I’m going to explain the concept of the efficient frontier by quoting one of my favourite finance books, All About Asset Allocation by Rick Ferri. I highly recommend it. It’s well written, easy to understand, and fascinating.

The first thing to understand is the idea of rebalancing.

When you choose an asset allocation, you have done so based on your risk tolerance – your ability to tolerate market risk.

As your investment goes up and down over time, it will drift away from your asset allocation and needs to be reset back to the desired target.

Let’s say you decided that your risk tolerance was such that you could tolerate the volatility of stocks with 70% of your assets, and the other 30% in safe assets (bonds). After a few years, you might find that the stocks have grown in value, and you now have an asset allocation of 80/20. If the market drops at that time, you have a lot more of your asset exposed to the volatility of the stock market.

To bring the overall risk back to that of your own tolerance, you would rebalance by selling down enough stocks to reset your allocation back to 70/30. This has the nice side effect of selling stock when they’re high – but without the need to time the market by guessing the future.

But it goes the other way too – when stocks drop in price, and your 70/30 allocation becomes 60/40, you’re now taking less risk than suits your tolerance, so you sell some bonds to buy more stocks to bring it back inline. This has the added benefit of buying stocks when they’re cheap.

By automatically selling stocks when they are expensive and buying more when they are cheap this way, you’re getting a higher return AND lower risk – all without having to guess where the market is going.

For this reason, a 90/10 allocation will not have a full 10% lower return than a 100% stocks portfolio.

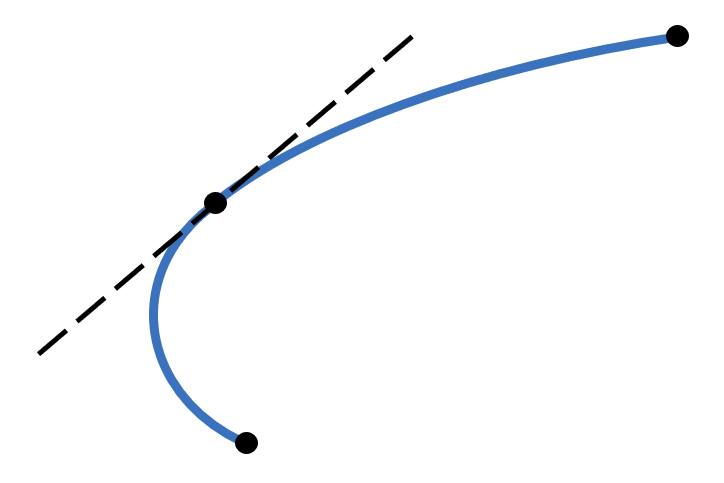

I’m going to show what is happening pictorially with an image by Rick Ferri.

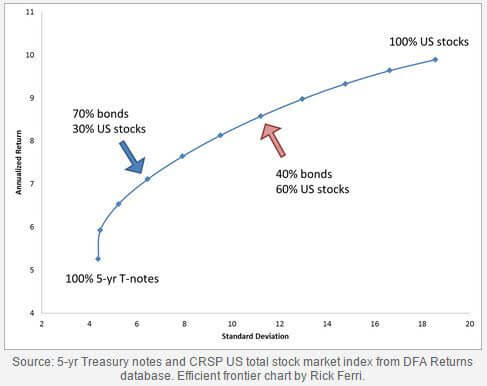

We can see what we described earlier in the risk-reward spectrum where bonds have a lower risk and, consequently, a lower expected return than stocks, which have a higher risk and a higher expected return.

If you did not rebalance, there would be a straight line between the two points, and depending on your asset allocation proportions, you would sit somewhere along that straight line.

But what happens when you have multiple low correlated asset classes such as stocks and bonds, and rebalance them regularly, is that the risk-return line gets pulled up and to the left, so you get a higher return and/or lower volatility.

You can also see that around the edge is where the biggest results occur – the bigger the upside and the lower the downside.

Introducing a small amount of stocks into a 100% bond portfolio adds significant return while adding a disproportionately small amount of risk.

Introducing a small amount of bonds into a 100% stock portfolio reduces significant risk while reducing a disproportionately small amount of returns.

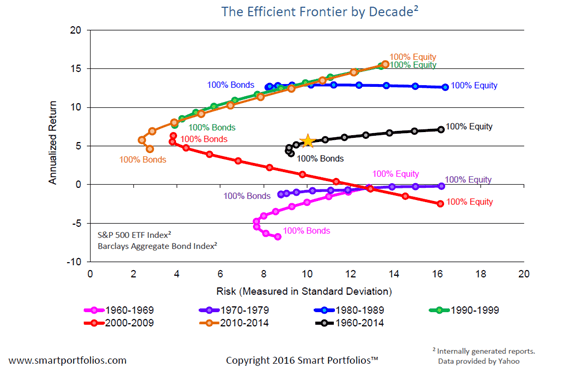

It’s important to point out that this graph was over a specific period. Here is a graph showing the efficient frontier by decade.

What you see is that adding a small amount of bonds significantly reduced volatility but hardly reduced returns at all in almost all cases. In the best case, it actually improved returns (2000-2009 when stocks had two bear markets), and in the worst case, it lowered returns but less so than if there was no rebalancing, which means even in the worst case you would have reduced your gains by less than the percentage you held in bonds.

Every time I read someone saying how terrible the 10% bonds are in VDHG, the efficient frontier immediately comes to mind, and I’m reminded how insignificant the 10% bonds are going to be in terms of reduced returns, and more so when accounting for the improvement in volatility.

Here is a link to Vanguard portfolio allocation models showing data from 1926 – 2017, and you can see that a 100% stock portfolio returned 10.3% compared to an 80/20 portfolio that returned 9.6%, a reduced average return of 7%[1] for a portfolio with 20% of the assets in bonds. For 10% in bonds, we can expect around a 3.5%[2] lower return relative to a 100% stock portfolio. Not nothing, but not far from nothing, and it does provide a benefit of diversification between asset classes and improved risk-adjusted returns.

There are some legitimate reasons to choose a DIY approach over VDHG, and having 10% in bonds might combine with some other reasons together making a solid argument against it, but on its own, it just doesn’t stand up as a reason to not go with a great fund like VDHG.

[1] 0.7/10.3 = 7% of the 10.3% return

[2] 0.35/10.3 = 3.5% of the 10.3% return