There’s a common misconception that dividends are somehow safer than selling down shares, and therefore dividends can provide a reliable income.

This is a fallacy. A dividend is a withdrawal. It’s not similar to a withdrawal — it’s an actual withdrawal.

How it works at a company level

After a company pays out wages, debts, and other obligations, it can pay out a portion of the remaining profit as dividends.

If a company worth $99M is gifted $1M, its new value is $100M.

In the same way, when a company pays out $1M in dividends, its new value is worth $1M less.

You can see this in real time when shares go ex-dividend and the shares drop by the value of the dividend paid out.

When you don’t reinvest your dividends, you have made a withdrawal.

Misconceptions

Sure, the price falls when dividends are paid out, but the share price also rises in the period leading up to the dividend payout, offsetting the fall.

That’s because the company is constantly earning money and the value of the company – and therefore your shares – reflects the growing cash position. This doesn’t invalidate the fact that the share price drops on the ex-dividend date due to the dividend being a withdrawal.

The price doesn’t fall by exactly the amount of the dividend paid out.

Yes, the share price doesn’t fall by exactly the amount of the dividend paid out, sometimes it’s more and sometimes it’s less. This can be explained by the fact that during the rest of the time when dividends are not paid out, the share price moves up and down and all over the place. The market is reacting to new information about the company, sector, or market it is in. For example, a company might release sales results for the past quarter, and the price moves up in anticipation of future earnings. When a share goes ex-dividend, these forces are still in play, and therefore the share price doesn’t drop by exactly the price of the dividend. The fact that the share price drop isn’t precisely the amount of the dividend paid out doesn’t refute the fact that the share price adjusts based on the dividend paid out.

But my dividends are safe, whereas the value of shares can drop wildly without notice.

Yes, your dividends are not affected by the ups and downs of the market – the same way that if you sell down some shares and take it out of the market, they’re no longer affected by the ups and downs of the market.

But if I sell shares, I own fewer shares and reduce future income!

Yes, that’s true, but you’re also reducing future income when you don’t reinvest dividends.

But selling units of ownership (shares) results in less income-producing assets, which reduces future income! Whereas dividends are paid out from company cash which doesn’t affect future income.

In a company, you have productive assets, and you have cash.

At this moment in time, they’re separate. The productive assets are producing an ongoing income. The cash is earning essentially nothing.

So, with the cash that is held and paid out as dividends, yes, the company still has the same income-producing assets producing the same income next year.

However, if the company didn’t pay that cash out as dividends, they wouldn’t have kept the cash sitting there unproductive indefinitely. They would’ve taken that money and reinvested it into growing the business.

What has happened by taking from the cash portion of the business to pay out dividends is that the company was unable to turn the cash into productive assets, and therefore, future income. So, even though cash is currently not productive, there’s a cost to taking this cash in the same way that there’s a cost to selling shares because by taking it, you’re missing out on future income in both cases.

This is why companies are valued as a single cohesive unit – because even though cash and productive assets are separate now, they can be converted back and forth between each other later.

The short version of this explanation is “money is fungible”.

But paying out dividends is done after considering potential growth for the company, so it’s not giving away potential for future growth.

There are several ways to use earnings, not only reinvesting it back in an attempt to grow the company or paying it out a dividend.

A company could do a share buyback. They could pay down debt.

The point is not whether reinvesting profits to grow the business or paying out dividends is a more productive use of capital. The point is that paying out or retaining dividends are irrelevant to your total return besides tax consequences because the fact is that:

- A company’s valuation takes into account available cash, and when it is paid out, the value of the company, and therefore the share falls; and

- Cash wouldn’t remain as unproductive cash indefinitely.

Dividend irrelevance has been known for over 50 years. As Ben Felix notes:

The basis for dividend irrelevance starts with the 1961 paper “Dividend Policy, Growth, and the Valuation of Shares” by Merton Miller and Franco Modigliani. They explained in their paper, before frictions like trading costs and taxes, investors should be indifferent between a $1 dividend (which causes the stock price to drop by $1) vs. receiving $1 by selling some shares. This is a fact that must be true as long as $1 is worth $1.

