There are a few reasons people use to justify investing most or all of their equities (which is another name for stocks) in the Australian stock market. Some of those reasons are sound and some are not so sound.

The most common reason is “I know more about Australian companies because I hear about Australian companies in the news”. For large companies (CBA, BHP, CSL, WBC, WES, TLS, etc.), this provides no advantage. Everything you know (and more) is known by the market (made up mostly of institutions) within seconds of any news coming out, and the market adjusts their price of the expected outcome of that news before you have a chance to react. You have no advantage by hearing about and following companies in the news because the market is efficient and prices-in any adjustments immediately.

So what are some legitimate reasons for overweighting Australian equities?

- Franking credits — these provide a significant boost in income. If you were getting 4% income and 4% growth (roughly what Australian equities offer), then the actual income would be 10/7 * 4% income = 5.7%, or an additional 1.7% p.a., which comes to a total return of 9.7 total return vs 8%. This is a massively higher return.

- Less currency risk — there is less currency risk with Australian companies than with international companies.

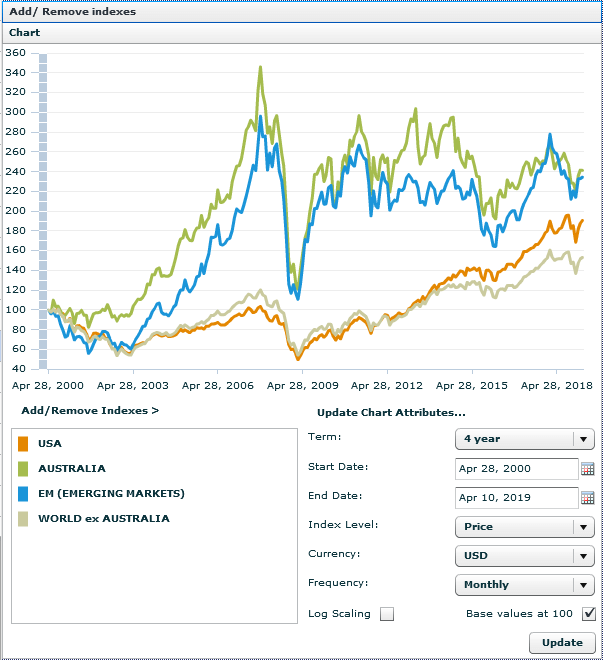

- Lower medium-term correlation — While Australian and international equities tend to move in the same direction most days, which makes it appear highly correlated when you look at the numbers, a medium-term chart like the one below shows that Australian equities seem to have a lower correlated with international equities, so that could potentially improve risk-adjusted returns over sufficient investment time periods.

So why not just invest everything in the Australian market?

Single-country risk

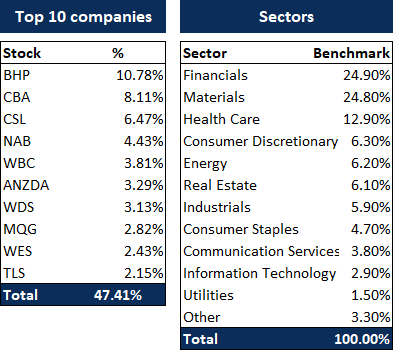

Investing most or all of your assets within the concentrated Australian market adds a a lot of single-country risk. Australia’s index has half the entire index is in just 10 companies and 2 sectors.

The risk is that it won’t take much for our stock market to be severely effected by an hit to just one or two industries.

