What is superannuation?

Superannuation was designed specifically for retirement savings. It is not an investment, but rather an investment vehicle/legal structure that holds investments such as stocks, bonds, property, and cash, just like outside super. The difference is that super offers massive tax concessions to boost your retirement savings but is inaccessible until you meet a condition of release (generally, retirement age).

You meet a ‘condition of release’ for the purposes of retirement once you:

- reach ‘preservation age’ (effectively, 60) and have retired; or

- cease a gainful employment arrangement on or after age 60; or

- are 65 years old, regardless of employment.

Since superannuation is just a vehicle that holds investments, everything from the section on Building a Passive Portfolio applies, such as the risk-reward spectrum, asset allocation and your risk tolerance, index funds, equity funds, bond funds, and currency risk.

So, we only need to learn about the structure itself.

Let’s start with the tax concessions.

Tax concessions of super

Tax advantage #1 — a massive amount of free money when you put money in

For someone on the 30% marginal tax rate (MTR), you are paying a 2% Medicare levy (ML), so you are losing 32% before you even see your income. In contrast, super contributions are taxed at 15%.

To calculate the benefit of putting it into super:

| 1. Outside super | (32% tax): | 68% | after tax | |

| 2. Inside super | (15% tax): | 85% | after tax |

The improvement is 85%/68% = 1.25

A return of 25%.

For someone on the 37% MTR, it is 39.34%.

For someone on the 45% MTR, it is 60.38%.

E.g., $10,000 of pre-tax salary results in:

Outside super (32% tax): $6,800 after tax

Inside super (15% tax): $8,500 after tax

Gain from investing in super:

8,500/6,800 = 1.25 = 25%

Returns from the stock market are about 10% p.a. on average, so that’s an incredible 2.5 years of average market returns (or 4 years for someone on the 37% MTR).

And this return is 100% risk-free unlike market returns. You also don’t need to wait 2.5 years.

Tax advantage #2 — lower tax on investment earnings every year

If the above isn’t enough, you also get a low tax rate of 15% on earnings to supercharge the compounding of your super.

Tax advantage #3 — zero tax after converting to an account-based pension

If somehow that still isn’t enough, when you convert to an account-based pension after age 60, all future earnings and withdrawals are 100% tax-free for decades until you take it out to use.

