In major market declines, couldn’t we temporarily switch to cash or bonds after a slight decline and then switch back to shares when it’s lower?

Trend following is a trading strategy according to which one buys an asset when its price trend goes up and sells when its trend goes down, expecting price movements to continue.

However, Adam Collins points out that:

Momentum and trend following models have been incorrectly marketed as able to “earn the upside without the downside.”

In practice, momentum models have historically imposed a very real cost for side-stepping severe stock losses like 2008. The cost is paid through false-positive signals that whipsaw investors when trends slightly turn negative, but a larger correction doesn’t develop.

With trend following, the cost of avoiding major drawdowns are the false positives where you sell after a decline only to find the market whipsaw back up, and you can’t get back in at your exit price. The loss then becomes permanent.

They found that 20% of the time, you would have avoided major declines resulting in an average improvement of 26.8% above leaving your money invested, but the overwhelming majority (80%) of the time you would have made a 6% loss due to a whipsaw, which means that the profit from avoiding major drawdowns is whittled away leaving you no better off.

Now, this doesn’t sound like the worst deal to me. You avoid the gut-wrenching declines yet get a similar long term expected return.

So, is there any major downside?

Yes.

If you do things right, then the expected return comes out to be similar, so while you’re no better off, you’re no worse off either, but the problem is that you’re human, and you can make mistakes and in that case, you would end up worse than just leaving your money invested.

So for those considering hopping out of the market with the idea you can avoid major losses, you may well be right, it may be one of the 20% of times that you avoid significant losses, but historically you’d have been wrong so often that all the losses you save would be lost during the overwhelming percentage of the time the market whipsaws. And that’s if you do it right. If you’re just making it up as you go along instead of using a trend-following strategy, there’s a higher chance of messing it up, resulting in a lower expected return compared to continuing to follow your investment plan.

How will you most likely mess it up by making it up as you go along? Instead of following a defined trend-following strategy, which gives you price movement signals of when to buy back in (resulting in little upside and little downside in the long term anyway), you’ll instead wait until it “feels safe” to be back in the market. By then, the price will have already gone up because risk (or in this case, lack of risk) will be priced-in by way of the price already rebounding and you having missed out on the rising market, buying in above where you sold, and resulting in a permanent underperformance compared to just leaving your investment alone.

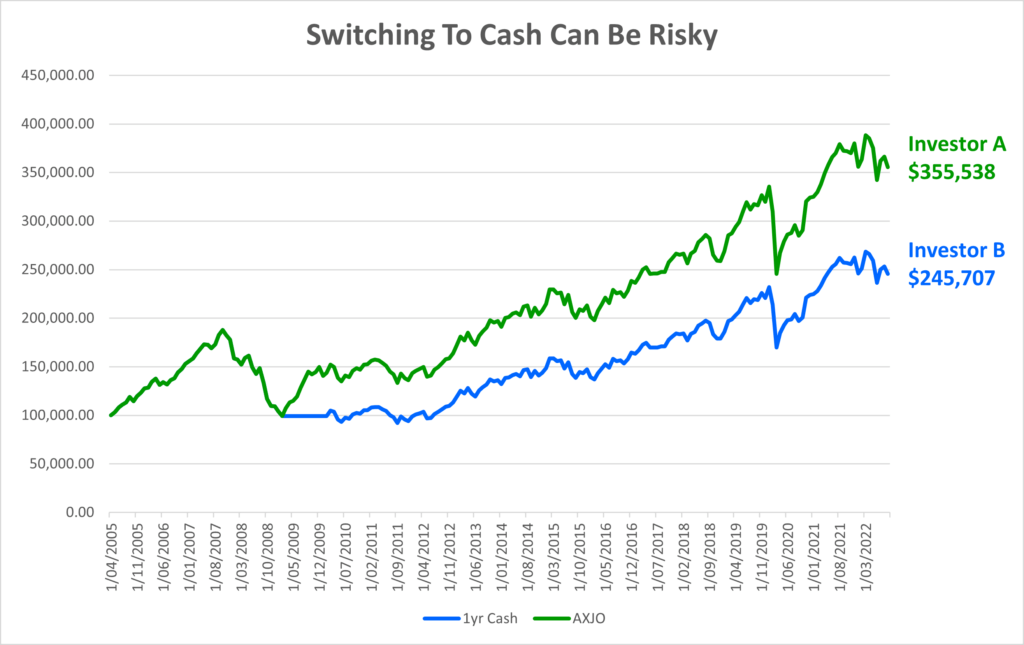

To illustrate this, below is a chart of two investors who each invested $100,000 in the ASX in 2005. The first left their investment alone throughout the GFC and the recovery. The second became worried and switched to cash at the time which turned out to be around the bottum of the market. They remained in cash for a year until they felt more confident the market was recovering and then switched back into the market.

The lesson is to make sure you have a plan of what you will do in all market situations, including downturn, and then stick to your plan no matter what. During accumulation, continuing to buy regularly, all the way down and all the way up no matter what the market is doing will most likely give you the best result, and there will be no need to guess which way the market will go and face the very real possibility of causing permanent damage to your investments.

As Jack Bogle said,

“Stay the Course. No matter what happens, stick to your program. I’ve said “Stay the course” a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”