A few of these sections have been covered in some other articles, but I thought I’d tie them together into a cohesive whole to explain stock market risk, a more in-depth explanation of the effect of what diversification can and cannot solve, why it can and cannot solve them, and how to use that information when building your portfolio.

Topics covered

- Systematic and unsystematic risk

- The risk premium

- De-risking vs diversification

- How to use this information

Systematic and unsystematic risk

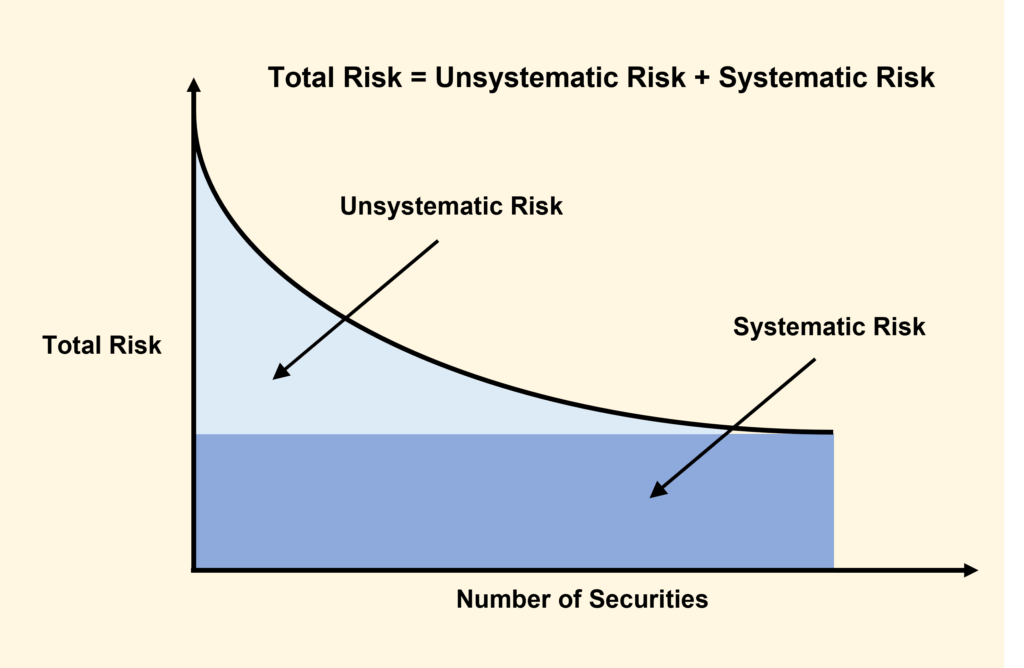

The risk of a single asset can be broken down into systematic and unsystematic risk.

Unsystematic risk (also known as idiosyncratic risk) refers to a risk specific to a single asset (such as a single company), or a single group of assets (such as a sector). Unsystematic risk can be diversified away. In an efficient market, there’s no reward for taking this risk, which is why when you diversify and lower or remove unsystematic risk, there’s no corresponding loss of reward either. This is why diversification is called the only free lunch – because by diversifying, you lower the risk without lowering the return. Conversely, when you don’t diversify away unsystematic risk, you’re taking on a higher risk without getting a reward — kind of silly when you think about it.

Examples include – single company risk, single industry risk, fund manager risk.

Systematic risk refers to a fundamental risk inherent in an asset class itself. This cannot be diversified away, and this is the risk that you get a higher expected return for taking.

Examples include – economic risk, interest rate risk, political instability, sector instability, small company risk.

