What is VDHG

Vanguard released a range of all-in-one funds to simplify investing for individual investors.

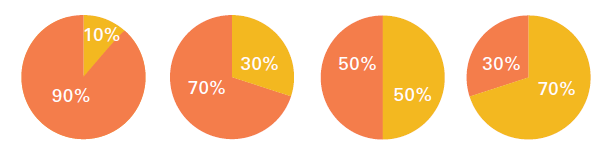

Here is a breakdown of the 4 funds.

| Fund | Asset allocation stocks to bonds |

|

|---|---|---|

| VDHG (High Growth) | 90 / 10 | |

| VDGR (Growth) | 70 / 30 | |

| VDBA (Balanced) | 50 / 50 | |

| VDCO (Conservative) | 30 / 70 |

What high growth, high risk, and balanced means

With Vanguard’s all in one funds, the words “high growth” and “high risk” (and balanced and conservative) don’t have quite the same meaning as those words do in regular conversations.

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss.

In investing language, stocks are called high risk because the short- and medium-term price goes up and down so much that you have a ‘high risk’ of (potentially large) short- and medium-term loss. But in the long term, they provide a higher expected return.

On the other hand, bonds or fixed-term deposits have almost zero short- or medium-term risk since the capital is returned on maturity.

So, in the all-in-one funds, they call the funds with most or all in stocks ‘high risk‘ or ‘high growth‘, and those with most or all in bonds ‘conservative‘, and those with 50/50 ‘balanced‘.

But over the long term, bonds return much less, so even though they have less short term volatility (i.e. what they call risk), they give you a much more significant risk of not earning enough money that you need to last the long term in retirement.

A high-growth or high-risk fund is simply a fund with most or all stocks and little or no bonds. So, if you already invest in VAS or VGS and little-to-no bonds or cash, your investment is already high risk or high growth.

But at the same time, if you don’t need to draw on your money for decades, bonds are not as important, and a ‘high risk’ portfolio with less bonds actually gives you a lower risk of ending up without enough money to last through retirement. Stocks and bonds both have their use because multiple competing risks need to be addressed when constructing a portfolio.

What is actually in them?

Now that we understand what the fund names mean let’s take a look under the hood.

Vanguard’s diversified funds invest in over 10,000 companies in 46 countries.

If you take a look back at our previous articles on risk tolerance, equity funds and personalising your AUD to non-AUD allocation, you can see that a personalised investment allocation is as simple as answering 3 questions

- Determine your equities to fixed income allocation based on your risk tolerance.

- Determine your AUD to non-AUD asset allocation based on your total wealth and liabilities.

- Determine how much you want in Australian equities (VAS) vs global equities AUD-hedged (VGAD).

With the Vanguard diversified funds, the first question is left to your decision of which fund you chose, so we will take a look at how the next 2 are split within the diversified funds.

In all the funds, the equity portion is split the same.

They’re the managed fund versions of the following.

| VAS | 40% | |

| VGS | 29% | |

| VGAD | 18% | |

| VISM | 7% | |

| VGE | 6% |

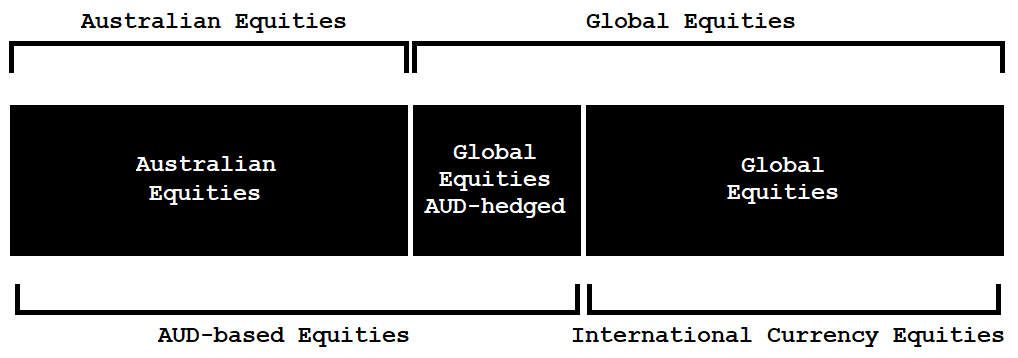

To make it more obvious, what they have is

- 40% Australian equities

- 18% Global equities AUD-hedged

- 42% Global equities

Resulting in

- Australian equities to global equities 40/60

- AUD-based equities to international currency equities 58/42

As you can see, they’ve decided on a generic allocation that is roughly what you would expect to be an average of the general population’s needs.

