The decision to invest in an Offset vs ETFs vs Super depends on investment time horizon, risk tolerance, and tax considerations. However, once you understand the considerations, the decision is straightforward.

In this article, we will also dispel the notion that the return on an offset can simply be ‘grossed up’ to show that investing has little benefit over keeping cash in the offset.

We’ll start with Offset vs ETFs and then extend it to super.

Some assumptions before we start:

- The offset is against your home loan and not against an investment loan.

- ETFs will refer to growth assets, specifically, stocks.

- Super will similarly refer to equivalent growth assets, but held inside super.

- We will use 5% interest rate on the loan being offset.

- We will use 10% return on growth assets (the historical return or stocks), made up of 3% income and 7% growth.

Quick Links

Offset vs ETFs

Offset vs ETF returns

Offset vs ETF returns with debt recycling

ETFs vs Super

Deciding how much to allocate to each

Final thoughts

Offset vs ETFs

Putting money into your offset is the same as paying down your home loan, but allows you to retain access to the funds. There are also significant tax benefits. However, we will see shortly that investing can have the same tax benefits. As a result, this is a question of risk tolerance, in particular, comfort with debt, investment risk, and investment time horizon.

Risk tolerance can be broken down into three aspects:

| • Ability to take risk | – | Is there enough time and income to recover and reach my goal if things go badly? |

| • Willingness to take risk | – | How am I going to react when things don’t go well? |

| • Need to take risk | – | How much risk do I need to take to reach my goal? |

If your ability to take risk is low, which means your investment time horizon until you need the money is short, you cannot tolerate the risk of investing primarily in stocks (i.e., ETFs), and the stability of capital held in an offset is more appropriate.

If your willingness to take risk, i.e., your ability to not panic-sell when the market falls, is low, you are not suited to investing primarily in stocks, and the stability of capital held in an offset is more appropriate.

If your need to take risk is higher than the returns available with an offset, then you have a disjointedness between your willingness, ability, and need to take risk, which you will need to consider carefully. If you cannot adjust your goal, such as lowering the amount needed or being able to access the funds later (e.g., retiring later), you may have to accept a higher risk than would ordinarily be appropriate. This will have to be with the understanding that you are allocating your money to a higher level of risk than is appropriate to your ability or willingness to take risk.

If your lower risk tolerance is due to a lower ability to take risk (i.e., your investment time horizon is shorter), it is usually better to adjust your goal to accept a lower level of return or to delay access if that is an option.

If your lower risk tolerance is due to a lower willingness to take risk (i.e., you are not comfortable with short-term volatility and may panic-sell), spending time learning more about investing and diversification may result in an increase in your willingness to take risk.

Offset vs ETF returns

Your home loan offset has an interesting advantage over an ordinary high interest savings account (HISA) in that the interest you earn on a HISA is taxable, meaning the return you receive in your hand is after tax has been taken out. On the other hand, with an offset, the return is received from paying less loan interest, which means no cash is paid out, and, therefore, no tax is paid on that return.

This is a huge advantage in terms of returns.

Let’s look at an example using current marginal tax rates with the 2% Medicare levy added.

| HISA | Offset | |

|---|---|---|

| After tax at 32%: | 5% x (1-32%) = 3.40% | 5% |

| After tax at 39%: | 5% x (1-39%) = 3.05% | 5% |

| After tax at 47%: | 5% x (1-47%) = 2.65% | 5% |

You can see that the after-tax return is much higher for the offset due to the advantage of not paying tax on your return, and the advantage increases with your marginal tax rate (i.e., the higher your income).

Note that in reality, your loan interest rate will be around 1% higher than a HISA, making the difference even more pronounced. However, the above is intended to illustrate the effect of tax on your returns because what matters is what remains of your investment after tax has been paid.

Another way to look at it is to look at the pre-tax return required to achieve the same return as the offset.

