Superhero is a low-cost online broker that lets you trade shares on the Australian and US markets. You can trade Aussie shares and ETFs for $2 (up to $20,000), and US shares and ETFs for $2 USD (up to $20,000). You can also buy fractional shares with their US trading. Superhero also has an auto invest feature, and is just one of four Australian brokers that offers automated investing with ETFs.

This Superhero broker review will go through what you need to know so you can make the best decision in choosing a broker, including who is Superhero for, how does Superhero work, is Superhero safe, how much does it really cost to trade with Superhero, how to sign up, and alternative brokers depending on what you are looking for.

As per the disclaimer at the end of the page, all information on this website is for general information only and should not be taken as constituting professional advice.

In this Superhero broker review

- Superhero Pros and Cons

- What is Superhero?

- How much does Superhero cost?

- Is Superhero safe?

- Is Superhero easy to use?

- How does Superhero Auto Invest work?

- Does Superhero offer live data and reporting?

- What is Superhero Superannuation?

- Frequently asked questions

- Does Superhero offer tax reporting?

- Does Superhero have autoinvest?

- Does Superhero have kids accounts

- Does Superhero allow non-residents?

- Is Superhero CHESS sponsored?

- Is Superhero good for investing?

- Is Superhero a good broker?

- Who is Superhero for?

- How does Superhero work?

- How do I sign up for Superhero?

- Superhero alternatives

- Online trading platforms comparison

- Superhero broker review — final thoughts

Superhero Pros and Cons

Pros

- Very low-cost $2 flat-fee trading fee (up to $20,000)

- Automated investing

- Invest on the ASX with as little as $10

- US trading, inc. fractional investing

- Easy to set up and easy to use mobile interface

- Offers kids accounts

Cons

- No individual CHESS HIN

- Very high foreign exchange fees

- High fees to leave them via transfer-out costs

- Only basic data and stock reports

What is Superhero?

Superhero is an online broker established in Australia in 2020 to offer zero-brokerage US trading, $2 flat-fee Aussie trades, and investing with only $10, as opposed to the $500 minimum required by CHESS sponsored brokers.

Superhero also offers trading stocks and ETFs in your superannuation without setting up an SMSF.

Who is Superhero for?

Superhero is for investors who want to manage their own share trading account and want to avoid the high fees of percentage-based platforms where the ongoing fees grow with your portfolio. It is suited to those looking for a broker that offers trading of both Australian and US markets at a reasonable price.

Setting up and trading through Superhero is very easy, and if you have not traded before, it will take almost no time to learn how. Although it is recommended that you learn about investing before buying shares, so you understand the nature of the stock market.

How much does Superhero cost?

What is Superhero’s Australian share trading costs?

For Australian share trading, there is a flat fee of $2 (AUD) up to $20,000 trade size and 0.01% above that.

Superhero can offer these low Australian trading fees due to using a custodian model rather than being CHESS sponsored. More on this in the next section: is Superhero safe?

Using the custodian model is also what allows them to get around the ASX requirement of $500 minimum initial purchase of any share and offer $10 minimum ASX trades.

What is Superhero’s international share trading costs?

US trading fees were free, but from April 15, 2024, this is no longer the case.

Superhero offers US share trading, also for a flat fee of $2 (USD) up to $20,000 trade size and 0.01% above that.

The obvious question here is —

How does Superhero make money?

In a word — foreign exchange (FX) conversion fees.

How much is Superhero’s FX fee?

The FX fees are quoted at 65bps (pronounced 65 basis points). A basis point means one-ten-thousandth, and 65 basis points is 0.65%, so you would presume it is 0.65% of how much you are transferring, but this is not the case with Superhero.

You are charged 65c USD per $100 AUD, which, depending on the AUD/USD rate, comes out to approximately 0.93% or a whopping $93 per $10,000 exchanged. And this will be payable again when you transfer back.

To calculate, Google ‘AUD/USD’ and divide 0.65% by that number. E.g., AUD/USD of 0.73 would cost 0.65%/0.73 = 0.89%.

Most Australian brokers that offer international trading charge very high FX fees of between 0.50% and 0.70%, but this is high even compared to them.

Is there an alternative to the high FX fees?

