Frustrated with the important but hard-to-find information on low-cost online brokers and the biases of reviews when searching online, I decided to create an online trading platforms comparison.

Individual broker reviews:

Pearler Review

SelfWealth Review

Stake Review

Superhero Review

Important notes:

- With brokerage fees, it is the percentage that matters, not the dollar amount. $10 for each of two $1,000 trades is not better than being charged $20 for a $2,000 trade. The percentage is colour-coded, bolded, and in a much larger font to make this clear in the grid below.

- You should endeavour to avoid paying over 0.5% in total fees ($5 per $1,000) so that you are not losing too much of your investment on the way in. Ideally you want to get that down to about 0.3%.

- For ASX trading, with pretty much all the low-cost brokers (i.e. not the banks), you can see this is achieved with trade sizes of at least $2-3,000 (i.e. saving up and making a single purchase). With Stake’s $3 brokerage, you can achieve this with as little as $1,000, and with CMC Markets you can split your purchases into amounts of no more than $1000 and spread them throughout different days to take advantage of the free brokerage.

- For international trading, the defining factor in cost is not the trade fee, but the foreign currency (FX) conversion fee because for all brokers besides Interactive Brokers (IBKR), the FX fees are very high at between 0.5% and 1% of your transfer amount.

Despite their advertising of free brokerage on US shares, your total cost, including converting the currency, is very high.

These high fees are how most Australian brokers make their money on US trading.

In addition, as explained in the annotated notes below, some brokers do an FX currency switch in their calculations, resulting in being much higher than what it appears.

I have included both of these in the grid below, adjusted for any currency switch, and converted it to a percentage to make it clear.

| BLUE | means total fee | BELOW 0.5% |  |

| Orange | means total fee | 0.5-1.0% | |

| RED | means total fee | OVER 1.0% |  |

Online trading platforms comparison

|

Pearler: |

VPI: |

Webull: |

| CMC Markets | Stake | Pearler | Pearler PrePay [4] |

SelfWealth | VPI (Vanguard ETFs) |

VPI (ASX shares) |

Betashares Direct |

Commsec | Superhero | Webull | Webull (Aus & US ETFs) |

IBKR | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ASX Trading | |||||||||||||

| CHESS [1] |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Fees (AUD) | Max [$11 or 0.10%] Free purchases up to $1,000/day [2] |

$3 up to $30,000 then 0.01% |

$6.50 | $5.50 | $9.50 | Free purchase trades $9 sell trades |

$9 | Free (ETFs & 300+ ASX shares) |

$5 up to $1,000 $10 up to $3,000 $19.95 up to $10,000 |

$2 up to $20,000 then 0.01% |

Max of $1 or 0.03% | Free (for ETFs only) [5] |

Max of $6 or 0.08% |

| $1,000 | 0% | 0.30% | 0.65% | 0.55% | 0.95% | 0% / 0.90% | 0.9% | 0% | 0.50% | 0.20% | 0.10% | 0% | 0.60% |

| $0 | $3 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $5 | $2 | $1 | $0 | $6 | |

| $2,000 | 0.55% | 0.15% | 0.32% | 0.27% | 0.47% | 0% / 0.45% | 0.45% | 0% | 0.50% | 0.10% | 0.05% | 0% | 0.30% |

| $11 | $3 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $10 | $2 | $1 | $0 | $6 | |

| $3,000 | 0.36% | 0.10% | 0.21% | 0.18% | 0.31% | 0% / 0.30% | 0.30% | 0% | 0.33% | 0.06% | 0.03% | 0% | 0.20% |

| $11 | $3 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $10 | $2 | $1 | $0 | $6 | |

| $5,000 | 0.22% | 0.06% | 0.13% | 0.11% | 0.19% | 0% / 0.18% | 0.18% | 0% | 0.40% | 0.04% | 0.03% | 0% | 0.12% |

| $11 | $3 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $19.95 | $2 | $1.50 | $0 | $6 | |

| $10,000 | 0.11% | 0.03% | 0.06% | 0.05% | 0.09% | 0% / 0.09% | 0.09% | 0% | 0.20% | 0.02% | 0.03% | 0% | 0.08% |

| $11 | $3 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $19.95 | $2 | $3 | $0 | $8 | |

