Quick Links

What is the First Home Super Saver scheme

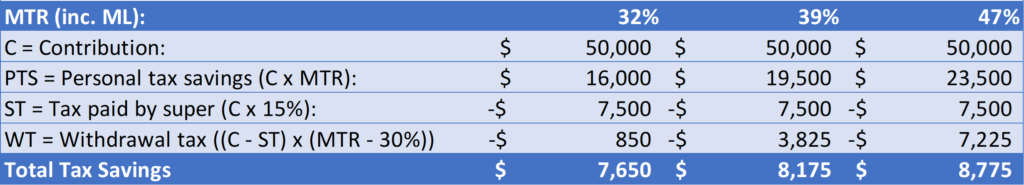

How much tax can you save with FHSS

First Home Super Saver scheme Eligibility

How much can you contribute towards FHSS

How to contribute to the FHSS scheme

Do you need to inform anyone that the contributions are for FHSS

How do you access money under FHSS

How much can you withdraw from FHSS

The impact of changing tax brackets

The Impact of div293

The Impact on HECS/HELP

Can I combine FHSS with other people

Can I change my mind and withdraw money from the FHSS scheme?

Can I change my mind after withdrawing the money under FHSS?

How to invest your super for FHSS

Checklist

What is the First Home Super Saver scheme

The First Home Super Saver (FHSS) scheme allows you to add extra money into super above your employer’s compulsory contribution, and rather than having to wait until you’re 60 to access it, you can withdraw it to buy your first property.

As a result, you can get significant tax deductions when making concessional contributions into your super fund and withdrawing it to buy your home. This is because, instead of paying your marginal tax rate on your income, you pay a reduced tax rate, getting thousands of dollars of essentially free money from the government by paying less tax.

While you can make non-concessional contributions to withdraw under FHSS, you miss out on almost all of the benefits of the scheme (unless you’re a low-income earner using the co-contribution scheme), so for the purpose of this article, we will assume all contributions are concessional contributions. The article linked above explains the difference between concessional and non-concessional contributions.

How much tax can you save with the First Home Super Saver scheme

A couple of acronyms before we begin:

- MTR = Marginal Tax Rate

- ML = 2% Medicare Levy

- Click here to view the Marginal Tax Rates for 2024/25

Under the FHSS scheme using concessional contributions:

- on the way into super, it will be taxed at only 15% instead of your MTR + ML

- on the way out, you pay tax at 30% below your MTR + ML (on the remaining 85%)

For someone on a MTR of 32% (inc. 2% ML), this is an effective tax rate of just (15% + (2% x 85%)) = 16.7%

When comparing using the maximum $50,000 under the FHSS scheme with not using the FHSS, your after-tax return is either:

| Outside super without FHSS | = | $50,000 | x | 68% | = | $34,000 |

| Inside super with FHSS | = | $50,000 | x | 83.3% | = | $41,650 |

So, for someone on a MTR of 30% (plus 2% ML), that’s $7,650 of free money even if you just left it invested in cash, earning nothing within your super.

A risk-free return of 22.5% courtesy of the government.

For someone on the 37% MTR, that’s $8,175.50 of free money.

For someone on the 45% MTR, that’s $8,775.50 of free money.

How much you can save with the FHSS scheme

Note that the above figures will be a little different if:

- you contributed while on one marginal tax rate, then withdrew on a different marginal tax rate

- your concessional contribution dropped you into a lower marginal tax rate

- your income plus concessional contributions are over $250,000 (div293 reduces the benefit of FHSS significantly).

First Home Super Saver scheme eligibility

To be eligible for the First Home Super Saver Scheme:

- you must be at least 18 years old to release the funds, but you can start to save before 18

- you can’t have owned any property in Australia before (unless the ATO determines you have suffered a financial hardship, including divorce/relationship breakdown)

- you will occupy the property, or intend to, and for at least 6 months within the first 12 months you own it, after it is practicable to move in

- you can’t have already applied to release money under the FHSS scheme

- you must request a FHSS determination or a release of amounts under the FHSS scheme

Are you still eligible to use the FHSS if your partner has owned a house before but you haven’t?

Quoting the below link from the ATO Community:

Eligibility is assessed on an individual basis. This means that couples, siblings or friends can each access their own eligible FHSS contributions to purchase the same property. If any of you have previously owned a home, it will not stop anyone else who is eligible from applying.

FHSS Partner already owns a house | ATO Community

FHSS Partner has already purchased a home before | ATO Community

How much can you contribute towards the First Home Super Saver scheme

Under the FHSS scheme, you can add voluntary contributions up to $15,000 per year, and this must be within existing contribution caps, up to a combined maximum of $50,000 over multiple years.