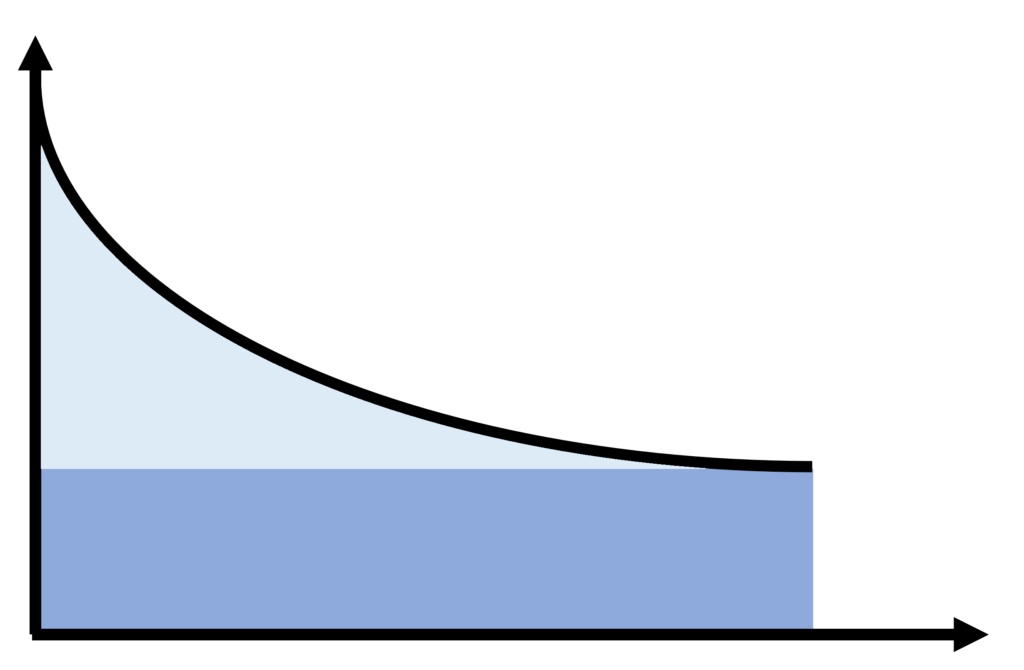

You can see it visually in the below image. As you diversify by adding more and more assets, you reduce unsystematic risk until you are left with only systematic risk.

Financial analysts calculate returns based on precisely these two risks, known as beta (systematic or asset class risk) and alpha (unsystematic or single asset risk).

RA = Beta (RM) + Alpha

| RA | = | asset return above the risk-free return. |

| RM | = | market return above the risk-free return. |

| Beta | = | the systematic risk (i.e. the degree of stock market risk inherent within the stock). |

| Alpha | = | return based on unsystematic risk (i.e. risk associated with the individual company not associated with the broader stock market). |

A quick note on diversifying away unsystematic risk. Finance textbooks show that around 15-25 stocks (depending on the local market) will lower standard deviation enough to remove single-asset risk. While this is true, it doesn’t mean you’ll get the market return by picking 20 individual stocks. This is because market returns are driven by a small number of stocks (and you will not know which ones in advance), so even if you own 100 individual stocks, you only have a 44% chance of earning the market returns. The way to get the market returns is by owning the whole market.

The risk premium

Once we have removed unsystematic risk through diversification, we are left with systematic risk, which for equities is stock market risk. This is the risk that you are getting paid to take.

A risk premium is where an asset has a known risk, and those who purchase it price the asset lower by way of not being willing to pay as much as for more stable assets to ensure that their expected return is higher to account for the higher risk.

‘Expected return’ is the weighted average return of all the expected outcomes.

However, even when paying less to make up for the times that the risk eventuates, an investor is not going to pay for a higher risk asset to get the same expected return. If you were looking at the same expected return of a safer asset as for a riskier asset, of course you would choose the safer asset every time. You aren’t going to go for an investment with higher volatility for the same expected return. The incentive for higher risk assets is paying even less still below the amount that would give you the same expected return as an incentive to take on the higher risk. What this means is that you’re expected return is higher, even after accounting for the times the risk shows up.

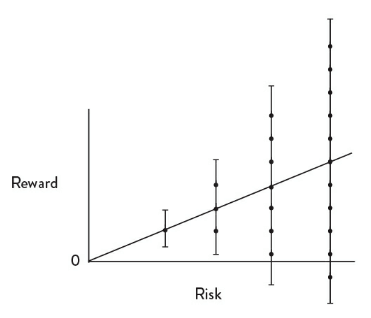

Let’s see this pictorially from an image in an earlier article.

As you move towards more risky investments, along with the higher risk (risk = larger range of possible outcomes), your expected return (the point on the diagonal line) increases. The expected return is like a weighted average of all potential outcomes. To get this higher expected return, you face the risk of a wider range of possible returns.

The average return over very long periods tends to be higher, but this higher risk can mean higher highs and lower lows.

Now, let’s take a step back for a moment and think about what would happen if we could diversify away systematic risk the same way we can with unsystematic risk.