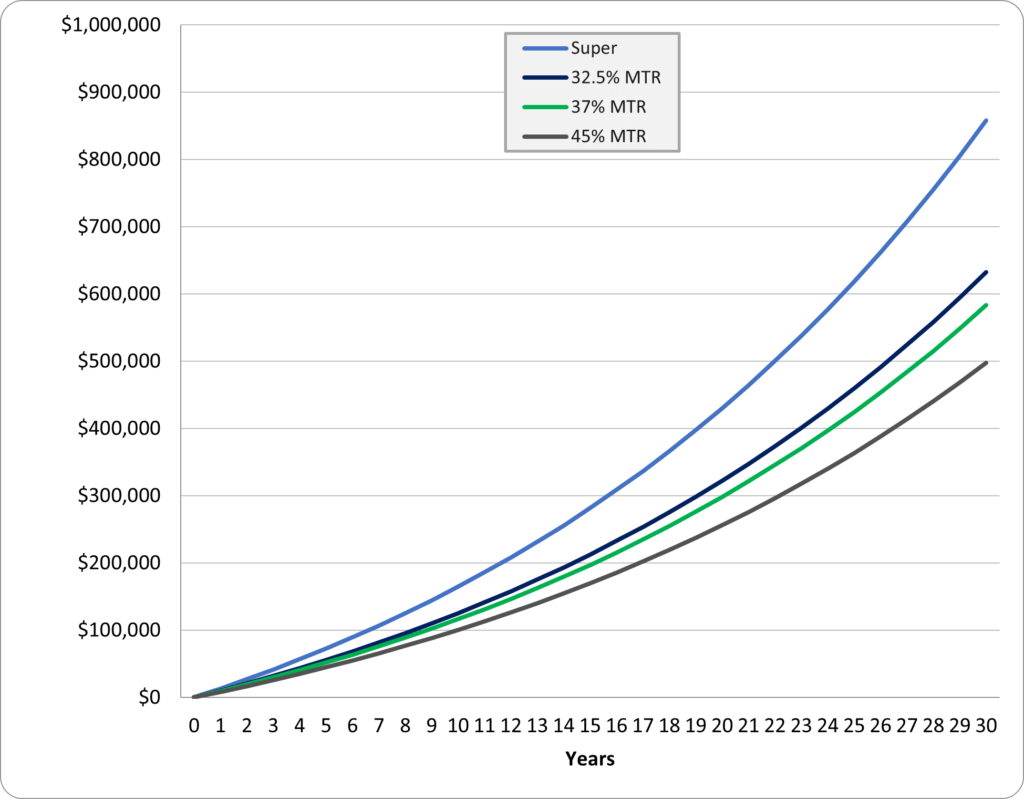

Seeing it visually

It bears repeating that you get a 25% return on whatever money you are willing to sacrifice from your take home pay if you are on the 30% MTR.

If you sacrificed $10,000 of your take-home pay, the government would give you a free $2,500 to make it $12,500 in your super.

And then the whole $12,500 would compound and grow faster due to being in a low tax environment.

Let’s take a look at how that looks when doing that each year for 30 years.

Over 30 years of putting in $15,000 per year into super invested at a 5% inflation-adjusted return, here is the final balance to compare investing outside super at your marginal tax rate vs using super.

| MTR | Balance |

|---|---|

| Super | $ 858,048 |

| 30% | $ 660,245 |

| 37% | $ 582,914 |

| 45% | $ 497,354 |

That’s almost $220,000 more cash in retirement when using super than the same investment outside super for those on the 32.5% marginal tax rate. Or over $275,000 or $360,000 for those on higher marginal tax rates.

And that’s only due to the first 2 tax advantages described above. Then, there is the zero tax for decades of retirement.

Here’s the table showing it year by year. You can see the vast savings even from the first year, and the difference compounds so that after 10, 20, 30, and 40 years, the difference is astounding.

By not using super to save up the portion of your retirement savings that you will need beyond the age of access to super, you are saying no to a serious amount of free money, and you’ll need to work and save for years longer to acquire the same nest egg. On the 30% MTR, acquiring $660,000 takes 26 years with super or 30 years without super. That’s 4 more years of work with nothing to show for it.

| Year | Super | 30% MTR | 37% MTR | 45% MTR * |

|---|---|---|---|---|

| 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| 1 | $ 13,138 | $ 10,497 | $ 9,411 | $ 8,172 |

