up money and investing lump sums of a thousand dollars or more to minimise the impact of fixed brokerage fees.

Microinvesting removes the barrier of the fixed fee for investing, and instead, you have an account keeping fee regardless of how much or how often you invest. This allows you to invest small amounts.

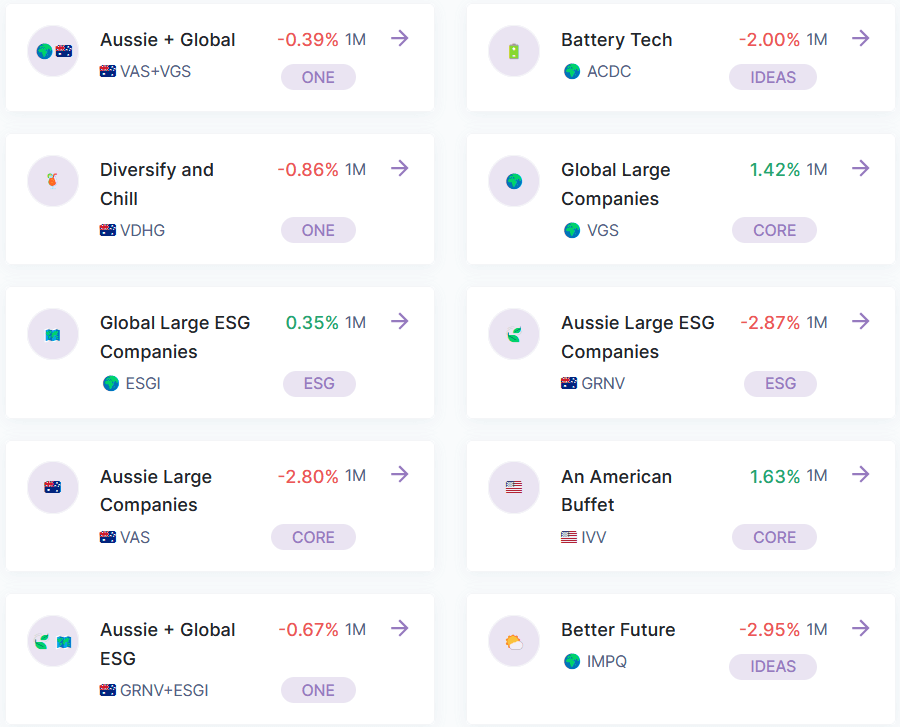

What investments can you choose from and what is the ownership structure?

Pearler Micro is a set of investment funds created and managed by Pearler, where each invests in one or two ETFs. For instance, “Aussie + Global” holds VAS and VGS, “Diversify and Chill” hold VDHG, and so on. Everyone using Pearler Micro invests into any of those funds and within each fund, it is all pooled together with other Micro investors.

It’s important to note that unlike investing through Pearler’s brokerage where you own the underlying holdings directly (and you can transfer to any other broker without selling and paying out CGT), with each Micro fund, the underlying funds are owned and held within the Micro fund, so if you ever want to move to another broker, you will be required to sell it to leave, which means realising (paying out) all your capital gains. This is a serious consideration when choosing Micro over a regular brokerage account if you are going to build it up to a large amount of money over time.

It’s great to see that there is finally a microinvesting app that offers an all-in-one diversified fund like VDHG.

What is the REAL cost of microinvesting?

The total cost to you will be the microinvesting platform fee in addition to the investment fee charged by the ETF provider.

This means that if you choose, say, VDHG, your total cost will be the flat fee quoted above plus the ETFs management fee of 0.27% p.a. on your balance.

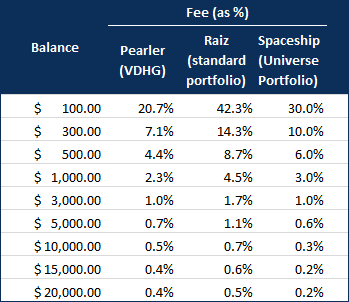

Let’s look at the percentage of assets your total fees comes to annually when investing in VDHG at various balances.

And let’s compare it to the Raiz standard portfolio and the Spaceship Universe portfolio.

Pearler’s microinvesting fees are competitive against the competition, but the problem is that paying more than 1% (regardless of the platform) is a bad idea, and here’s why.