Regarding the allocation to Australian equities, Vanguard has similar diversified funds in Canada, but with 30% in home country equities as opposed to the 40% they decided to use in the Australian version. They’ve mentioned in research papers that franking credits have a place in determining home country equity proportion, which explains why they went for a higher portion of Australian equities (VAS).

Regarding the AUD to international currency allocation, it looks like a good average across the general population. Someone with less AUD assets outside their equities (property, bonds, cash, business) would be well-served with a bit more AUD based equities (VAS/VGAD). Someone with more AUD based assets outside their equities would be well-served with less AUD based equities, but this is a good average for someone more inclined to keep it simple.

Also, note that the total global equities (combined hedged and unhedged) is in cap-weighted proportions, which means they have maintained market-priced proportions of large, medium, and small companies in 45 developed and emerging countries – avoiding active management risk of trying to guess which asset classes will do what in the future.

Considerations when choosing a diversified fund or rolling your own

Pros of a Vanguard diversified fund

1. Simplicity and ease

When you choose a Vanguard diversified fund, there is nothing more to do. You can spend your time focusing on your career and other non-financial parts of your life, such as your family, travel, hobbies, and so on. You just take out money each month from your pay cheque and add it to your fund, and you’re done!

2. No need to rebalance

When you go the DIY route, as the values of your asset classes change over time, so does the risk-return profile of your overall portfolio. To bring it back, you need to rebalance. During small market changes, this is easy enough by always adding to the one that is most underweight, but in a bear market, when your equities are falling in value before your eyes, it becomes very difficult to sell some of your safe assets and add them to your risky assets to take advantage of buying low. Having Vanguard do this for you becomes a more significant benefit than many realise.

3. Removes behavioural risk

The biggest risk to long term performance is an investor changing their allocations based on what they saw on the news or heard at the water cooler. Someone will say there’s a recession coming, and you lower your proportion of Australian equities. Of course, the market so often makes fools of us and goes in the other direction. You sell right before Australian equities rise, resulting in a lower return than if you left it alone as you should have.

This is the most significant advantage of the Vanguard diversified funds – the allocations are set, and you can’t sabotage your returns by tinkering.

Nobody thinks they will mess it up and change allocations based on everyone saying which way the market will go or stop rebalancing into the falling asset class, but it is human nature to do so. For many, this alone will make it better to go with the all-in-one even at the slightly higher fee.

There are various studies on actual returns of investors compared to what the index returned. One I recall quoted 2-3% lower performance, and another around 1%, so if you’re a tinkerer that is always trying to find the absolute best investments – by going the DIY route, you might be saving a small amount but paying for it with 1% lower performance is a terrible trade-off.

4. Enables your partner to manage finances when you’re unable to

One more advantage of all-in-one funds that are seldom spoken of is that one day you’re not going to be around anymore, and most likely, your partner hasn’t got a clue how to manage a portfolio, or the interest to learn, or the ability to find the unbiased information required to learn even if they wanted to. Having a single-fund portfolio for them to draw down from will be very straightforward and save them a lot of trouble trying to figure out what to do later. Also, you may think you can just switch to that later, but there’s no reason you couldn’t get hit by a vehicle and even if you did have time to prepare, you would face the cost of realising significant gains to switch from a multi-fund portfolio to a one-fund portfolio.

Pros of the DIY approach

1. The cost

The annual management expense ratio (MER) for the diversified fund is 0.27%.

To put it in context, I normally consider costs based on a portfolio of $1M, so in that regard, the cost is $2,700 per year.