| $50,000 | 0.10% | 0.01% | 0.01% | 0.01% | 0.02% | 0% / 0.018% | 0.018% | 0% | 0.12% | 0.01% | 0.03% | 0% | 0.08% |

| $50 | $5 | $6.50 | $5.50 | $9.50 | $0 / $9 | $9 | $0 | $60 | $5 | $15 | $0 | $40 | |

| Ongoing fees | No | No | No | No | No | No | 0.1% p.a. | No | No | No | No | No | No |

| CMC Markets | Stake | Pearler | Pearler PrePay [4] |

SelfWealth | VPI (Vanguard ETFs) |

VPI (ASX shares) |

Betashares Direct |

Commsec | Superhero | Webull | Webull (Aus & US ETFs) |

IBKR | |

| US Trading | |||||||||||||

| Fees (brokerage) | $3 USD | $2 USD | US 0.5c/share | ||||||||||

| = ~4.30 AUD [11] | = ~2.86 AUD [11] | [min $1 max 1%] | |||||||||||

| up to $30,000 | $9.50 USD | Max [USD 5 or 0.12%] | up to $20,000 | 0.025% + | = AUD 0.7c/share | ||||||||

| $0 | USD then 0.01% | $6.50 AUD | $5.50 | = ~$13.57 AUD [11] | No US Trading | No US Trading | No US Trading | = ~MAX [AUD 7.14 or 0.12%] [11] | USD then 0.01% | (0.0153% Sell Only) | $0 | [min $1.4 max 1%] [11] | |

| Fees (FX) | 55bps | 60bps | 65bps | 50bps | 50bps | 0.3bps | |||||||

| 0.60% | = ~0.79% [10] | 0.50% | 0.50% | = ~0.85% [10] | 0.55% | = ~0.93% [10] | = ~0.71% [10] | = ~0.71% [10] | = 0.003% [12] | ||||

| $1,000 | 0.60% | 1.20% | 1.15% | 1.05% | 2.21% | 1.26% | 1.13% | 0.75% | 0.71% | 0.17% | |||

| $6 | $12.15 | $11.50 | $10.50 | $22.14 | $12.64 | $11.29 | $7.43 | $7.10 | $1.70 | ||||

| (BR 0 + FX 6) | (BR 4.30 + FX 7.86) | (BR 6.50 + FX 5) | (BR 5.50 + FX 5) | (BR 13.57 + FX 8.57) | (BR 7.14 + FX 5.5) | (BR 2 + FX 9.29) | (BR 0.33 + FX 7.1) | (BR 0 + FX 7.1) | (BR 1.4 + FX 0.30) [12,13] | ||||

| $2,000 | 0.60% | 1.00% | 0.83% | 0.77% | 1.53% | 0.9% | 1.03% | 0.75% | 0.71% | 0.13% | |||

| $12 | $20.00 | $16.50 | $15.50 | $30.71 | $18.14 | $20.57 | $14.94 | $14.29 | $2.60 | ||||

| (BR 0 + FX 12) | (BR 4.30 + FX 15.70) | (BR 6.50 + FX 10) | (BR 5.50 + FX 10) | (BR 13.57 + FX 17.14) | (BR 7.14 + FX 11) | (BR 2 + FX 18.57) | (BR 0.65 + FX 14.29) | (BR 0 + FX 14.29) | (BR 1.4 + FX 0.60) [12,13] | ||||

| $3,000 | 0.60% | 0.93% | 0.71% | 0.68% | 1.30% | 0.79% | 1.00% | 0.75% | 0.71% | 0.08% | |||

| $18 | $27.85 | $21.50 | $20.50 | $39.07 | $23.64 | $29.86 | $22.41 | $21.43 | $2.30 | ||||

| (BR 0 + FX 18) | (BR 4.30 + FX 23.57) | (BR 6.50 + FX 15) | (BR 5.50 + FX 15) | (BR 13.57 + FX 25.50) | (BR 7.14 + FX 16.5) | (BR 2 + FX 27.86) | (BR 0.98 + FX 21.43) | (BR 0 + FX 21.43) | (BR 1.4 + FX 0.90) [12,13] | ||||