A 5% offset return would be equivalent to a return from a taxed investment of this amount:

| Pre-tax return required to match offset | |

|---|---|

| At 32% tax rate: | 5% / (1-32%) = 7.35% |

| At 39% tax rate: | 5% / (1-39%) = 8.20% |

| At 47% tax rate: | 5% / (1-47%) = 9.43% |

With historical stock market returns of 10%, the question becomes – is it worth taking on the risk of investing in stocks to get a 10% return when you can get an almost equivalent after-tax return from your offset and have no market risk of your capital falling in value?

Why take a large amount of risk for virtually no reward? As a result of this important understanding, many people decide that investing makes no sense when you have an offset.

However, if we add a bit of nuance, we can see that this is missing some important information that significantly changes things. In particular, we are not taxed on the full gain of our stocks every year, and investing has the following benefits to produce a higher return than cash:

- returns on delayed taxes on capital gains (and the long-term compounding of these returns)

- the ability to sell down investments in retirement on a low or zero tax rate

- the 50% CGT discount

- franking credits

Let’s go back to the figures showing the after-tax returns and add in the after-tax return of an ETF portfolio of stocks with a 3% income component and a 7% capital growth component.

| Stocks (selling at MTR:) |

|||||

|---|---|---|---|---|---|

| HISA | Offset | 32% | 18% | 0% | |

| After tax at 32%: | 3.4 % | 5 % | 7.9 % | 8.4 % | 9.0 % |

| After tax at 39%: | 3.1 % | 5 % | 7.7 % | 8.2 % | 8.8 % |

| After tax at 47%: | 2.7 % | 5 % | 7.5 % | 8.0 % | 8.6 % |

* The stock formula in the first line is 3% x (1-32%) + 7% x (1-(0% x 50%)) = 9.0%.

This breakdown is based on:

- the 3% income being taxed at the marginal tax rate (MTR) shown in the first column of the row.

- the 7% capital gain being taxed at a variety of MTRs that you may be on when selling down in retirement, and using 0% in the example above, and using the 50% long-term CGT discount.

Let me draw your attention to the bottom row, where the individual is on the highest marginal tax rate and on the 32% MTR in retirement when selling. An offset, where cash has no investment risk, returns 5% after tax. In contrast, taking the full brunt of a 100% stock portfolio only returns 2.5% more, so it’s an important decision whether to take on so much more risk for a 2.5% additional after-tax return.

This highlights the significant impact of taxes on your investment decisions and why, if you don’t factor taxes into account, you may make uninformed and often incorrect decisions.

Investment property offset

The tax advantage of an offset does not exist if the offset is against an investment property. This is because, unlike your home loan, the interest on your investment property loan is tax-deductible, as an investment property is income-producing.

The result is that when you put money into the offset of an investment property, you are reducing your tax deductions by the same amount of tax you are saving through getting your returns in the form of lower interest repayments that do not add to your taxable income.

The net effect is that you have the same tax benefit of a HISA, and the only difference is the interest rate. Typically, mortgage rates are about 1% higher than HISA rates, so it is still beneficial to use an offset on an investment property over a HISA, but the difference is nowhere near as pronounced as using an offset on a home loan.

Offset vs ETF returns with debt recycling

Debt recycling is a tax strategy where you use cash that you have decided to invest, and rather than invest directly, first pay it down into your home loan and then redraw it right back out before investing. Sending it on this detour before investing makes the interest on that portion of your home loan tax-deductible for the life of the loan while it is invested in income-producing assets.

This provides the same tax benefit to ETFs as the offset has, so we can add the tax deduction of the loan interest to the return of stocks.

| Stocks (selling at MTR:) |

Stocks with debt recycling (selling at MTR:) |

|||||||

|---|---|---|---|---|---|---|---|---|

| HISA | Offset | 32% | 18% | 0% | 32% | 18% | 0% | |

| After tax at 32%: | 3.4 % | 5 % | 7.9 % | 8.4 % | 9.0 % | 9.5 % | 10.0 % | 10.6 % |

| After tax at 39%: | 3.1 % | 5 % | 7.7 % | 8.2 % | 8.8 % | 9.7 % | 10.2 % | 10.8 % |

| After tax at 47%: | 2.7 % | 5 % | 7.5 % | 8.0 % | 8.6 % | 9.8 % | 10.3 % | 10.9 % |

* The debt recycling simply has the deductible interest added to the return. So:

- the 1st line is adding 5% x 32% (i.e. 1.6%) to all three headline marginal tax rates in the previous column

- the 2nd line is adding 5% x 39% (i.e. 2.0%) to all three headline marginal tax rates in the previous column

- the 3rd line is adding 5% x 47% (i.e. 2.3%) to all three headline marginal tax rates in the previous column.