This can be through either concessional or non-concessional contributions, but virtually all the benefits are through concessional contributions since you are getting a tax concession (i.e., paying less tax) on the contribution.

Note that if your compulsory employer contributions leave your concessional contribution cap below the $15,000 maximum that you can put in for the FHSS scheme in a single year, you may still be able to make more concessional contributions if you have previous years’ unused concessional contributions as per the carry-forward rule.

However, if you have unused concessional contributions from previous years to be able to contribute over $15,000 voluntarily in one financial year, as mentioned above, only the first $15,000 of contributions in any financial year will count towards FHSS. If you have $50,000 worth of unused concessional contributions from previous years, even though you can contribute that amount, only the first $15,000 will count towards FHSS and the rest will not be accessible to release under the FHSS scheme.

How quickly can the contribution be done

To get the money in, depending on your concessional cap, you could put up to $15,000 at the end of the first financial year in June* and up to $15,000 at the start of the last financial year, so technically, it is possible to:

- Make use of up to $30,000 (per person) within the space of a few weeks (e.g., if you found out about this towards the end of the financial year and are planning on purchasing in the new financial year);

- Make use of up to $45,000 (per person) within just over 12 months; or

- Maximise FHSS savings within just over 2 financial years.

* If you contribute in June, make sure to do it a week or two before the end of the financial year because super funds get an avalanche of requests at that time and usually have a cut-off date if you want to be sure it is in before the end of the financial year.

How much can you save if you don’t have several years

If you found out about the FHSS scheme too late and don’t have several years to contribute the full $50,000, using the figures from the section on how much tax you can save, you can calculate how much you can save.

Someone on the 30% MTR can save up to:

$15,000/$50,000 x $7650 = $2,295 per financial year.

This can also be calculated as follows:

| Personal tax savings on contribution | $15,000 x 32% (inc. 2% ML) | = | $4,800 |

| Tax withheld on contribution | $15,000 x 15% | = | $2,250 |

| Tax withheld on withdrawal | $15,000 x 85% x (32% – 30%) | = | $255 |

| Total tax savings | $4,800 – $2,250 – $255 | = | $2,295 |

For those purchasing in the next financial year on the 30% MTR, they can get up to $4,490 of essentially free money by contributing the maximum for each of this and the next financial year.

Note – for both of the above sub-headings on ‘how quickly you can contribute’ and ‘how much you can save if you don’t have several years’, as mentioned, you not only have to be within the $15,000 FHSS annual contribution limit, but for concessional contributions, you also must be within the annual concessional contribution cap of $30,000.

So, if your employer’s compulsory super contribution leaves you with less than $15,000, you will be limited to a lesser annual concessional contribution (if you do not have any carry-forward contributions). For instance, someone on a $180,000 income, with their employer contributing 12% to their super, will have only $8,400 per year they can contribute if they don’t have carry-forward contributions available.

Tip – If you are a PAYG earner (meaning tax is taken out before you get your wage), your tax savings in the second-last year from personal contributions may be locked up with the ATO until you get your tax assessed, but you can talk to your accountant about submitting a PAYG withholding variation application.

The ATO will review your circumstances and if you are expected to receive a large tax refund at the end of the financial year, they can direct your employer to reduce the amount of tax you pay each pay cycle. This can give you the added cashflow to contribute in the final year to maximise your FHSS contributions.

How to contribute to the First Home Super Save scheme

Compulsory employer contributions do not count as eligible contributions under the FHSS scheme, only voluntary contributions count.

The two ways to add voluntary payments to super are:

- Salary sacrifice — asking your employer to automatically take some of your salary and add it to your regular employer super contribution), and

- Personal contribution — transferring money directly to your super account.

Salary sacrifice is also referred to as a pre-tax contribution since it is taken out before it is taxed.

Personal contributions are also referred to as post-tax contributions since you contribute it after tax has been paid.

With the after-tax contribution, provided your total concessional contributions (voluntary contributions plus employer contributions) are within the concessional cap of $30,000, you can claim the tax deduction and turn it into a pre-tax contribution. To do this:

- the money must be in your super account before the end of the financial year (most super funds require a week before the end of the financial year for processing); and

- you must lodge an NOI form (Notice Of Intent to claim a tax deduction) with your super fund before you lodge your tax return (or by the end of the following financial year, whichever is earlier), and you will need to receive written acknowledgement from your super fund for the NOI – and you will need that acknowledgement document when you lodge your tax return.