Let’s see the effect of not reinvesting dividends in a market downturn

When you don’t reinvest your dividends at a time when stocks are down, you’ve made a withdrawal when stocks are depressed, and the higher your dividend, the more you’re drawing down.

You want to avoid selling when stocks are down. You should instead be living off the safe part of your portfolio (high-grade bonds or cash accumulated during bull markets), leaving your stocks to recover by way of reinvesting your dividends when stocks are cheap.

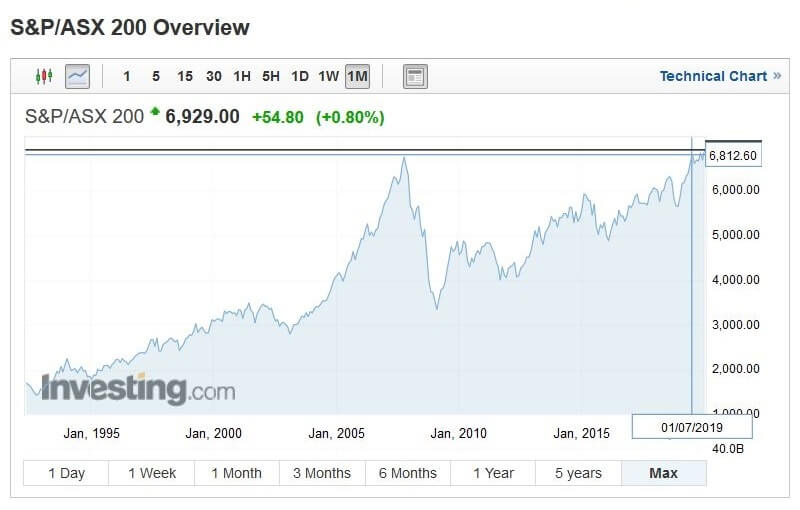

To help you understand the importance of reinvesting dividends when the market is down, let’s compare the ASX200 accumulation index (the total return index with dividends reinvested) with the ASX200 price index (which excludes dividends).

When you take a look at the accumulation index, you can see that after the GFC, the market recovered and exceeded its previous peak within 6 years.

When dividends were not reinvested, it took 12 years before it recovered. You would have been drawing down and depleting your portfolio faster and for many more years, increasing the risk of running out of money in your old age had you been living off your dividends instead of living off your safe assets and reinvesting your dividends to recover sooner.

Dividends are not something you can rely on in a market downturn

Bonds and fixed-term deposits are legal contracts to pay specific amounts on specific dates. The amount does not change based on the movement of the market. The issuer of the bond or fixed-term deposit must pay you if it can, which you can be pretty sure of with a government bond or a fixed-term deposit within the government guaranteed amount.

Stocks, on the other hand, do not guarantee dividends. The company does not owe you dividends. When business turns bad, companies can and do cut dividends, skip dividends, or stop paying them entirely. In fact, if a company starts to go under, it must stop paying dividends — debt such as payroll and interest on loans must be paid first.

This article on what a bear market feels like points that out.

If we start seeing property prices go down, unemployment goes up, and banks start taking losses then they’re going to be cutting their dividends pretty sharpish which will likely push their share prices lower. In the last crisis in the US the major banks weren’t allowed to pay out dividends for quite some time, it’s not unthinkable that the same thing could happen here.

