I got an email from someone asking for my thoughts on an interview where a prospective financial adviser suggested a portfolio of low-cost index funds. I said that was a great sign — provided they didn’t tack on a high fee for themselves like a 1% assets-based fee. Of course, you guessed it — that’s exactly what this person replied with.

When I told them of its effect, they couldn’t understand how 1% fees cost you a third of your nest egg and half your retirement income.

This is such an important concept that I wanted to provide a simple, easy-to-understand explanation of what 1% really means.

What is 1%

That 1% is based on your total assets invested, not 1% of your profit.

Historically, the stock market has returned 10% p.a., so right off the bat, 1% is actually 10% of your expected (or average) annual gain.

Still think 1% doesn’t sound like much?

It gets worse.

Inflation eats away at your capital each year, so that 10% historical return included 4% inflation.[1] The after-inflation return (also referred to as the ‘real return‘) of 6% means that 1% in fees is 16.7% of your expected annual portfolio gains in real terms.

[1] The Australian Equity Market over the Past Century | RBA. Table 1 shows returns of 10.2% and inflation of 3.9%

Ok but I still don’t understand how 1% fees cost you a third of your nest egg.

In a word — compounding.

You know how it is unintuitive that $1,000 invested each year for 40 years at 6% p.a. comes out to over $150,000 when you only contributed $40,000? The reason is that not only are there earnings on that money, but earnings on those earnings. And earnings on the earnings of those earnings. And so on. That’s what compounding is.

Well, it works the same way for fees, but in reverse.

You see, when fees are taken out, you don’t just lose the amount taken out. You also lose the earnings it would have generated. And the earnings on those earnings. And the earnings on the earnings of those earnings… you get the idea.

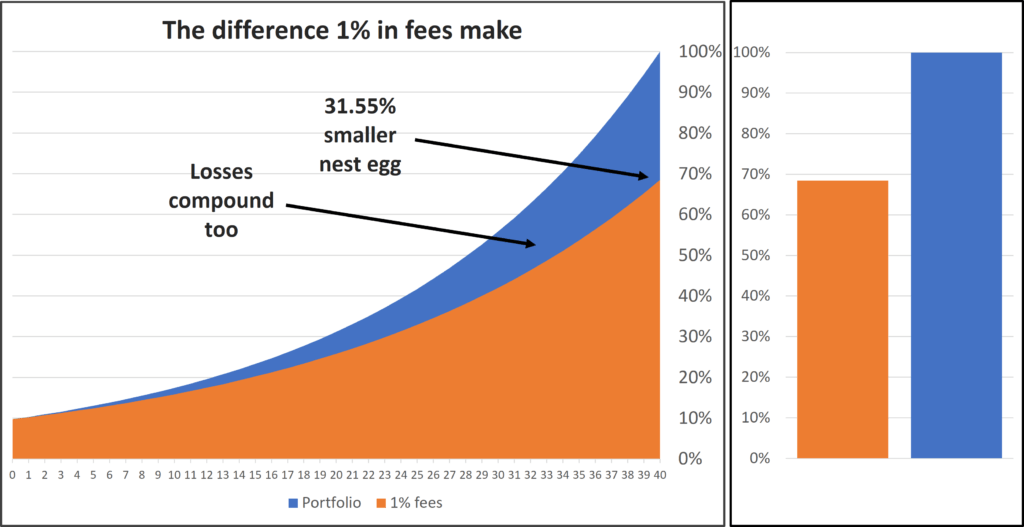

Here is a graph so you can see it visually

The top line is 6% annualised real returns. The line below it is 5% annualised returns. That gap in blue doesn’t increase in a linear fashion. It increases more aggressively as time goes on because of the compounding of your lost earnings.

As you can see, at the end of 40-years, the difference between 6% and 5% is 31.55% or about a third less.

Having to live off half your retirement income

That 31.55% is just the difference during your accumulation of assets. Let’s move on to when you start living off your assets.

Suppose you planned on retiring with $800,000 of retirement assets, drawing down $32,000 p.a. (using the 4% rule).

With a 31.55% reduction in your nest egg due to those ‘only 1%‘ fees, you now have only $548,000.

This has reduced your 4% annual drawdown rate from $32,000 p.a. to $21,920 p.a.

But wait, it gets WORSE!

That 4% rule includes fees. So if you are paying 1% in annual fees in retirement, you can only draw down 3% per annum under the 4% rule. That means your annual drawdown rate has fallen from $32,000 to $16,427.