* Note that if you change super funds (called a ‘rollover’) before receiving the NOI acknowledgement, you miss out on the tax deduction, and it remains a non-concessional contribution.

Salary sacrifice can help in that you save on tax immediately, whereas personal contributions have to wait until your tax return (but you may be able to submit a PAYG withholding variation to get it sooner).

However, salary sacrifice can have issues because you may not accurately calculate your cap because you could get a pay rise, lose your job, get a bonus, and, most importantly, your employer may not get their last compulsory employer super payment in by the end of the financial year (they can pay your last payment later which counts towards your next financial year).

Typically, I’d go the personal contribution route to have more control.

Do you need to inform anyone that the contributions are for the First Home Super Saver scheme

No, you do not need to inform anyone that your additional contributions are specifically for FHSS. It just needs to be contributed.

But if you contribute the additional money directly to super (not via salary sacrifice through your employer), you must complete and submit an NOI if you want to claim the tax deduction on the contribution. If you do not do this, or if you do it too late, you will lose your ability to claim the tax deduction.

Also, to get the tax deduction on personal contributions, you must complete the NOI:

- before your final determination,

- before your request to release (explained in the next heading) and

- before any rollover to another superfund.

My suggestion is that after every personal super contribution, submit your NOI, and once you get your acknowledgement letter and can see a transaction showing the 15% tax has been deducted from your account, do a determination through MyGov (explained in the following section). While you can do these later, you may forget and lose significant amounts of money.

Tip – If you contribute through salary sacrifice rather than direct personal contributions, be aware that until 2026 (which is years away), your employer is only required to pay super every three months, and in the following month of each quarter, so they may be late and contribute it in July, which means the concessional contribution goes towards your next year’s contribution cap. This is especially important for FHSS contributions due to the $15,000 per year limit, which cannot be carried forward like other concessional contributions. For this reason, if you’re making use of the FHSS scheme, consider personal contributions over salary sacrifice, which gives you complete control over when the contributions are made.

How do you access money under the First Home Super Saver scheme

This is important. Read it carefully, and maybe more than once.

There are two steps to access the funds – a determination and a request to release.

- A determination – is where the ATO determines the maximum amount that can be withdrawn, which includes contributions and associated earnings.

- A determination can be done as many times as you want, but it must be done before settlement* (transfer of legal ownership). It’s a quick and easy online form. Do one regularly, just in case you forget with everything going on around the time of the purchase, and try to remember to do the final one shortly before signing to get the maximum amount.

- If you signed without having submitted the determination, ask the vendor if you can sign a new contract with a new date to allow for this.

- A request to release – can be done before or after signing the contract.

- If you sign it before, you have 12 months to sign, but you can apply for a further 12 month extension, making it 24 months.

- If you sign it after, you have 90 days after signing the contract*.

- If you miss that date, you can withdraw or amend the request to release, provided the ATO has not yet paid out the money*. This means you can withdraw your application and reapply later, or you can change the amount to withdraw.

- If you miss that date, you can still get it, but you lose the tax deduction (i.e., you lose the benefit of the FHSS scheme). Also, note that the ATO states it can take as many as 15-25 days to receive your money from them, so it’s essential you are not in a hurry to put down the deposit.

*Changes from September 15, 2024

Prior to September 15, 2024:

- A determination had to be done before the contract was signed. It now must be done before settlement (transfer of legal ownership).

- A request to release the funds had to be done within 14 days of signing the contract. It now can be done up to 90 days after signing the contract (although settlement is often much shorter than this)

- You could not amend or revoke requests for release. You are now allowed to amend or revoke requests for determination and release if the ATO has not paid out the money yet and has not begun processing the amounts from your super fund.

These changes avoid the following issues:

- people forgetting, in the heat of the excitement of buying their first home, that they must have done a determination before entering into the contact.

- only having 14 days after signing a contract to submit the request to release the funds

- change of mind after the requested to release and before the ATO has paid it out.

Transitional rules

If you made a determination and missed the 14-day window after the contract was signed under the rules prior to the changes on September 15, 2024, and never received a payment from the scheme, you can re-apply for the request to release for up to three years after the September 15, 2024 changes, based on your last determination.

Tip:

As mentioned in the previous heading, to get the tax deduction on personal contributions, you will need to submit the NOI before your final determination and request to release, so a good rule of thumb is to submit an NOI and have a new determination done after you make any personal contributions.

