What is superannuation?

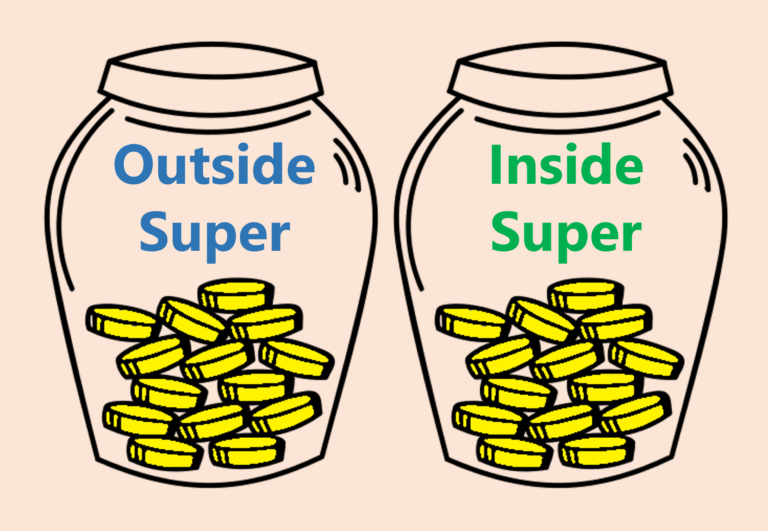

What is superannuation? Superannuation is a structure that holds investments, just like outside super, with the difference being that it attracts massive tax concessions, but the money is inaccessible until retirement age. Read on to learn how you can make super work for you. Read on »