For international share trading, Interactive Brokers (IBKR), along with very low-cost trading fees, has wholesale FX rates at 0.002%, which comes to $0.20 per $10,000 exchanged. That’s 500 times cheaper than Superhero. Also, IBKR is the largest broker in the world and is listed on the US stock exchange.

Other fees

For Australian trading:

- There is a $20 fee per security to transfer your listed securities out of your Superhero Account. This is free with almost every other broker for ASX-listed securities, and is a penalty for leaving them.

- BPay deposits attract a $1 processing fee. PayID deposits do not attract a fee.

For US trading:

- SEC Fee: $0.08 per US$10,000 of sale proceeds. An SEC Fee for regulator costs

- TAF Fee: $0.000166 per share capped at US$8.30. A FINRA fee (a US regulatory body) fee

- US share transfers In from another broker: Free

- US share transfers Out to another broker: US$100 per account on ACATs. DTC US$100 per security. DRS US$115 per security.

Final thoughts on Superhero’s fees

Superhero offers a benefit of low-cost brokerage and $10 minimum trades on Australian share purchases. This is great for those wanting to invest small, frequent amounts into ETFs, as the fixed fees of other Australian brokers can eat up a lot of your investment on the way in for small amounts.

An alternative for those wanting to invest in small trade sizes is Betashares Direct, which offers fractional investing, free brokerage, and no fee to transfer out to another broker if you decide to do so.

Is Superhero safe?

Superhero has their own financial services license in Australia, so they are subject to regulation by the Australian Securities and Investment Commission (ASIC).

Australian share trading

The ASX uses a system of CHESS Sponsorship with Holder Identification Numbers (HINs) to keep a record of who owns what shares. However, with Superhero, your shares are not held under your own HIN in your own name, and you are not the legal owner. Australian shares are held in custody on your behalf by a third-party company — a custodian — Superhero Nominees Pty Ltd, which has a single institutional HIN, and you are the beneficial owner.

As the beneficial owner, you receive the benefits of the asset (proprietary interest in your investments and the income and rights attached to your investments) without legal ownership. The shares purchased within your Superhero account cannot legally be accessed by others, including claims from any creditors of Superhero in case Superhero goes out of business. In that case, your shares could be transferred by you from Superhero Nominees to another broker.

However, it may take you a long time to get access to those shares. In Australia, this has happened from time to time, and here is a relatively recent example from 2018, where customers were locked out of their investments and funds were returned only three years later. Where a broker has not followed legal procedure, the result could be worse, such as what happened with Opes Prime.

It is by operating with a single holder identification number (HIN) held under a custodian, rather than individual HINs for each user, that Superhero can pay lower settlement fees and offer cheaper ASX trades.

Superhero uses CHESS sponsored market participant Finclear to execute their trades in real time using their Best Execution Policy. Finclear is also used by Stake and is a competitor of Openmarkets, which is used to execute trades for Pearler, Raiz, SixPark, Stockspot, and others.

US share trading

US shares through Superhero are held under a custodian model the same as for Australian shares.

For US trading, Superhero itself does not provide the stockbroking. They provide access to US financial markets by partnering with Apex Clearing Corporation LLC (Apex), which provides both clearing (trade executions) and custodial services. So just as Australian shares are held in custody on your behalf, so are US shares.

The two most important things to be aware of in determining if Apex is safe are:

- Their FINRA registration status, which you can check here to validate their registration, licenses, and any arbitration cases or violations. FINRA is the Financial Industry Regulatory Authority. They monitor all registered broker dealers in the US.

- That they are listed with SIPC to provide another level of protection in case they go bankrupt. SIPC protects against the loss of cash and securities – such as stocks and bonds – held by a customer at a financially-troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.

More information here: Safety of Customer Assets at Apex Clearing Corporation.

Is Superhero easy to use?

Trading is very easy with Superhero. When you open your app, you will be taken to your dashboard, which shows key account information, including portfolio value, holdings, and pending orders.

To invest, you go to the Invest tab and select a share to view more detailed information about the stock. When you are ready, click Buy or Sell and place either a limit or a market order and confirm.