How much can you withdraw from the First Home Super Saver scheme

The determination specifies the maximum amount that can be withdrawn, which includes (from 2017-18 financial year onwards):

- FHSS concessional contributions amount (after 15% tax on contributions has been taken out)

- FHSS non-concessional contributions amount

- Associated earnings

Deemed earnings

Associated earnings are calculated using a deeming rate. Deeming is a method used to calculate earnings on your super returns. Rather than using actual earnings, it assumes that the money you have invested is earning a particular amount of income regardless of the actual amount earned. This way, if your super is down, you can still withdraw the full amount plus a bit more, and the excess will come from the rest of your super. The deeming is based on the SIC rate.

Tax withheld

In addition to the contributions and associated earnings, your payment summary will include tax withheld for withdrawing under FHSS. As mentioned above, when withdrawing, there is also a tax of 30% below your MTR+ML on concessional contributions, so 2% for an MTR+ML of 32%.

You will need to include the amount stated in your payment summary in your tax return for the financial year you request the release, and the payment summary will show details of tax withheld, which also needs to be included in your tax return.

Your marginal tax rate in the year you withdraw includes the withdrawn FHSS amounts (with the 30% tax offset). The tax withheld is used to cover this, however, this may bump up your MTR, resulting in having to pay additional tax in that financial year and reducing a portion of the benefit of the scheme.

Examples

If you contributed concessionally, as noted above, you are taxed at 15% on contributions and 30% below your MTR + ML when you withdraw.

Someone on the 32% MTR (inc. ML) who contributed the maximum of $50,000 in concessional contributions could withdraw

$50,000 x (85% – (2% x 85%)) = $41,650 (plus deemed earnings)

Someone on the 39% MTR (inc. ML) who contributed $35,000 in concessional contributions could withdraw

$35,000 x (85% – (9% x 85%)) = $29,482.25 (plus deemed earnings)

If, for some reason, you had non-concessional contributions, you did not have 15% withheld on contribution. The non-concessional contribution itself is not taxed on withdrawal, but any related earnings are taxed on the withdrawal at 30% less than your MTR + ML.

So, someone on the 32% MTR (inc. ML) who contributed $20,000 in non-concessional contributions with $2,000 related deemed earnings could withdraw $20,000 + $2,000 x (100% – 2%) = $21,960

The impact of changing tax brackets

As mentioned above, FHSS withdrawals are taxed at your marginal tax rate (MTR) less a 30% tax offset, and that is calculated in the year you release the funds.

From the ATO page:

You need to include the amount stated in your payment summary, in your tax return for the financial year you request the release – this may be different to the financial year you receive the FHSS amount.

Below is what occurs when moving up or down a tax bracket in the financial year the release is requested.

Moving up a tax bracket

Let’s say you contribute when you’re on the 30% tax rate. The contribution gets taxed at 15% by your super fund.

- If you withdraw at the 30% tax rate, it gets taxed at 0%, resulting in a tax savings of 15%.

- If you withdraw at the 37% tax rate, it gets taxed at 7%, resulting in a tax savings of 8%.

- If you withdraw at the 45% tax rate, it gets taxed at 15% on the way out, so little or no tax savings.

So, this may significantly diminish the benefit of the scheme.

In this case, where you may move up a tax bracket in the following year, it may be worth considering some planning by:

- planning to contribute the last $15,000 in the financial year that you will withdraw the money, assuming it is the highest marginal tax rate before withdrawal that year

- releasing your super earlier while on a lower MTR (you have up to 24 months to use it once released)

- adding further concessional contributions to reduce your marginal tax rate in the year you withdraw, which could save you thousands in tax.

Moving down a tax bracket (relevant for the 2024/25 tax year)

Let’s say you contribute when you’re on the 45% tax rate (without div293). The contribution gets taxed at 15% by your super fund.

- If you withdraw at the 45% tax rate, it gets taxed at 15%, resulting in a tax savings of 15%.

- If you withdraw at the 37% tax rate, it gets taxed at 7%, resulting in a tax savings of 23%.

- If you withdraw at the 30% tax rate, it gets taxed at 0%, resulting in a tax savings of 30%.

If you moved down tax brackets, you would reduce your withholding significantly.

The impact of div293

Using the same example above, let’s say you contribute when you’re on the 45% tax rate, but with div293 applicable on the entire amount. The contribution gets taxed at 15% by your super fund and another 15% from div293 tax.

If you withdraw at the 45% tax rate, it gets taxed by a further 15%, resulting in little or no tax savings.

The Impact on HECS/HELP

Withdrawing

The amount you withdraw under the FHSS scheme is not added to your income for the purposes of calculating HECS/HELP.