| 2 | $ 26,920 | $ 21,485 | $ 19,254 | $ 16,710 |

| 3 | $ 41,377 | $ 32,987 | $ 29,549 | $ 25,631 |

| 4 | $ 56,543 | $ 45,027 | $ 40,316 | $ 34,953 |

| 5 | $ 72,452 | $ 57,631 | $ 51,577 | $ 44,692 |

| 6 | $ 89,140 | $ 70,825 | $ 63,355 | $ 54,869 |

| 7 | $ 106,646 | $ 84,636 | $ 75,674 | $ 65,502 |

| 8 | $ 125,010 | $ 99,093 | $ 88,558 | $ 76,612 |

| 9 | $ 144,274 | $ 114,228 | $ 102,033 | $ 88,221 |

| 10 | $ 164,481 | $ 130,070 | $ 116,127 | $ 100,350 |

| 11 | $ 185,679 | $ 146,654 | $ 130,867 | $ 113,024 |

| 12 | $ 207,915 | $ 164,014 | $ 146,284 | $ 126,266 |

| 13 | $ 231,242 | $ 182,186 | $ 162,409 | $ 140,102 |

| 14 | $ 255,711 | $ 201,209 | $ 179,273 | $ 154,558 |

| 15 | $ 281,379 | $ 221,122 | $ 196,912 | $ 169,664 |

| 16 | $ 308,305 | $ 241,967 | $ 215,360 | $ 185,446 |

| 17 | $ 336,550 | $ 263,788 | $ 234,655 | $ 201,937 |

| 18 | $ 366,179 | $ 286,630 | $ 254,835 | $ 219,168 |

| 19 | $ 397,260 | $ 310,541 | $ 275,942 | $ 237,172 |

| 20 | $ 429,864 | $ 335,571 | $ 298,017 | $ 255,983 |

| 21 | $ 464,066 | $ 361,772 | $ 321,105 | $ 275,638 |

| 22 | $ 499,944 | $ 389,199 | $ 345,253 | $ 296,175 |

| 23 | $ 537,579 | $ 417,910 | $ 370,509 | $ 317,633 |

| 24 | $ 577,059 | $ 447,965 | $ 396,924 | $ 340,054 |

| 25 | $ 618,473 | $ 479,426 | $ 424,552 | $ 363,481 |

| 26 | $ 661,917 | $ 512,360 | $ 453,448 | $ 387,959 |

| 27 | $ 707,489 | $ 546,835 | $ 483,669 | $ 413,534 |

| 28 | $ 755,295 | $ 582,923 | $ 515,278 | $ 440,257 |

| 29 | $ 805,443 | $ 620,700 | $ 548,337 | $ 468,179 |

| 30 | $ 858,048 | $ 660,245 | $ 582,914 | $ 497,354 |

| 31 | $ 913,231 | $ 701,641 | $ 619,077 | $ 527,837 |

| 32 | $ 971,118 | $ 744,974 | $ 656,900 | $ 559,687 |

| 33 | $ 1,031,841 | $ 790,335 | $ 696,459 | $ 592,967 |

| 34 | $ 1,095,540 | $ 837,819 | $ 737,834 | $ 627,740 |

| 35 | $ 1,162,360 | $ 887,526 | $ 781,107 | $ 664,072 |

| 36 | $ 1,232,454 | $ 939,558 | $ 826,367 | $ 702,034 |

| 37 | $ 1,305,983 | $ 994,026 | $ 873,703 | $ 741,700 |

| 38 | $ 1,383,115 | $ 1,051,042 | $ 923,212 | $ 783,144 |

| 39 | $ 1,464,027 | $ 1,110,727 | $ 974,994 | $ 826,448 |

| 40 | $ 1,548,903 | $ 1,173,206 | $ 1,029,151 | $ 871,695 |

| -$375,698 | -$519,752 | -$677,208 | ||

| * Nb. if your income and concessional contributions exceed 250,000, div293 may apply. | ||||

How much will your contribution grow to by 60

For a 25 year old, $10,000 of sacrificed take-home pay will turn into:

$10,000 x 1.25 x (1.06)35 = $96,076

Assumptions:

- 1.25 is for someone on the 30% marginal tax rate. Change it if you are on a higher marginal tax rate (see above)

- 6% is the after inflation rate of a high growth investment option achieving the historical average

- $10,000 of sacrificed take-home pay means contributing more than $10,000, but you get the difference back in reduced tax.

The downside to super

The downside to super is that any money you put in super is inaccessible until you meet a condition of release, which for those born after 1964 is 60 years of age if you have retired or ceased a gainful employment arrangement, or else 65.

So, the question of investing inside super or outside super can be expressed as tax savings vs flexibility.

Inside super = tax savings but losing access until age 60-65.

Outside super = flexibility to use before preservation age.

Reasons you may not way to put everything in super

While super offers amazing advantages, there are some reasons you may not want to put everything into super:

- Opportunity cost – i.e., better use of the money outside super (e.g., paying down non-deductible debt, using the money to pay interest on an investment loan and having a lot more capital invested and growing, or starting a business).

- Wants or needs for before you can access super (renovation, car/house upgrade, gifts)

- Bridging the early retirement gap – you have enough super projected for retirement funding beyond when you can access it, and now want to focus on saving to bridge the gap between early retirement and when you can access super.

- Foregoing the ability to change your plans later. For example:

- initially planned to retire at 60 but later changed your mind to retire/semi-retire earlier

- as you got older, your career took a nosedive, and you became less employable

- caring for someone with a disability

- Regulatory risk – potential legislative changes (an increase of preservation age, adding taxable brackets in super). I wouldn’t expect preservation age to be pushed so far back that super isn’t useful because it would deter people from using super and result in more people relying on the aged pension – which is exactly what super is there to avoid. And the last time the government pushed back access to super, it was legislated in 1998 and only came into effect in 2015, and was phased in over 9 years.

Essentially, you lose access to those funds until you are of retirement age.

Having said that, the tax benefits are incredible. Just keep in mind that you lose flexibility if 100% of available surplus funds go into super.

Final thoughts

Hopefully by now, you know ‘what is superannuation‘, the tax effects, and reasons why and why not to add to your super.

In general, you will want to invest outside super to meet your financial need before you can access super and take advantage of super for any funding for the decades from when you can access super onwards to supercharge your accumulation of retirement savings.

Next articles you may find useful

When can you access super

Superannuation contribution types

Superannuation account types

How to invest your super

How much to save inside vs outside super