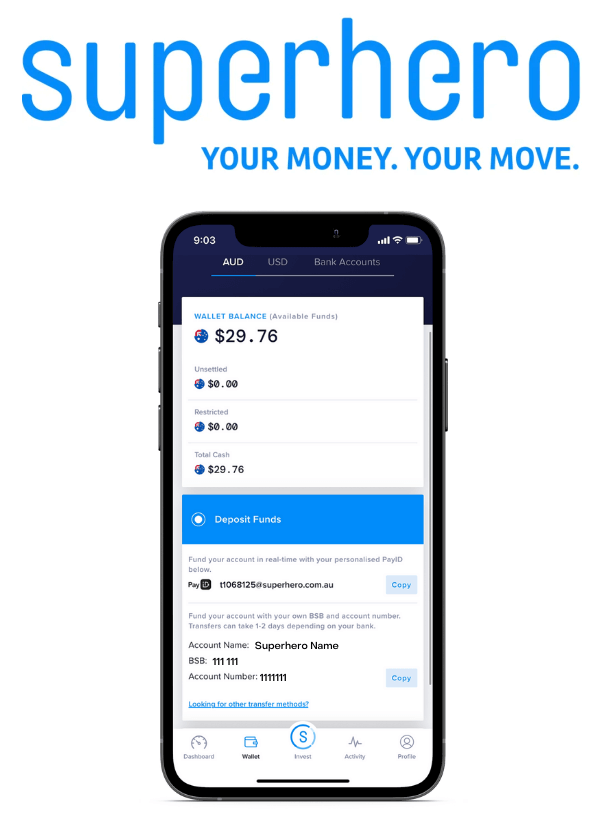

For your funds, you go to the Wallet tab and can choose to make deposits, withdrawals, or transfer currency between AUD and USD.

How does Superhero Auto Invest work?

Fidelity did a study between 2003 and 2013 and found that clients with the best returns belonged to people who had died or forgotten they had accounts! This shows how important it is not to touch your investment once your plan has been established. Auto Invest is the best way to leave your investment alone to do its thing.

To set up Auto Invest, you will need to set up an automated regular transfer from your own bank account into your Superhero Wallet (your personal cash management account in Superhero). Use your Superhero Wallet BSB and Account number when setting up where to transfer to.

Then in your Superhero account, you can set daily, weekly, fortnightly or monthly orders. The orders will get executed as long as you have the money in your linked cash management account.

This is not as sophisticated as Pearler’s Auto Invest feature, where you can select which of your investments to be added to such that it can automatically rebalance with inflows.

Does Superhero offer live data and reporting?

Superhero gives you basic data and reporting, such as:

- Real-time pricing

- Live market depth

- Price performance charts (going back only 1 year)

- Watch lists

When Superhero started up, they offered this only with a premium monthly subscription, but after not long they removed the fee and now this is free for all users.

For active traders, this is still likely not going to be enough. The performance charts go back only 1 year, there are no buy-sell ratings, no technical analyses, and no in-depth company financials.

The data and reporting is better than some online brokers, but not as extensive as Commsec, which offers all that Superhero has plus:

- Stock screener and advanced charting including heat maps, graphs and comparison charts

- Data that goes back a very long way

- Pricing alerts (email or mobile notification)

- Buy-sell ratings and stock recommendations

- A news feed with technical analyses for your stocks (useful for traders, not so much for buy-and-holders).

What you can do if you want that, however, is use Superhero for trades and open a Commsec account (which is free) just for the reporting and historical data, which would provide both low-cost brokerage (through Superhero) and extensive reporting and market data (through Commsec).

What is Superhero Superannuation?

Superhero offers two superannuation products — Control and Autopilot.

Superhero Control – allows you to invest up to 75% in Australian ETFs, ASX 300 shares, Australian LICs. The rest will be invested in VDBA (a 50/50 shares/bonds mixed fund).

Superhero admin fee: $108 per year + 0.49% of the account balance per annum.

Investment manager fee: VDBA is currently 0.27% p.a.

Brokerage fee: $5 flat fee per trade.

Superhero Autopilot – allows you to invest up to 30% in a range of themed investments such as US Tech, Asia Tech, Global Healthcare, and Global Sustainability, with a maximum of 10% in each theme. The rest will be invested in VDBA (a 50/50 shares/bonds mixed fund).

Superhero admin fee: $52 per year + 0.49% of the account balance per annum.

Investment manager fee: VDBA is currently 0.27% p.a. and thematic funds are often much higher.