Note that the after-tax return when debt recycling stocks is very close to the pre-tax return of 10%, since debt recycling gives the same unique tax benefit of an offset to stocks. The difference between those options after tax is similar to the difference before tax, making the returns more commensurate with the risk of stocks.

So now we are back at the fact that the decision of whether to use the offset vs investing comes back to being based on the risk-reward spectrum. The longer you can wait to access the money and the more you can tolerate seeing your investment fluctuate in value without selling (from needing access to the cash or from panic-selling), the higher the expected return you can get.

If you need your money in the short term or you cannot tolerate seeing the value fluctuate with the stock market, your offset will provide the safety that you are looking for, but it also comes with a lower expected return than stocks.

If you won’t need the money for at least seven years and you can tolerate some fluctuation in the value of your investment in that time, investing in ETFs with debt-recycled money provides a much higher expected return.

ETFs vs Super

When we refer to super contributions in this article, we are going to talk about concessional contributions and not about non-concessional contributions

Concessional contributions to super give a massive boost to returns by getting to keep much more of your income due to paying less tax than you otherwise would, much more than the tax deductions mentioned above, because the tax deduction is provided on the principal at the start, not just on returns. This gives you a much higher starting amount before the compounding even begins.

For someone on the 30% marginal tax rate (MTR), you are paying a 2% Medicare levy (ML), so you are losing 32% before you even see your income.

In contrast, super contributions are taxed at 15%.

To calculate the benefit of putting it into super:

| 1. Outside super | (32% tax): | 68% | after tax | |

| 2. Inside super | (15% tax): | 85% | after tax |

The improvement is 85%/68% = 1.25

A return of 25%.

For someone on the 37% MTR, it is 39.34%.

For someone on the 45% MTR, it is 60.38%.

E.g., $10,000 of pre-tax salary results in:

Outside super (32% tax): $6,800 after tax

Inside super (15% tax): $8,500 after tax

Gain from investing in super:

8,500/6,800 = 1.25 = 25%

Returns from the stock market are about 10% p.a. on average, so that’s 2.5 years of average market returns (or 4 years for someone on the 37% MTR).

At current high-interest savings account rates, that’s 5 years worth of interest (or 8 years for someone on the 37% MTR).

And this return is 100% risk-free, unlike market returns.