Historical returns in the broad stock market have been around 8-10% p.a. So investing where you are charged over 4-5% makes no sense — you take on 100% of the investment risk, and the provider gets over half the return (and risk-free!).

It only becomes cost-effective where fees are below about 1%, and as you see, this is about $3,000 with Pearler Micro and Spaceship, and $5,000 with Raiz.

If you are likely to reach $3,000 in a relatively short period like a year, then a single year hit to your finances isn’t so bad, but if you are likely to invest small amounts that take several years to get to $3,000, you should question the value of microinvesting. In that case, you will almost certainly be better off saving it into a savings account and using regular brokerage when your saved amount is large enough.

However, if you’re going to be saving up large amounts of money like that, it may be more tax efficient to use a brokerage account and buy it directly.

Important points on each for selecting Pearler Micro or a regular brokerage account

- Incurs individual brokerage for every buy and sell trade, making it uneconomical to invest small, frequent amounts

- You can move to anther broker without realising capital gains since your account holds the individual ASX-listed funds or shares directly.

- Vastly wider range of investment options (all shares and funds listed on the ASX).

- Simpler as you don’t have to make the trades or keep track of anything.

- Does not incur brokerage costs as Pearler buys (or sells) one big batch each day, but there is a buy/sell spread of 0.15%-0.16%, as well as a small monthly account fee of $1.70-$2.30.

- You cannot transfer to another broker without selling and realising all capital gains.

- Limited range of investment options.

Regular brokerage account

Pearler Micro

Downsides of Micro

- You can get a brokerage account (for an adult or a minor trust account) with free purchase trades and no ongoing account fees with other providers (CMC Markets for any ASX-listed asset where the purchase price is under $1,000 per security per day and Vanguard’s VPI for Vanguard funds).

- Having to realise all capital gains to move to another provider is a significant downside.

- Limited range of investment options

The real value of microinvesting

While microinvesting isn’t very cost-effective, the benefit of microinvesting is that it is a low-stakes introduction into the world of investing. You can invest meagre amounts and still get to see the value of your investments going up and down each day, week, and month. This allows you to get more comfortable with stock market volatility and gauge your level of comfort with the risk of your invested money growing and shrinking over the short term. It is better to learn this with little on the line than to find it out when you have 10 or 20 thousand dollars ready to invest and see it fall by 10-20% in a short time and think about how many hours you have to work to save and recover the lost money.

Is Pearler easy to use?

Pearler is very easy to use because the platform is very minimalist. Active traders would find it lacking in data and research, but as Pearler is targeted at long term investing and actively discourages traders, this is likely to be a plus rather than a minus.

However, one particularly annoying thing is that it doesn’t provide real-time pricing or live market depth (the open orders waiting to be executed if their price is met). As mentioned below in the section on live data, unlike with ordinary shares, with ETFs, you should be using what is called marketable limit orders, which require real-time pricing and ideally market depth. To get that, you would need to be logged into another broker that provides this information when you make your trades.

Customer service

Unlike several other online brokers, Pearler also has phone support if you need it, which is a plus. They also offer email support for non-urgent assistance if you prefer.

I have read comments on forums about slow customer service, potentially due to under-staffing, but I did not find this personally.

Also, unlike some brokers that have embraced the digitisation of everything, getting set up with Pearler is rather slow. Establishing a new HIN (CHESS holder ID) to begin trading, for example, takes 1-4 business days, and sometimes much longer. Whereas with a fully digitised broker such as Stake, it is relatively instantaneous, and you are in the markets ready to trade within minutes once your account is funded. This lack of digitisation may increase your reliance on customer services.

Does Pearler offer live data and reporting?

Pearler doesn’t have live data or research reports.

Research reports are not relevant to long term investing, but real-time pricing and live market depth (the open orders waiting to be executed if their price is met) are essential for ETF investing. This is because, unlike with individual shares, with ETFs, you should be using what is called marketable limit orders, which is where you use a limit order and place the price a few cents above the ask if buying or a few cents below the bid if selling. Due to the way orders are matched, it will act just like a market order, but you’ll never have any big surprises. Not seeing the market depth means you will need to open up another platform to see the live buy and sell orders.

In addition, some may prefer more data, and some other brokers offer extensive data for free.

Commsec, for example, offers:

- Real-time prices

- Stock screener and advanced charting including heat maps, graphs and comparison charts

- Data that goes back a very long way

- Pricing alerts (email or mobile notification)

- A news feed with technical analyses for your stocks (useful for traders, not so much for buy-and-holders)

- Personal watch lists.