| $5,000 | 0.60% | 0.87% | 0.63% | 0.61% | 1.13% | 0.72% | 0.97% | 0.75% | 0.71% | 0.06% | |||

| $30 | $43.57 | $31.50 | $30.50 | $56.42 | $36.07 | $48.43 | $37.35 | $35.71 | $2.90 | ||||

| (BR 0 + FX 30) | (BR 4.30 + FX 39.30) | (BR 6.50 + FX 25) | (BR 5.50 + FX 25) | (BR 13.57 + FX 42.85) | (BR 8.57 + FX 27.5) | (BR 2 + FX 46.43) | (BR 1.63 + FX 35.71) | (BR 0 + FX 35.71) | (BR 1.4 + FX 1.50) [12,13] | ||||

| $10,000 | 0.60% | 0.83% | 0.56% | 0.55% | 0.99% | 0.72% | 0.95% | 0.75% | 0.71% | 0.06% | |||

| $60 | $82.86 | $56.50 | $55.50 | $99.28 | $72.14 | $94.86 | $74.96 | $71.43 | $5.80 | ||||

| (BR 0 + FX 60) | (BR 4.30 + FX 78.57) | (BR 6.50 + FX 50) | (BR 5.50 + FX 50) | (BR 13.57 + FX 85.71) | (BR 17.14 + FX 55) | (BR 2 + FX 92.86) | (BR 3.27 + FX 71.43) | (BR 0 + FX 71.43) | (BR 2.8 + FX 3) [12,13] | ||||

| $50,000 | 0.60% | 0.80% | 0.51% | 0.51% | 0.87% | 0.72% | 0.94% | 0.75% | 0.71% | 0.03% | |||

| $300 | $397.86 | $256.50 | $255.50 | $438.57 | $360.70 | $469.29 | $347.47 | $357.14 | $17 | ||||

| (BR 0 + FX 300) | (BR 5 + FX 392.86) | (BR 6.50 + FX 250) | (BR 5.50 + FX 250) | (BR 13.57 + FX 425) | (BR 85.70 + FX 275) | (BR 5 + FX 464.29) | (BR 16.33 + FX 357.14 | (BR 0 + FX 357.14 | (BR 14 + FX 3) [12,13] | ||||

| Ongoing fees | No | No | No | No | No | No | No | No | No | No | |||

| Beware of | No USD acct [15] | FX currency switch [10] |

FX currency switch [10] |

No USD acct [15] | FX currency switch [10] |

FX currency switch [10] |

FX currency switch [10] |

||||||

| CMC Markets | Stake | Pearler | Pearler PrePay [4] |

SelfWealth | VPI (Vanguard ETFs) |

VPI (ASX shares) |

Betashares Direct |

Commsec | Superhero | Webull | Webull (Aus & US ETFs)) |

IBKR | |

| Features | |||||||||||||

| 2FA [7] |  |

|

|

|

|

(SMS only) (SMS only) |

(SMS only) (SMS only) |

(SMS only) (SMS only) |

(SMS only) (SMS only) |

(SMS only) (SMS only) |

(SMS only) (SMS only) |

(SMS only) (SMS only) |

|

| Free ASX purchases | Up to $1,000/day/ stock [2] |

|

|

|

|

Vanguard ETFs [16] | Vanguard ETFs [16] |  |

|

All ETFs [3] |  |

All AU/US ETFs [5] |  |

| Markets | Global | Aus/US | Aus/US | Aus/US | Aus/US | Aus | Aus | Aus | Global | Aus/US | Aus/US/HK | Aus/US/HK | Global |

| Free real-time prices |  |

|

|

|

|

|

|

|

[18] [18] |

[18] [18] |

[14] [14] |

||

| Free research reports |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Tax reporting |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Autoinvest |  |

[6] [6] |

[6] [6] |

[6] [6] |

|

[6] [6] |

[6] [6] |

[6] [6] |

|

|

[6] [6] |

[6] [6] |

|

| Support | Phone |

Email only |

Phone |

Phone |

Livechat |

Phone secure message |

Phone secure message |

Phone livechat |

Phone |

Livechat only | Phone secure message |

Phone secure message |

Phone livechat |

| Kids accounts |  |

|

|

|

|

|

|

|

|

|

|

|

|

| Allows non-residents |  [*] [*] |

[*] [*] |

[*] [*] |

[*] [*] |

[*] [*] |

|

|

|

|

[*] [*] |

|

|

|

| ASX min initial / subseq purchase |

$500 / $0 | $500 / $0 | $500 / $0 | $500 / $0 | $500 / $0 | $200 / $0 | $200 / $0 | $10 / $0 | $500 / $0 | $100 / $100 | $500 / $0 | $500 / $0 | $500 / $0 |

[1] What is CHESS sponsorship?

