Another downturn is upon us, and the usual slew of questions and comments on forums about sitting out of the market until it is ‘safer’ has reappeared.

In investment language, risk = volatility, and since risk and return are linked, if you wait until there’s less volatility, you’ll reduce your expected return.

Here’s how it works – when there’s bad news, the market prices in the higher risk by only being willing to pay less for a share and that’s why the value goes down. Once the risk has subsided or reduced, the market will price-in the lower risk by requiring a higher price to purchase stocks, and the discount will be gone. You’ll end up buying at a higher price, resulting in an opportunity cost of missing out on cheap stocks and the enormous gains that eventually follow in the recovery.

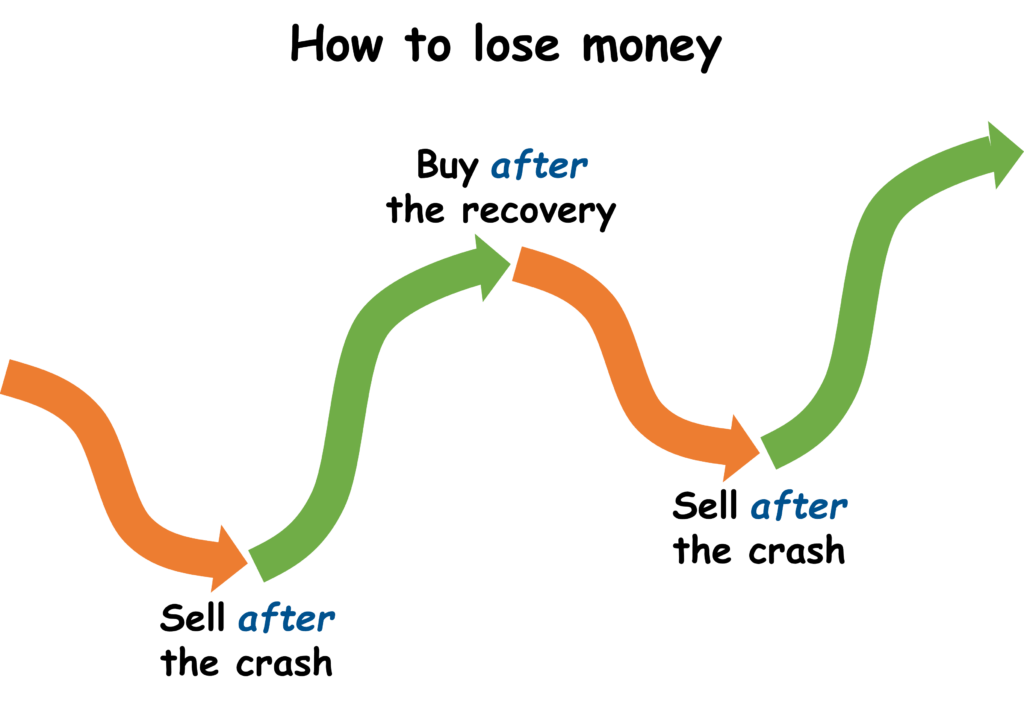

This is what I mean by risk and return being linked. If you wait until the risk is gone you’ve also waited until the return is gone. For funds currently invested, it feels wrong to leave it invested when the market is crashing and every bone in your body wants to sell, but if you sell out to sit out of the market until the risk is gone, you’ll have sold out after the price fell and bought back in after the price went up, resulting in a permanent loss compared to just leaving it invested.

This sketch explains graphically why waiting to buy after market volatility subsided, just as why selling after market volatility has increased, is a terrible idea.

Most people are so focused on whether the market will continue further down or how far down it may go that they usually end up missing a great opportunity, but since you should only be investing money that you can leave invested for at least 10 years, it shouldn’t matter if the market continues to drop, because you were always going to just leave it in there long enough to recover anyway.

No one rings a bell to tell you the market has hit bottom and will begin recovering. You only know it in hindsight after the market has already recovered. You also can’t tell if the recovery has begun by waiting for the price to go up because the price could easily go up and then continue down again. If your goal is to wait until it has bottomed, good luck because there’s no way to know this. I’d be happy with the currently huge discount (Editor’s note: this article was written during the Covid crash), and I’d want to get it invested before things turn around to avoid missing out on the huge discount. It makes no difference buying 30% below peak on the way down or 30% from peak on the way up. What If You Buy Stocks Too Early During a Market Crash?.

Of course, anything you invest into stocks should be with the intention of leaving it invested for the long term and not be taken out no matter what, and if you need to increase your emergency fund or pay off personal debts like a car loan instead of investing your surplus income when the economy is shaky, don’t be afraid to prioritise improving your cash flow position if you were not as prepared as you should have been, but once you have decided that money is to be invested, I’d be over the moon with a 30% discount. (*This article was when the market was down 30%)

If you wanted to, you could invest half and DCA the rest over the next 6-12 months, but of course your chance of buying lower over that time is offset with the chance that it rises in that time and you miss out on some of the discount.