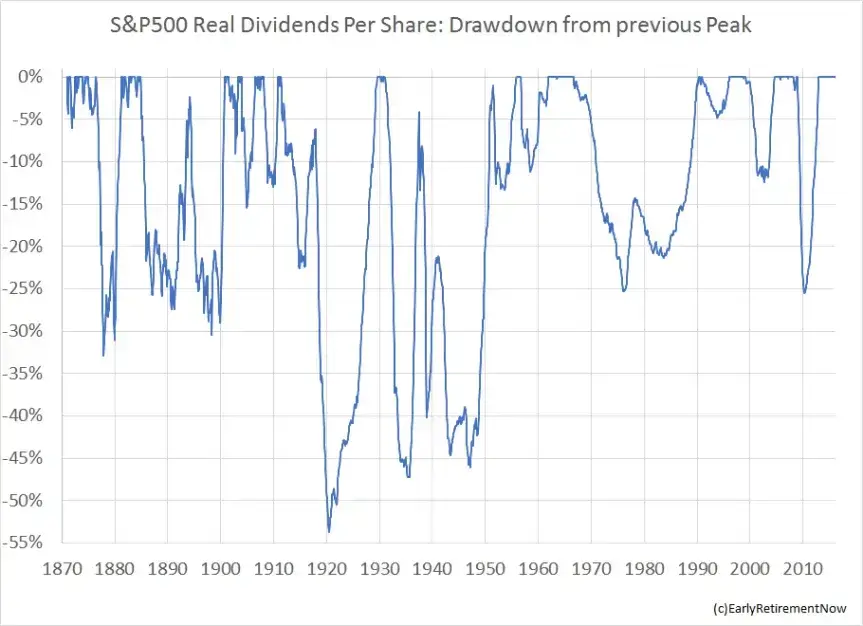

Early Retirement Now notes that

Dividends have suffered dramatic multi-year, even decade-long drawdowns in the past! Though drawdowns in dividends per share were relatively shallow during the Great Recession and especially the Dot Com bust.

This should give you some pause to consider the danger of assuming historically strong dividend payers are a bond proxy that will provide you with safe income during a downturn.

Here are some more links from Early Retirement Now with a US perspective debunking the idea that dividends offer a safety shield in downturns.

The Yield Illusion: How Can a High-Dividend Portfolio Exacerbate Sequence Risk? – Early Retirement Now

The Yield Illusion Follow-Up – Early Retirement Now

The Yield Illusion (or Delusion?): Another Follow-Up! – Early Retirement Now

Tax consequences of focusing on dividends

The main advantage of focusing on high dividends for Australians is franking credits, and there’s a benefit with that, particularly if you retire on a low taxable income.

However, you need to keep the following in mind.

- Dividends miss out on the 50% CGT discount.

- With dividends, you’re unable to earn money on unpaid tax that is delayed by potentially decades.

- Dividends are taxed while you’re receiving your full-time salary – and at your highest tax bracket, potentially even pushing you into a higher bracket. You can’t elect to delay realising gains until after you’ve retired, where your returns would be taxed at a time when you have no other salary.

- Franking credits are largely priced-in, and what remains may be gone in the future.

- Chasing yield deters people from diversifying internationally, leaving you overexposed to an isolated economic crisis. Also, since your income and job security are tied to Australia, by not diversifying internationally, you increase the risk of your income and investments going down together. You also miss out on improved risk-adjusted returns from investing globally.

Final thoughts

Dividends are widely misunderstood. Many believe that taking dividends and not reinvesting them is different from selling shares and that dividends are safe and can be relied upon in downturns. This leads to a false confidence in the reliability of dividends and an irrational fear of selling shares. The irony is that people choose dividend-focused investing specifically to avoid eating into their nest egg, yet by using high dividend shares and not reinvesting the excess, and by using dividends to live off in a stock market downturn, they’re doing exactly that.

Don’t get me wrong, dividends are not bad, and I’m not suggesting anyone avoids stocks based on high dividends. The problem is concentrating your portfolio on stocks that pay higher dividends due to an incorrect assumption they provide a safer, higher, or more reliable return.

Rather than arbitrarily splitting up your stock returns into income and growth components as though they’re separate, focusing instead on the total return drives your attention towards what really matters – improving diversification and lowering risk.

Further reading/watching

Why Getting a Dividend Should Not Be Exciting | White Coat Investor

Dividends are not investment returns. They are not free money, and do not offer downside protection.