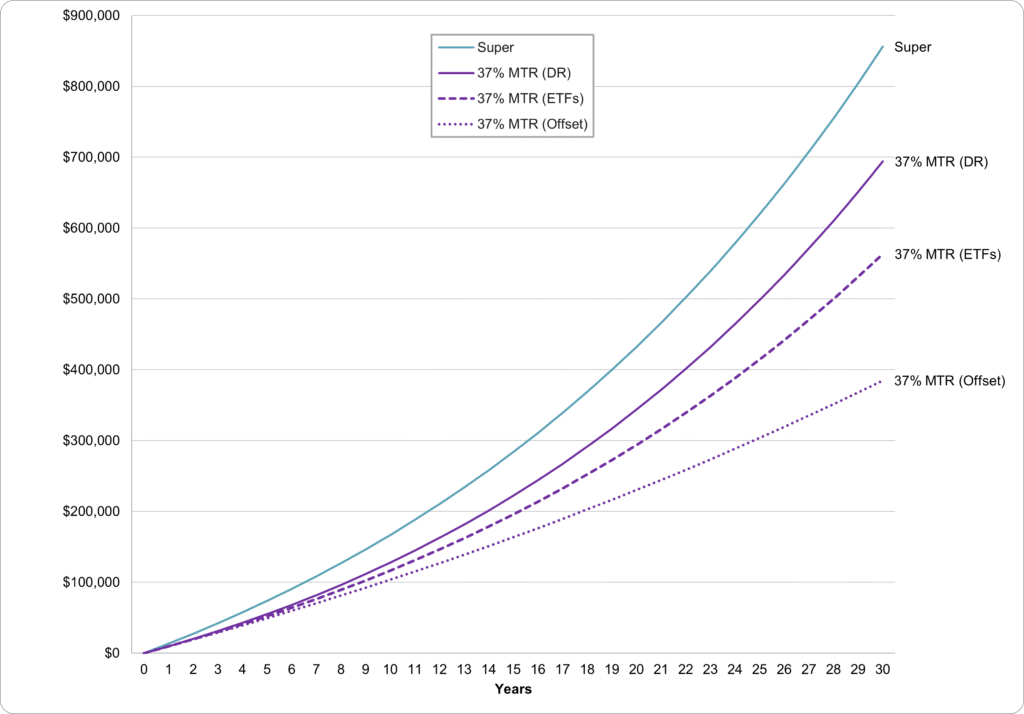

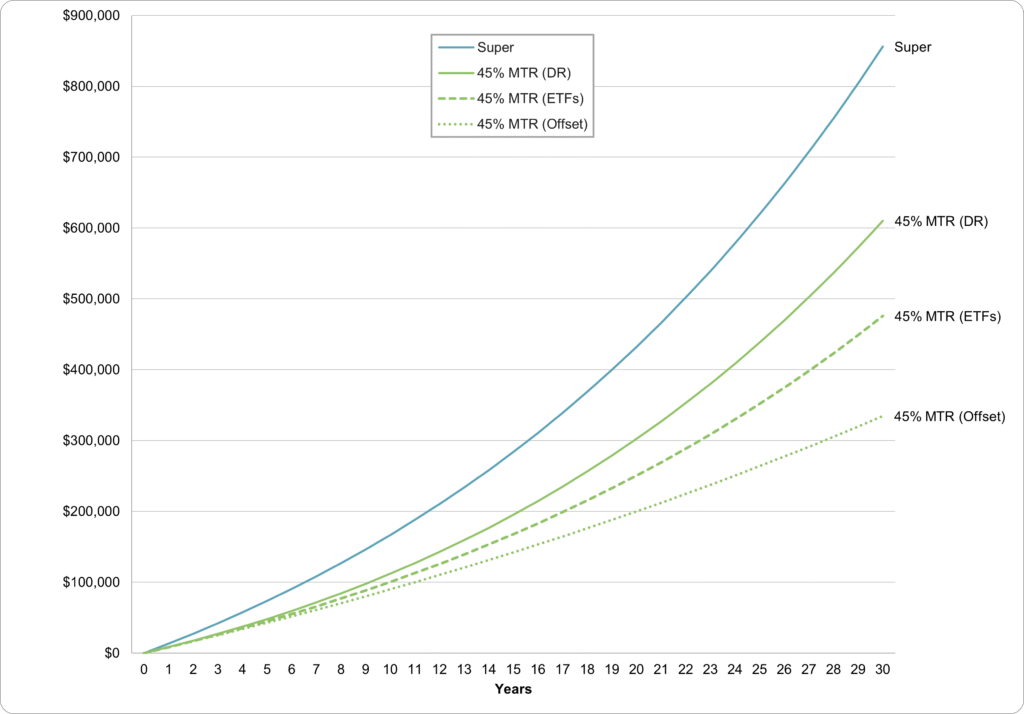

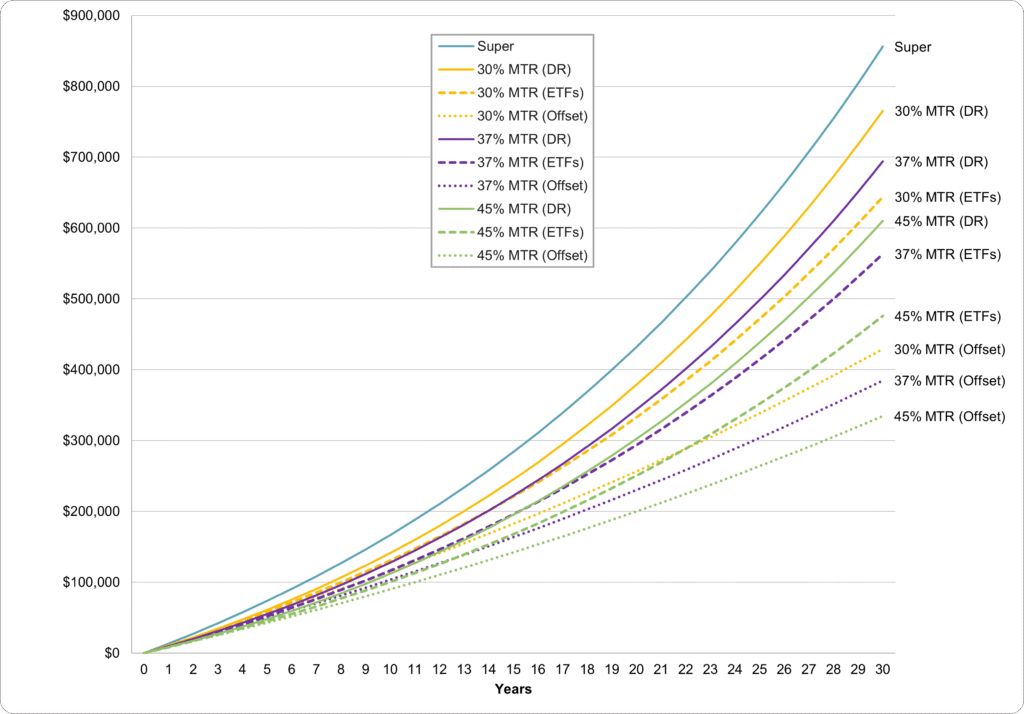

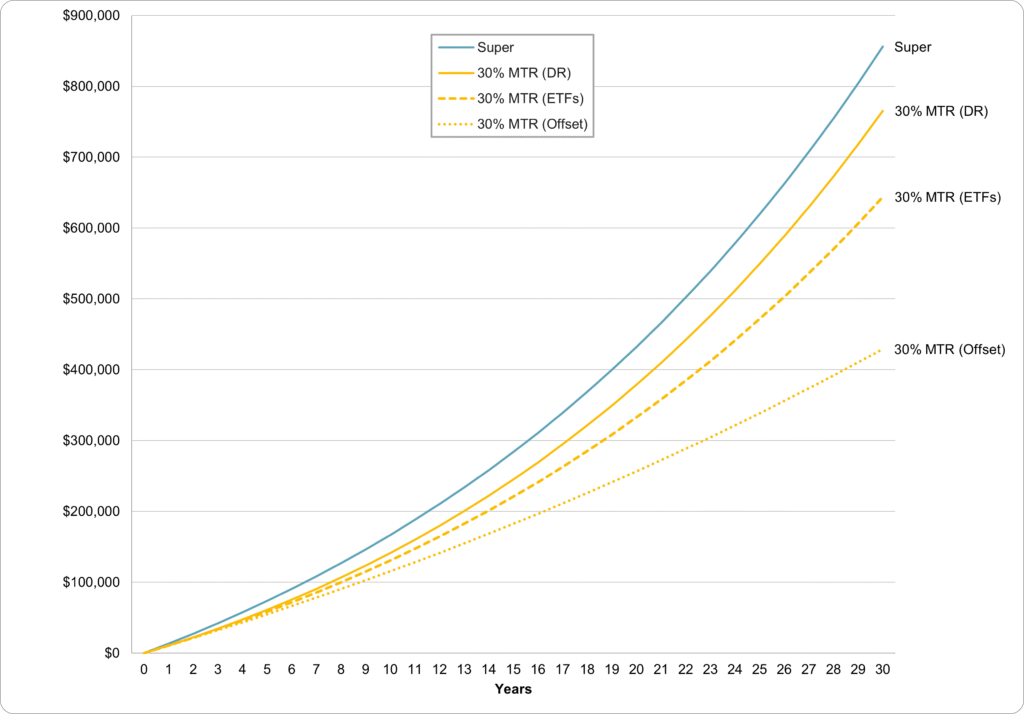

You can read more about the difference in returns from super vs outside super here, but that page does not include the benefit of debt recycling on returns, so here is an updated image comparing the benefits of superannuation over debt recycling for 30 years, assuming a $15,000 annual contribution to superannuation versus debt recycling.

Find out your marginal tax rate and click the following links to view 30%, 37%, 45%, or all marginal tax rates.

As you can see, debt recycling has a significant advantage over investing without debt recycling. However, investing with concessional contributions in super has a vastly superior benefit over that, approximately doubling the benefit of debt recycling over investing directly. And that benefit is more pronounced the higher your marginal tax rate.

The downside of investing in super is that it is inaccessible until you reach preservation age (60). However, there is no reason to invest entirely outside super or entirely inside super. If you plan to retire early at 50, you only need assets outside of super to last 10 years, while you can still utilise super for the last 30 years of your life. By using super for the portion of your retirement from age 60, you can acquire wealth faster, allowing you to retire earlier, or with more money, or both.

Make sure your super is invested to maximise your outcome:

How to invest your super