If you use Pearler’s Autoinvest feature, live pricing doesn’t matter since their automated system makes the purchase for you, but if you make the purchases yourself, what you can do, and what I would suggest, is to use your Pearler account for buying and selling, and open a Commsec account (which is free to open) for real-time pricing, research, watch lists, reporting and historical data.

Criticisms of Pearler

Pearler gets some criticism from the online community. Here is a list.

- no US trading

- no ability to use it with trusts or SMSFs

- no minor trust accounts for kids

- no lmit orders

- customer service in line with other online-only brokers (and therefore lacking compared to brokers with phone support)

- no data and research reports

- interface feels clunky

- when you buy shares, it does not execute quickly as with other brokers

- takes a long time to sign up and actually start trading

- that Reddit incident

A number of these were from early on and negative sentiments seem to have remained despite the changes.

1,2,3,4,5 — Pearler now offers US trading, SMSFs, kids accounts, and they have phone support and limit orders.

6 — Lack of live data is still an issue. The lack of research reporting probably isn’t an issue for their target audience of long-term buy-and-hold investors, but as I mentioned above, real-time pricing is an issue for ETF investors. You can overcome it by using a free Commsec account just for the data, but it’s annoying to have to login to a whole other broker each time.

7 — Clunky interface — seems more of an issue for active traders because it is intentionally minimalistic to make it easier and simpler and without distractions for their target audience.

8 — Slow trade execution times — If that is an ongoing problem, it is certainly an issue. Their trades are executed by OpenMarkets, which is the same wholesale broker used by Six Park, Stockspot, Raiz, and a number of others, so I am curious how this problem exists, and if it still exists.

9 — Slow to set up an account — definitely a pain compared to Stake, where you are able to trade within minutes of funding your account. However, most brokers besides Stake take time to get an account set up (and many complain about all of them, too).

10 — And we wouldn’t be complete if we left out that Reddit incident! From what I understand, there were software issues on Pearler’s end and a customer ended up with an additional purchase of shares and a negative cash account balance to pay for it. When they contacted Pearler, Pearler did not offer to resolve the issue at their own cost until it was posted publicly. This seems to have left a long-lasting stain on their brand in the online community.

Frequently asked questions

Does Pearler offer tax reporting?

Pearler partners with Sharesight (which is free for up to 10 holdings) to provide tax reporting capabilities. You can connect, manage and sync with Sharesight from your Settings => Reports.

Pearler also has this step-by-step guide on setting up automated tax reporting on your Pearler account using their Sharesight integration.

Does Pearler have kids accounts?

Yes. There are two options to invest for children through Pearler.

- Through the main Pearler platform

- Through Headstart

1. Kids accounts through the main Pearler platform using a minor trust account

Pearler offers minor trust accounts, allowing children to have their very own trading accounts. An adult can open a share trading account as a trustee and the child as the beneficiary. When they turn 18, shares held in the trustee account are transferred into their own name.

Investing using a minor trust account can be extremely tax effective. You still need to be aware of the requirements for a minor trust account to be entitled to those tax benefits, such as not taking the dividends or franking credits for yourself and declaring any income from the shares in the child’s own tax return. But provided you follow the letter of the law, the tax advantages can be significant. Also, note that the legal requirements to claim the tax advantages are rarely explained by brokerage companies, so you will need to do your own research or speak to an accountant.

To learn more about investing for kids (including minor trust accounts), have a read of Investing for children – the ultimate guide

2. Kids accounts through the Headstart app

Headstart is a new investment app launched by Pearler for parents to invest for their kids and to help them develop financial skills. Headstart uses Pearler Micro (explained above with full details), which is where Pearler has created a handful of funds where they are the fund manager of each fund (e.g. VDHG in one fund, VGS/VAS in another, and so on) and everyone using Micro and Headstart invests into any of those funds, where, within each fund, it is all pooled together with other investors.

As noted in the section on Pearler Micro, you will be required to sell down if you ever want to move to another broker, which is a serious consideration with minor tax rates. You can also get get a brokerage account (for an adults or minor trust accounts) with free purchase trades and no ongoing account fees with other providers (CMC Markets for any ASX-listed asset where the purchase price is under $1,000 per security per day and Vanguard’s VPI for Vanguard).