Australia has an electronic system called CHESS, where the ASX keeps a list of who owns what shares. If a broker is CHESS sponsored, it means that when you buy or sell shares through that broker, there is a record of those shares being owned directly by you and in your name (via your own personal HIN — Holder Identification Number). This means you can view your ownership independently of your broker via the share registry to verify that you own it, providing an unmatched layer of transparency.

The alternative is the custodian model, which is where the broker appoints a separate company — a custodian — to hold the shares under trust on your behalf. The custodian holds the legal title for you, meaning they are the legal owner and you are the beneficial owner. So you receive the benefits of the asset without legal ownership.

CHESS sponsorship is only available for ASX shares, so even if a broker is CHESS-sponsored for ASX shares, if you buy shares from other exchanges through them, it will be through the custodian model.

A more in-depth explanation can be found here: What is CHESS sponsorship?

[2] CMC Markets brokerage-free ASX purchases

CMC Markets offers free brokerage for ASX purchases up to one trade per day per share for a maximum of $1,000 each. This means you can buy up to $1,000 each of multiple different stocks or ETFs for free on any given day.

Subsequent purchase trades of the same stock on the same day, sale trades, and trades over $1,000 attract their standard ASX trade fee.

CMC Markets ASX trading is CHESS sponsored.

[4] Pearler PrePay

Pearler offers you the option to PrePay $55 worth of credit and get an additional $10 for your buys for both Australian and US share trading. If they drop their prices, you continue to get the advantage of your remaining credit going towards even more trades at the new lower price.

This applies to trades on both Australian and US shares but does not apply to the FX fee for US trading.

[5] Webull free ETF trades

I haven’t been able to ascertain how Webull is able to offer minimum initial purchases of under $500 on Australian-listed ETFs using your own individual CHESS Holder Identification Number (HIN) because if the ETF units are purchased via the ASX, the $500 initial minimum would be a requirement. They mentioned to me that it “is similar to Commsec pocket”. However, Commsec Pocket is able to do this due to bypassing the ASX and having an agreement with the providers of those ten ETFs directly and only for those ETFs. I’m not sure how this can be the case for all ETFs on the ASX. This is not to say it isn’t possible, and if you do indeed end up having these shares held on your individual HIN (which you can check directly through the registry of that specific ETF), then I don’t see an issue.

[6] Autoinvest

- Stake – any ETFs or shares

- Pearler – any ETFs or shares

- Superhero – any ETFs or shares

- Webull – any ETFs or shares

- Vanguard – only Vanguard ETFs and managed funds, no direct shares

- Betashares – up to 5 Betashares ETFs (you can create a ‘Custom Portfolio’ for a fee of 0.25% p.a. – or $4 p.m. if under $10,000 – that includes non-Betashares ETFs)

Note that other brokers doe not offer auto invest that is as sophisticated as Pearler’s Auto Invest feature, where you can select which of your investments to be added to such that it can automatically rebalance with inflows.

[7] 2-Factor Authentication (2FA)

There are typically three types of 2-factor authentication in use in the listed brokers above.

- SMS 2FA – This works by sending a one-time password over SMS. SMS is not a particularly secure channel of communication. This could be due to someone getting your ID documents and porting your phone number, surveillance by ISPs or government agencies that often outsource this to third parties, or even having your SIM card stolen as there is insufficient protection against that.

- A PIN that you set up and then use just for making trades. This suffers the same problem as a password in that it does not change, so if spyware were to get it, they would have it for all future situations.

- A secure app like Google Authenticator – This is far more secure and avoids all the above issues mentioned.