While choosing your own ETFs in your super sounds great — the fees are incredibly high. Even if we average out the self-selection fee to around 0.15%, the total cost will be 0.70% after including the cost of VDBA. 0.70% is a serious amount lopped off your returns. The historical after-inflation compounded returns on shares have been around 6.5% p.a., so 0.70% is actually over 10% of your annual expected returns. Furthermore, these losses compound to much more than losing 10% of your retirement balance over time.

Compare that with HostPlus as one example offering low-cost index investment options — their Australian and international index options come to about 0.07% or a 10th of the cost.

If you wanted direct ETF exposure in super, HostPlus ChoicePlus offers that for a fixed fee (but only with select broad market ETFs). So once you are over a certain balance, the fees don’t keep climbing. In contrast, with Superhero super, your fees will climb as your investment balance climbs.

You also cannot choose which Vanguard diversified fund to use for the remainder of your account. VDBA is half in defensive assets, which will be a drag on returns for those with a long accumulation period ahead.

In addition, once you are in Superhero super, you will have to realise capital gains to switch out once you become aware that those fees are starting to climb, so it’s going to hurt a lot more to switch later.

Frequently asked questions

Does Superhero offer tax reporting?

Superhero provides several reports to help with tax and reporting. These reports include:

- Portfolio Valuation Report: Shows you all of your current holdings with a summary of the gains or losses on each holdings at the selected date.

- Transaction Statements: Shows you all transactions on your account between the dates selected.

- Cash Statement: Shows you all of the cash movements on your account between the dates selected.

- Unrealised Gain Report: Shows you all of the unrealised (potential) gains and losses on your current holdings at the selected date.

- Realised Gains Report: Shows your realised (traded) gains between the dates selected.

- Realised Gains Detail Report: Shows you a detailed breakdown of your realised (traded) gains between the dates selected.

- Fees & Expenses: Shows you all of the fees and expenses charged to your account between the selected dates. This does not include brokerage, which is capitalised and forms part of the cost base of your investments.

Does Superhero have autoinvest?

If you want a completely set-and-forget investment where part of your salary is automatically sent to your trading account and purchased regularly, so your wealth is growing in the background, you will need to seek out an alternate broker such as Pearler.

Besides removing one more thing to remember, automation has a behavioural benefit along the same lines as mentioned above. Automation removes the need to log in to your account, see the value of your portfolio fluctuate (which is entirely normal), and potentially result in you capitulating (abandoning your otherwise good plan).

Fidelity did a study between 2003 and 2013 and found that clients with the best returns belonged to people who had died or forgotten they had accounts! This shows how important it is not to touch your investment once your plan has been established. Autoinvest is the best way to leave your investment alone to do its thing.

Does Superhero have kids accounts?

Superhero offers minor trust accounts, allowing children to have their very own trading accounts. An adult can open a share trading account as a trustee and the child as the beneficiary. When they turn 18, shares held in the trustee account are transferred into their own name.

Investing using a minor trust account can be extremely tax-effective. You still need to be aware of the requirements for a minor trust account to be entitled to those tax benefits, such as not taking the dividends or franking credits for yourself and declare any income from the shares in the child’s own tax return. But provided you follow the letter of the law, the tax advantages can be significant. Also, note that the legal requirements to claim the tax advantages are rarely explained by brokerage companies, so you will need to do your own research or speak to an accountant.

IMPORTANT NOTE:

In the above paragraph I mentioned that to be entitled to those tax benefits, you will need to declare any income from the shares in the child’s own tax return. At the time of writing, I’ve come across a comment that in Superhero, you get a child account with its own name and wallet balance but not its own tax settings. Be aware that if declare income in your own tax return, you could unknowingly be up for a large capital gains bill 18 years down the line.

To learn more about investing for kids, have a read of Investing for children – the ultimate guide.

Does Superhero allow non-residents?

You do not need to be a permanent resident of Australia. However, the requirements to open an account are:

- Be 18 years or older

- Have a valid address in Australia

- Have a valid Australian mobile number

You are not obligated to provide your tax file number when opening an account. However, if you do not, you may not receive certain tax credits and may have tax withheld on certain income and interest paid on your investments.

Is Superhero CHESS sponsored?

The ASX uses a system of CHESS Sponsorship with Holder Identification Numbers (HINs) to keep a record of who owns what shares. However, with Superhero, your shares are not held under your own HIN in your own name, and you are not the legal owner. Australian shares are held in custody on your behalf by a third-party company — a custodian — Superhero Nominees Pty Ltd, which has a single institutional HIN, and you are the beneficial owner.