How would your quality of life be reduced if you had to live off half of your otherwise potential retirement income?

The reddest of red flags

The reddest of red flags when interviewing a prospective financial adviser is if they make it sound like a 1% fee isn’t much. The reason it is so bad is that it’s not an innocent mistake. As someone whose job involves detailed financial projections, they know this better than anyone. So when an adviser makes 1% fees sound like it isn’t a big deal, even if they seem otherwise knowledgeable, competent, and friendly, this is a sign to make sure they have no place in advising you on your finances.

Nothing is more important than trust when it comes to your money, and this is the clearest demonstration that you cannot trust a person like this. Or rather, you can trust them — to take advantage of you.

What you can do instead — Pay a flat fee

For financial advice, pay a flat fee that is not tied to the value of your assets. Percentage based fees grow with your assets even though there is no more work in managing $2,000,000 than $200,000. But when you pay percentage-based fees, your adviser gets more money over time for the same amount of work. They often hook you when you start and say that 1% isn’t much based on your current asset balance, knowing that you will keep that current dollar amount in mind and not notice the amount increasing as the fees are painlessly extracted from your investment account each year out of your attention.

Independent advisers that are PIFA members cannot take percentage-based fees

Advisers who have elected to be independent advisers and members of PIFA (the Profession of Independent Financial Advisers) cannot take percentage-based remuneration.

Independent advisers must not take:

- commissions (unless rebated in full to the client)

- volume-based payments (i.e., payments based on how much business they send to a financial product issuer)

- other gifts or benefits from a financial product issuer.

And PIFA members must be independent and, additionally, must not:

- have ownership or affiliations to any products

- charge asset-based fees.

Another red flag is advisers who are not independent rubbishing the idea of independent advice. I had a long conversation with an adviser/podcaster who did just this during the conversation. He said that the idea of independent advice is a failed attempt to be like the fiduciary equivalent in the US and that independent advisers are allowed to take percentage-baed fees. When I interjected that independent advisers who are PIFA members cannot take percentage-based fees, he went on to rubbish PIFA in an attempt to distract from the real point, which is not about PIFA itself, but that by choosing to be independent, the adviser is electing to be held accountable in providing advice that is free of these remuneration-based conflicts.

Are there times when 1% fees are acceptable?

There are two situations where it may be acceptable to pay 1% fees.

- A company that directly manages unlisted assets.

For example, a property trust that manages individual assets directly — as opposed to a REIT that simply holds other listed REITs. The reason why 1% fees may be acceptable is that, unlike most managed funds, the fee also includes the running of the business of managing the individual assets. Just be aware that unlisted assets have a lot of challenges and you need to have some expertise in that area. - Actively managed funds that you believe in.

If you know how to vet fund managers, and if you have the conviction to stick with them through underperformance to the index over long periods, there may be a case for higher fees. However, by vetting, I don’t mean just looking at their past performance. There are a host of reasons why I don’t do this.

I would not trust a financial adviser to select either of these because too often it is as part of a sales tactic to make you feel like you need to pay high ongoing fees for their super-secret investment selection strategy, which is targeted at your greed (of wanting outperformance) and fear (of wanting lower risk without lower returns). If you don’t know how to do it yourself, how would you ever know if it was a sales tactic or if they really had the expertise.

Sit down for this one — 1% advice fees and 1% fund fees

On top of the ongoing 1% adviser fee, most advisers put you into actively managed funds with fees of another 1%. When combining the 1% adviser fees and 1% fund fees, the loss to your portfolio over 40 years is half instead of a third. And the income you can draw down in retirement is reduced by 75% instead of 50%. There’s a reason I say to be very critical of financial advisers.

Final thoughts

It is my hope that people more deeply understand what 1% fees mean and are as bothered as me when an adviser knowingly makes it sound like 1% isn’t much.

Here is a recap:

- An annual fee of 1% of your total assets is really 10% of your annual return.

- Due to inflation, a 1% asset-based fee is over 16% of your average annual portfolio gains in real terms (i.e. in buying power).

- Lost earnings from fees compound to vast amounts over time, much more than the actual amounts paid. The result is that 1% higher fees result in a loss of a third of your nest egg.

- A 1% asset-based fee in retirement reduces a 4% drawdown rate to a 3% drawdown rate.

- Once you combine the reduction of a third of your nest egg at the end of your accumulation as a result of 1% fees with the loss of a quarter of your income generated from that shrunken nest egg, your retirement income has fallen by half.