Providers:

- CMC Markets – Yes

Stake – Yes - Pearler – Yes

- SelfWealth – Yes

- VPI – Yes (SMS only)

- Betashares Direct – Yes (SMS only)

- Commsec – Yes (SMS only)

- Superhero – Yes (SMS or trading PIN)

- Webull – Yes (SMS only)

- IBKR- Yes

[10] FX currency switch

A number of brokers do an FX currency switch which results in much higher fees than what it appears to be.

Stake, Superhero, and SelfWealth do this.

Let’s use Stake as an example.

They advertise their currency conversion (FX) fees as 70bps (pronounced 70 basis points). A basis point means one-ten-thousandth, and 70 basis points is 0.70%, so you would presume it is 0.70% of how much you are transferring, but this is not the case.

Rather than being charged 70c per $100 where both the 70c and $100 are in the same currency, you are charged 70c USD per $100 AUD.

So, depending on the AUD/USD rate, it comes out to approximately 1%, which is much higher than the 0.70% most people assume.

To calculate the percentage at any given time, Google ‘AUD/USD’ and divide 0.7% by that number. E.g., AUD/USD of 0.73 would cost 0.7%/0.73 = 0.96%.

For the purposes of putting down figures in the table at the top of the article, I have assumed an exchange rate of 0.70c USD for all calculations.

Three brokers do the FX currency switch — Stake, Superhero, and SelfWealth.

[11] Converting USD to AUD

Everything is shown in AUD to make it comparable, and since the exchange rate is constantly in flux, I have assumed an exchange rate of 0.70c USD for all calculations.

[12] Interactive Brokers (IBKR) FX fees

Client initiated (i.e., spot) currency conversions

If currency conversion is client-initiated, the FX fees are 0.2bps, which is 0.002% or $0.20 per $10,000.

There is a minimum $2 fee for client-initiated conversion from AUD to USD.

Security purchase currency conversions

If you place a trade to purchase a security without converting first, your AUD will be automatically converted to USD without the $2 minimum FX fee.

However, the exchange rate is 6.7 times higher at 3bps, which is 0.03% or $3.00 per $10,000.

Which one to use?

Assuming an exchange rate of 1.5 AUD for 1 USD:

- For trades under $10,000 AUD, it is cheaper to use the 3bps security purchase conversion.

- For trades over $10,000 AUD, it is cheaper to use client-initiated (i.e., spot) conversion.

- This is because $3 AUD ($2 USD min fee) divided by 3bps gets to $10,000 AUD where they are approximately equal.

There have been a couple of mentions on forums of people who are charged the minimum with security purchase conversions. I wonder if it may be where:

- They converted their account to a margin account. In that case, I wonder if they may just end up with an ongoing margin loan in USD that is accruing interest without the auto conversation being done.

- They signed up to the IBKR LLC (the US arm of IBKR) rather than IBKR AU (the Australian arm of IBKR). Although in 2017, Australian clients were forced to move to IB AU under Australian law.

[13] Interactive Brokers (IBKR) brokerage fees

Interactive brokers have a fixed fee structure and a tiered structure.

We are using the more expensive fixed fee structure for simplicity, which is half a US cent per share, with a minimum of USD $1 and a maximum of 1%.

For most commonly available index ETFs and amounts up to $10,000 brokerage will be $1 as we will explain now.

The smallest share price (resulting in the most brokerage) to reach that $1 minimum for various trades comes to:

| $1,000 | — $5/share and up will cost no more than $1 in brokerage |

| $2,000 | — $10/share and up will cost no more than $1 in brokerage |

| $3,000 | — $15/share and up will cost no more than $1 in brokerage |

| $5,000 | — $25/share and up will cost no more than $1 in brokerage |

| $10,000 | — $50/share and up will cost no more than $1 in brokerage |

If you are going with penny stocks, the maximum 1% rule will apply. Also, as a passive investing website, this probably isn’t something my readers are likely to be interested in. So I will go with a stock price that is as low as $25 for my calculations to err on the side of the most expensive fees.