If you’re willing to buy the individual funds and just top up the lowest performer each time you add funds to your portfolio, it will have an MER of around 0.19%, and for a $1M portfolio, that’s $1,900 per year. Not insignificant, in my opinion, considering the extra work involved is a few minutes a year.

2. Ability to customise

As we saw above, you might have investment property, in which case, there is likely no need for investment in the concentrated Australian equities market at all. Conversely, you may have retired young and decided to rent, and so a higher AUD based equities proportion might be more suitable.

You also may consider 40% of your equities allocation in the concentrated Australian market to be more concentration risk than you consider reasonable.

The Australian stock market makes up just 2.5% of the world’s markets by cap weight (company valuation proportions), and the Australian market has around half its entire value in just 10 companies and 2 sectors. If that isn’t enough, the value of your house, bonds, cash, and income are all tied to the Australian economy. The question has to be asked whether you want 40% of your equities tied to it also. If there’s an isolated economic downturn, how much of your assets are you comfortable being exposed to it?

The Vanguard diversified funds are inflexible for these customisations.

3. Tax efficiency

When you retire and move to the distribution phase of your investment, if you have your funds split up, you can just withdraw from the asset class that has over performed to help bring your allocation closer to your target allocation.

But if you have an all-in-one, you have no choice but to sell a piece of all the asset classes, including the underperformers. Then Vanguard will end up buying more of the same underperformer as part of their rebalancing, so you have to pay CGT on those realised gains where you otherwise wouldn’t.

This is most relevant for splitting between stocks and bonds, which have a low correlation more than between the different equity classes.

Splitting it up also allows you to keep your bond portion in your super as bonds are tax-inefficient, which you can’t do with the Vanguard diversified funds since they all include a fixed income allocation. [Although while interest rates are around zero, the returns on high-quality bonds are so low that you’re probably better served using up the tax-advantages of super for stocks and keeping your bonds out of super.]

You could go with a 2-fund portfolio of VDHG with a separate bond fund placed in super, reducing tax inefficiency.

Another tax inefficiency with the diversified funds (both the ETFs and the managed fund equivalents) is that the underlying funds held within them are the managed funds and not the ETFs. Since ETFs are more tax-efficient, holding the underlying ETFs yourself would be more tax-efficient than holding the all-in-one funds.

ETFs are more efficient because, in managed funds, other investors selling their units triggers capital gains for all investors of the fund. So even if you don’t sell any units, you still have to realise gains. This doesn’t occur with ETFs due to their tax structure, and instead, you defer these capital gains until you sell your ETF shares.

A more detailed explination on how VDHG is tax-inefficient.

In summary

Vanguard diversified funds

- Simplicity and ease

- No need to rebalance

- Removes behavioural risk of tinkering

- Enables your partner to manage finances when you’re unable to

DIY

- Cheaper

- Ability to customise

- More tax-efficient

It’s going to be incredibly hard to beat the Vanguard diversified funds, so it is still an excellent choice despite some downsides. For those who want a little more control, you can go the DIY option – it’s not that much more work in practice if that’s what you prefer.

If you’re still unsure, I have two suggestions to consider.

- Focus on the big items in the list of pros and cons.

- The most significant item for many will be removing the behavioural risk of seeing something in the news and then selling down your assets after the entire market (who has access to the same news) has already reacted. Then you buy after it has gone back up. If you’re the type to tinker, then going with an all-in-one outweighs all the con’s combined.

- If you have an iron will and that is not a problem, then I’d say that ability to customise is probably the next biggest one.

For example, if you already have investment property, it makes the most sense for your portfolio’s equities portion to be entirely global (unhedged).

Another example might be that you’re able to save enough for retirement without facing additional risks to meet your goals and therefore have no need to take more concentration risk to chase franking credits and prefer to go with an all-global portfolio with VGAD taking up your entire AUD proportion.

- Strive for simplicity

- If you still have no opinion one way or the other, consider the simpler approach of fewer funds. It doesn’t make sense to make things more complicated without reason.