The real benefit of Headstart

The real benefit of Headstart is that it may encourage people to invest for their children where they previously were not. This is an important point that can be missed when looking at the most cost-efficient, tax efficient, and flexible investment options available.

While investing for kids through Headstart does not seem to be any better than through CMC Markets or VPI, it is miles ahead of not investing at all.

Does Pearler allow non-residents?

Pearler is one of the few Australian CHESS sponsored brokers that allow non-residents.

However, due to their online ID verification system, you are required to have an Australian address for ID verification to meet their compliance requirements to sign up.

Can you buy individual stocks on Pearler?

Yes, you can buy individual stocks and even set up auto-investing, which automatically buys the individual stock for you.

Is Pearler CHESS sponsored?

For ASX trading, Pearler is CHESS sponsored with your own individual holder number (HIN).

For US trading, shares are held under custodian because CHESS sponsorship is only available for Australian listed securities.

Is Pearler good for investing?

Pearler is suited for long term investing. It has low-cost CHESS sponsored trading and was built with long-term passive investing in mind. As a result, they provide several features unavailable on other platforms such as autoinvest, and a prepay option to lower the cost further.

Is Pearler a good broker?

It is easy to set up an account with Pearler, and they offer a wide range of features, including autoinvest, microinvesting, US trading, fractional US share purchasing, automated lodging of US tax compliance forms, and no gimmicky distractions to entice you to trade more often. They are also transparent with their fees.

How does Pearler work?

When you sign up, you will be asked if you want to create a new CHESS HIN (personal ID that your shares are registered to) or if you want to transfer an existing HIN from another broker.

Australian share trades are executed through Openmarkets, an ASX CHESS sponsored wholesale broker with your own individual holder number (HIN), so you can see your ownership externally to Pearler in the share registry.

US share trades are executed by DriveWealth (a US dealer-broker).

Trades can be set as market or limit orders. For ETFs, it is recommended to use what is known as marketable limit orders, which means using a limit order and placing your order a few cents above the ask if buying or a few cents below the bid if selling. You will still be matched with the best price, so it will act just like a market order, but you’ll never have any big surprises for those rare times when the ETF price deviates from the underlying value of the stocks it holds.

How do I sign up for Pearler?

You can sign up online or through their mobile app.

On the first screen, you will need to enter your email, password, and first and last name. You then need to provide the following information:

- Select an account type — individual, joint, company, trust/SMSF for an individual, trust/SMSF for a company, minor. We will go through the process of setting up an account as an individual.

- Verify your email in the verification email.

- Verify your phone number via SMS.

- Employment information — source of funding, annual income, employment status

- Details of any affiliations you have with government bodies or publicly traded companies (required by the US regulator)

- Your country of tax residency and tax file number

- Bank details.

You also need to provide the details of an ID document (passport, driver’s license, or Medicare card.) for online ID verification.

You will need to select to either transfer from another broker or create a new HIN to trade under, which takes 1-4 business days.

Pearler alternatives

FFor ASX trading, Pearler is an excellent option due to being the lowest cost CHESS sponsored broker.

However, some reasons to consider Pearler alternatives include:

- Lower-cost US share trading and trading on other exchanges (Interactive Brokers)

- Lower-cost CHESS sponsored broker for Australian shares (Stake)

- Purchasing smaller amounts more frequently (Superhero, Vanguard Personal Investor)

- Better reporting (Commsec)

Online trading platforms comparison

Online trading platforms comparison

Pearler review — final thoughts

Pearler is an excellent low-cost CHESS sponsored broker designed for long term investing. There are several features not available elsewhere, such as autoinvest and prepaid brokerage fees to reduce the cost. They also have loads of other features to remain competitive such as US trading, automated US tax form filing, microinvesting, and accounts for kids, trusts and SMSFs.

However, Pearler discourages frequent trading, and there is little in the way of data and research reports. Although, you can always signup for a free Commsec account while using Pearler’s unique features.

The fees for US trading (including FX fees) are cheaper than other local brokers but still very high. To avoid high FX rates, Interactive Brokers has FX rates 250-500 times cheaper than local brokers, although without autoinvest.

The interface when trading on Pearler is not as user-friendly as Stake, which also has the lowest CHESS sponsored ASX trading fees on the market. So if that is more important to you than Pearler’s features, Stake is an excellent option. However, Stakes’s ASX trading fees aren’t much lower than Pealer Prepaid.