| $1,000 | — $1 in brokerage |

| $2,000 | — $1 in brokerage |

| $3,000 | — $1 in brokerage |

| $5,000 | — $1 in brokerage |

| $10,000 | — $2 in brokerage |

For reference, here is a range of the most well-known index funds, along with a couple of the most well known individual stocks. None of them even come close to the $25 mark (the higher it is, the fewer shares you would purchase for the same dollar amount, resulting in lower trade fees as per their rule of half a US cent per share):

| VTI | USD $225 | IJR | USD $104 | |

| VEU | USD $57 | AVDV | USD $62 | |

| VT | USD $100 | AVUV | USD $77 | |

| IVV | USD $450 | AAPL | USD $170 | |

| VOO | USD $411 | GOOG | USD $2680 | |

| SPY | USD $447 | MSFT | USD $296 | |

| QQQ | USD $350 | TSLA | USD $1025 |

[14] Real-time prices on Interactive Brokers (IBKR)

On IBKR, real-time quotes cost US 1c per price quote for US trades and USD 3c per price quote for ASX trades.

However, you get USD $1 of snapshot quotes free of charge each month.

[15] CMC Markets, Commsec, and NAB Trade have no USD currency account

CMC Markets does not maintain a USD currency account. If you sell one US security to buy another, the sale carries two FX conversion fees — to convert to AUD and again to convert back to USD, so that is 1.2% of your trade amount paid unnecessarily. In contrast, with other brokers, there would be neither of these FX conversion fees until you decided to convert from your USD account back to your AUD account. In addition, your dividend payments would suffer the same fate. More information here.

International shares with NAB Trade suffers the same problem.

International shares with Commsec suffers the same problem unless you elect to use International Shares Plus, which carries a higher fee.

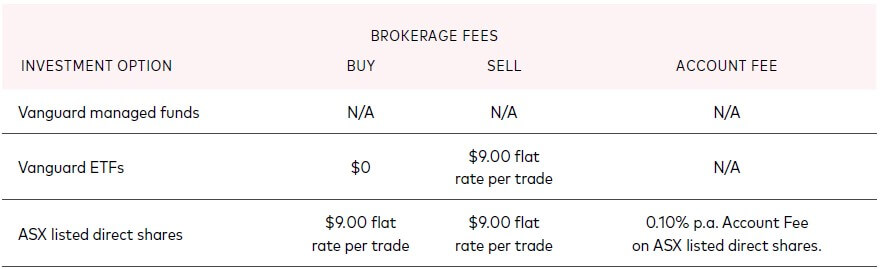

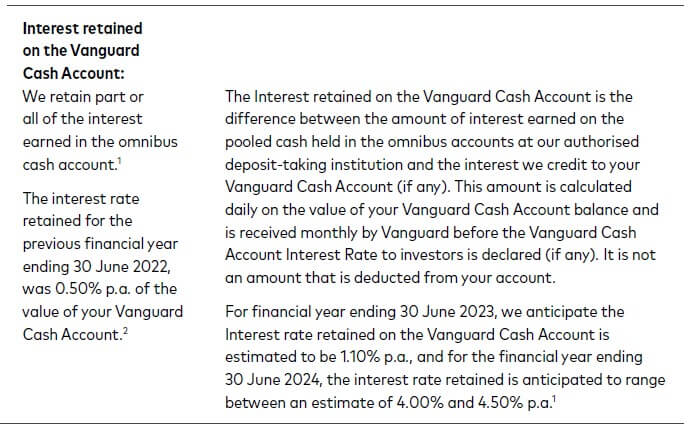

[16] Vanguard’s VPI pricing

Three important things to note

- You cannot buy non-Vanguard ETFs on VPI

- There is an ongoing percentage-of-asset based fee for holding ASX direct shares, which other brokers do not have (but other platforms do have).

- Part or all of the interest on your cash account is kept by Vanguard as below.

[17] Webull trade pricing calculations

US trading

| Commission | 0.025% |

| SEC Fee (Sell Only) | 0.0008% (Min. US$0.01) |

| TAF Fee (Sell Only) | 0.0145% (Min. US$0.01, Max. US$7.27 per Trade) |

[18] Webull live data prices

Au trading

Webull offers click-to-refresh live market data for free. Customers who are after real-time data can subscribe to ASX Real-Time.

US trading

Webull offers NBBO, which shows the best bids and asks, time, sales, and real-time price movements for the 16 exchanges.