Contributing

If you contribute via salary sacrifice rather than personal super contributions, your employer will withhold less tax for you due to having a lower taxable income. However, HECS/HELP repayment amounts are based on your taxable income plus those voluntary concessional contributions added back in. If you don’t ask your employer to pay the HECS on the original pre-salary sacrifice income, you will get a nasty surprise bill from the ATO at tax time for the difference.

Can I combine the First Home Super Saver scheme with other people

Yes! Couples, siblings, or friends can each access their own eligible FHSS contributions to purchase the same property, so a couple could have an advantage of around $16,000 between them.

Can I change my mind and withdraw money from the FHSS scheme?

Yes, you can change your mind about buying a house and withdraw it from super.

However, you will be subject to a flat tax equal to 20% of your assessable FHSS released amount, which means you essentially lose the benefit of the scheme.

Can I change my mind after withdrawing the money under FHSS?

Yes, you can change your mind after withdrawing the money and decide not to buy.

You can either:

- Recontribute an amount into your super fund(s) that is at least equal to your assessable FHSS released amount, less any tax withheld. This amount:

- is stated in your payment summary and may be less than the total amounts released to you

- must be a non-concessional contribution and you can’t claim a tax deduction for it

- means you won’t be able to apply for FHSS again, including where you have recontributed the amount to your super fund.

- Keep the released amount and be subject to FHSS tax, which is a flat tax equal to 20% of your assessable FHSS released amount., which means you essentially lose the benefit of the scheme.

How to invest your super for FHSS

Remember that super is not an investment but rather an investment vehicle/legal structure that holds investments, so when you use the FHSS scheme, consider how you will invest that money within your super.

If you are planning on buying within the next 3-5 years, the risk of growth assets may not be the best option because there could be a market crash shortly before you withdraw it, and your contributions would have lost value. If you withdrew the contributions and deemed earnings, that would mean selling part of your normal super balance at a loss.

For instance, let’s say that shortly before you were about to withdraw to buy your home, you had the following:

- Contributed the full $50,000, with $42,500 remaining after the 15% tax on concessional contributions

- $7,500 of deemed earnings

- Another $50,000 in your super from other contributions.

So a total of $100,000, of which you are entitled to withdraw $50,000 under the FHSS.

If you withdrew $50,000 at that point, you would be left with $50,000 in your super.

However, if the market crashed 40% around the time you were ready to withdraw and buy, you would have only $60,000, and after withdrawing the $50,000, you’d only be left with $10,000 in your super.

So, if you’re likely to purchase within the next few years (which I expect is the case for most people), keeping it in defensive assets like the cash investment option in super may be more sensible. When you withdraw, it will be taken proportionally from each of your investment options, not only from your cash investment option, but you can easily move the remaining cash into your other investment option(s) to rebalance it back to your desired asset allocation.

On the other hand, if you are likely to use it further down the line, such as in 5-10 years, a portion in growth assets may be more suitable due to having the time needed to recover from the short-term ups and downs of the market.

As a rule of thumb, the longer your investment timeframe, the more short-term volatility from growth assets you can tolerate.

Checklist

- Make sure you are eligible.

- Understand that concessional contributions are where virtually the entire benefit comes from (with the exception of the government super co-contribution for low-income earners).

- Consider using personal contributions and claiming the tax deduction, rather than salary sacrifice, to maintain control over your contribution timing.

- Set up a savings plan. This could mean automated transfers on payday into a separate bank account that is not used for spending. If you need more than the FHSS limit for your deposit, also create a savings plan for that portion of your deposit.

- Contribute money into super.

- Submit an NOI (if relevant) anytime before you do your tax return for the year of the contribution, and keep the acknowledgement letter from your superfund stating that it has been processed in your tax records.

- Declare the concessional contribution on your tax return in the year of the contribution.

- Submit a determination. I’d suggest doing this each time after you have both received your NOI acknowledgement and the 15% contribution tax has been deducted from your super account.

- Submit a request to release (can be done before you sign, or not later than 90 days after signing – but must be after receiving the determination).

- Declare tax on the FHSS scheme in the year the request to release was submitted, not when the funds were received.

- Sign the contract

- Live in the property for at least 6 months within the first 12 months you own it, after it is practicable to move in

And if your income plus concessional contributions exceed $250,000, check if the scheme is still beneficial after div293 comes into play.

Further information

First home super saver scheme | Australian Tax Office

First home super saver (FHSS) scheme – the essentials | Australian Tax Office