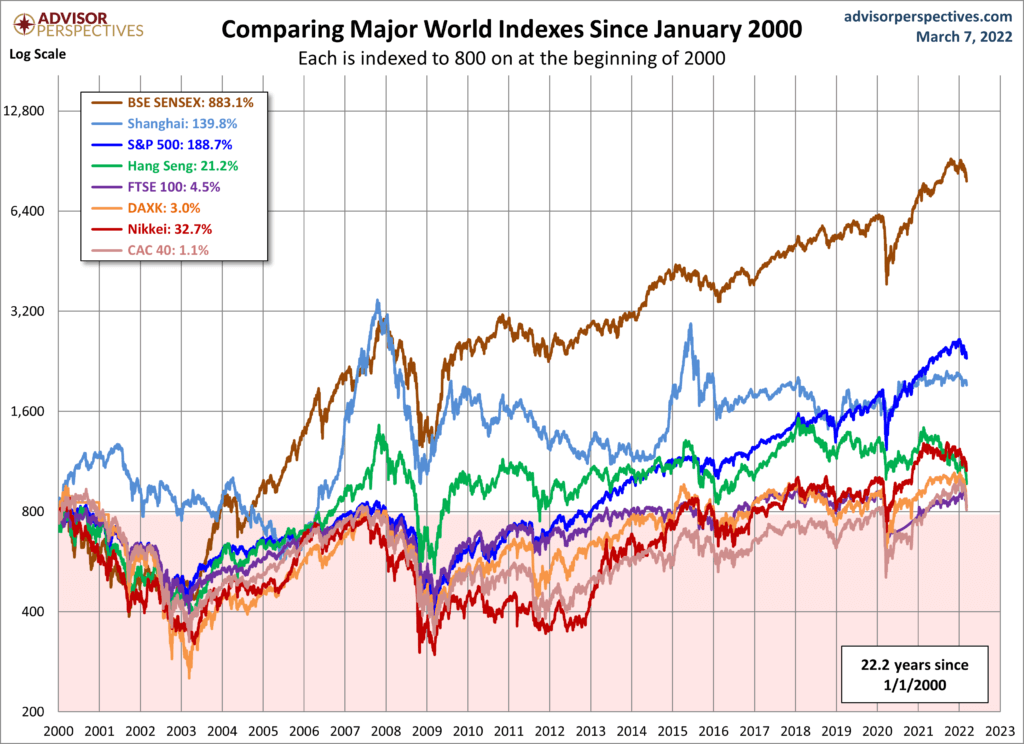

There are lots of examples where single-country risk has showed up to illustrate the effect of this.

Here’s how a UK investor would have fared by having most or all of their equities in their home country over the last 2 decades.

The UK index also fell a whopping 73% back in 1973-74.

Then, of course, there is Japan, where after three decades, it has still not come back to where it was in 1990.

And let’s not forget Germany 1945, Argentina 2002, Iran 1979.

Here is a visual display of single-country risk. It is just price without distributions but that doesn’t take away from what can easily result from single country risk.

Oh, and one more article, if you are still not convinced – single country risk showing up in Italy, Spain, and Greece.

Franking credits aren’t all they seem

Franking credits are also partially priced in, reducing the benefit for what has been estimated at 40-80%.

And the benefit that remains is not free, you pay for it with additional risk as explained above.

Additionally, if you are on a high marginal tax rate, a lot of the franking credits are eaten up by having to pay tax at your full marginal tax rate and without the 50% CGT discount.

Australian shares tend to be high yield, which is tax-inefficient

The main advantage of focusing on high dividends for Australians is franking credits, and there’s a benefit with that, particularly if you retire on a low taxable income.

However, you need to keep the following in mind.

- Dividends miss out on the 50% CGT discount.

- With dividends, you’re unable to earn money on unpaid tax that is delayed by potentially decades.

- Dividends are taxed while you’re receiving your full-time salary – and at your highest tax bracket, potentially even pushing you into a higher bracket. You can’t elect to delay realising gains until after you’ve retired, where your returns would be taxed at a time when you have no other salary.

- Chasing yield deters people from diversifying internationally, leaving you overexposed to an isolated economic crisis. Also, since your income and job security are tied to Australia, by not diversifying internationally, you increase the risk of your income and investments going down together. You also miss out on improved risk-adjusted returns from investing globally.

- Franking credits are largely priced-in (as noted above), and what remains may be gone in the future.

And even with franking credits, those on a high marginal rate still pay a price for it. Someone on the highest marginal tax rate loses ongoing compounding of the otherwise yet-paid tax of 47% of their investment returns along with 47% of the franking credits. Those on the 32.5% marginal tax rate loses a third (including a third of the franking credits).

What to make of all of this?

There are legitimate reasons to overweight Australian equities and legitimate reasons not to overweight them too much.

As far as the choice between investing everything in the Australian market or everything internationally, I’d go as far as to say that you can live without Australian shares in your portfolio as it would essentially be the same as a total global index (the 2% in Australian shares that the index makes up will have no material effect), but going the other way and having all or most of your equities in the Australian market poses a significant risk due to the lack of diversification.

Something less extreme by mixing the two is not a bad option, but just be aware even 50% of your assets in the concentrated Australian market poses quite a high risk to your portfolio due to the lack of diversification.