As the beneficial owner, you receive the benefits of the asset (proprietary interest in your investments and the income and rights attached to your investments) without legal ownership. The shares purchased within your Superhero account cannot legally be accessed by others, including claims from any creditors of Superhero in case Superhero goes out of business. In that case, your shares could be transferred by you from Superhero Nominees to another broker.

However, it may take you a long time to get access to those shares. In Australia, this has happened from time to time, and here is a relatively recent example from 2018, where customers were locked out of their investments and funds were returned only three years later. Where a broker has not followed legal procedure, the result could be worse, such as what happened with Opes Prime.

It is by operating with a single holder identification number (HIN) held under a custodian, rather than individual HINs for each user, that Superhero can pay lower settlement fees and offer cheaper ASX trades.

For US trading, shares are held under custodian because CHESS sponsorship is only available for Australian listed securities.

Is Superhero good for investing?

Superhero is designed for those wanting to buy small, frequent parcels of ETFs due to the low-cost brokerage on ETF purchases and $10 minimum trades on the ASX. However, it is worth noting that the shares are not held in your name. For US trading, they offer zero-fee brokerage. However, their FX fees are very high, which will eat into the returns of long term buy and hold investing.

Is Superhero a good broker?

It is very easy to set up an account with Superhero, and their interface is easy to use. They offer fractional US share purchasing, automated lodging of US tax compliance forms, have good customer service, and low fees.

How does Superhero work?

When you sign up for AUD trading, you are provided with a Wallet. Your Superhero Wallet is your personal cash management account. This is where you can hold uninvested cash, see all your trading activity, and where any income or investment distributions you’ve received are deposited. You can fund your USD wallet either through PayID or BPAY.

Australian share trades are executed through Finclear, an ASX market participant, but are held under the legal ownership of a custodian — Superhero Nominees — where you are the beneficial owner but not the legal owner.

US share trades are executed by Apex Clearing Corporation, which provides both clearing (trade executions) and custodial services. So, just as Australian shares are held in custody on your behalf, so are US shares.

Trades can be set as market or limit orders. For ETFs, it is recommended to use what is known as marketable limit orders, which means using a limit order and placing your order a few cents above the ask if buying or a few cents below the bid if selling. You will still be matched with the best price, so it will act just like a market order, but you’ll never have any big surprises for those rare times when the ETF price deviates from the underlying value of the stocks it holds.

How do I sign up for Superhero?

You can sign up online through their mobile app.

You will need to:

- Enter your details — email address, password, your real name, date of birth, contact details.

- Verify your identity online — with either an Australian passport, driver’s licence or Medicare card.

- Verify your email address to complete your account setup. Live Chat is available If you have any trouble.

- Fund your Superhero Wallet using BPAY or PayID

And you are ready to start investing!

Superhero alternatives

FFor ASX trading, Superhero is an excellent option due to being the lowest cost CHESS sponsored broker.

However, some reasons to consider Superhero alternatives include:

- Autoinvest (Pearler, Vanguard Personal Investor)

- Lower-cost US share trading and trading on other exchanges (Interactive Brokers)

- Lower cost ASX share trading that is CHESS sponsored (Stake)

- Better reporting (Commsec)

Online trading platforms comparison

Online trading platforms comparison

Superhero broker review — final thoughts

Superhero offers a unique benefit unavailable on other Australian brokers with the low-cost brokerage on Australian ETF purchases and the low $10 minimum trades on Australian shares. This is ideal for those wanting to invest small, frequent amounts into ETFs where the fixed fees of other Australian brokers result in losing a lot of your investment on the way in for small amounts.

However, if you would like the peace of mind of a CHESS sponsored broker for your Australian shares, Pearler, Stake, and SelfWealth are other low-cost competitors, with Stake offering cheap trading on ASX shares, but at $3 instead of $2.

If you would like to avoid the high FX rates to trade US stocks, or if you would like to trade on other exchanges besides the US and Australia, Interactive Brokers (IBKR) has cheap trades and foreign currency exchange rates 500 times cheaper.

Alternatively, if you would like the ability to set up autoinvest with your Australian shares, Pearler is an excellent option.