The market would no longer price the assets at a discount. It would be priced higher, and as a consequence, your expected return would fall.

This is why risk and expected return are linked, and why attempts to remove stock market risk results in lower returns.

What about options where you purchase the right, but not the obligation, to buy or sell stocks at a later date, and then, if the market moves in a way that results in a negative outcome, you can avoid the risk altogether by simply letting the option lapse?

Unfortunately, the unrecoverable cost of purchasing the option lowers your expected returns, essentially removing the higher expected return associated with the risk that is being removed. You cannot escape the fact that to get higher expected returns requires taking on the associated risk.

It is often said that you have to earn the premium by tolerating the risk and not panic-selling through the hard-to-stomach volatility.

De-risking vs diversification

Diversification is having exposures to assets that move out of sync with each other to lower variance.

In William Bernstein’s book The Intelligent Asset Allocator, he tells a story. Let’s assume you have a weighted coin. When it flips heads, you get a 25% return, and when it flips tails, you get a -5% return. The average of these two outcomes is 10%, while the standard deviation (a measure of the amount of variation from the average) is 15%. It just so happens that these metrics are similar to the long-term average and standard deviation of the S&P500.

Now, let’s assume we have a second coin that produces the same +25%/-5% results and the outcome of this second coin is completely independent from the first. In order to spread your bets, you decide to split your investments between the outcome of both coins equally. The result is that you now have four potential outcomes instead of just two. If both coins flip heads, you get +25%. If the first is heads and the second is tails, you get 10%. Likewise, if the first is tails and the second is heads, you get 10%. Lastly, if both are tails, you get -5%. Overall, your average of the four outcomes is still 10%. However, the standard deviation (amount of variation from the average) is now reduced to only 10.6%.

In a nutshell, diversifying between two equal but uncorrelated asset classes lower your risk without lowering your expected return.

De-risking is the process of reducing the variance (magnitude of the ups and downs) of a portfolio.

In the above example, we invested half our money with one coin and half with the other coin whose outcome was independent of the first coin. The result was a lower variance (i.e. risk) without a corresponding lowering of expected return.

If we instead invested half our money with one coin and didn’t invest the other half, we would also be lowering our risk (de-risking), but unlike the above example, we would be lowering our expected return in direct proportion to the lower risk.

An important point here is that diversification lowers your risk by keeping more of your returns centred closer to their mean, but diversification does not necessarily remove downside risk, which would occur if both assets in the above example flipped tails at the same time. This is particularly important, because in a global crisis, correlations tend to align where all risky assets can crash together.

The other important point is that to lower downside risk, you will need to lower your expected return.

In summary

Diversification reduces risk without a corresponding loss in return by way of removing unsystematic risk.

But you can only reduce risk so far before all you are left with is the risk that you are getting paid for, systematic risk.

If you want to reduce this risk any further, you will need to ‘de-risk’ by owning less risky assets and replacing them with low-risk assets such as cash or short-term bonds. This will come at the cost of lower expected returns because risk and reward are intertwined through the way that asset pricing itself works on a fundamental level.

This is why we want to manage risk rather than eliminate risk – because while eliminating risk will remove the chance of capital loss, it will also remove the chance of capital appreciation.

The goal is to take on as much compensated risk (systematic risk) as we can personally tolerate given our circumstances.

How to use this information

Firstly, diversify broadly with any assets that have unsystematic risk, such as stocks.

After that, invest with the understanding that the market can drop deeply and rapidly before you even realise what has happened and have time to react. Taking this as a given, the only solution is to invest only as much as you can tolerate this volatility with, and be able to leave your investment alone long enough to recover. The rest of your assets should be in low-risk asset classes like cash or high-quality bonds.

If you’re nervous or uncomfortable with your stock investment, it’s a sign that you have a lower risk tolerance, and you should have less of your money in equities. Your risk tolerance may increase as you become more educated in the nature of the stock market and you become more comfortable with it, but don’t feel like it’s wrong to lower your allocation of equities until you feel more at ease with the stock market’s volatility. Just because someone else may have most or all their money in stocks doesn’t mean you need to.

In fact, you most likely don’t need to invest 100% in stocks to meet your goals, and as explained here, at the top end of the stock to bond allocation spectrum, replacing some stocks for bonds has a disproportionately high benefit relative to the cost, so don’t feel the need to invest beyond your risk tolerance.