Deciding how much to allocate to each

Here is the process to decide how much to allocate to each of Offset vs ETFs vs Super.

1. Split your financial goals into short, medium, and long-term.

For instance:

Short-term financial goals (1-5 years):

- Emergency fund

- Saving for a home deposit (within the next 5 years)

- Saving for a holiday

- School fees for the next few years

- Saving for a car

Medium-term goals (5+ years) and long-term goals (until age 60):

- Early retirement – specifically to get you from retirement until you can access super

- Investment for kids to give to them when they are an adult in 10-20 years (assuming you won’t have access to super yet)

- Private school fees that are over 5 years away

Long-term goals (from age 60):

- Funding retirement from age 60 onwards (this is the main one)

- Leaving a legacy/inheritance

- Investment for kids if you don’t need it until you can access your super.

2. Allocate your money based on your goals and needs

Your short-term financial goals do not have sufficient time for the risk inherent in investing, so the offset is the most appropriate place. If you need to keep track of each of these, consider a lender that allows multiple offset accounts. Separate accounts can be a great way to regularly contribute and save money for each of your goals, so that it is not in your monthly spending account.

Your medium-term goals and long-term goals that you need before you can access super, have sufficient time to be invested to get a higher return than the offset. As explained above, debt recycling provides a far higher return than investing directly. So consider debt recycling when investing.

Your long-term goals, which you can access super for, have sufficient time to achieve the highest return that concessional contributions offer, so it’s silly not to take advantage of the additional return for those goals.

In terms of retirement funding, front-loading your super, funding your post-60 retirement first, is superior, as it allows your higher returns to compound more when that portion is funded before your early-retirement portion.

Final thoughts on Offset vs ETFs vs Super

The decision of using an offset vs ETFs vs super is one of when you will need access to the money. The longer you can delay access, the higher your expected returns will be.

For capital that you need in the short term (less than about 5-7 years), the risk of investing is not worth the higher average return provided. This is because you are unlikely to get the long-term average return on your investment in such a short period due to the short-term volatility, and the investment may be down at the time you need it. You would need to re-earn the lost money, which is often difficult or impossible. In this case, an offset would be most suitable.

For capital you can leave untouched for at least 7 years, and ideally more than 10 years, investing can provide a higher expected return while also having a long enough time to get closer to the long-term average return. Routing your cash through your loan (i.e., debt recycling) adds significant returns to investing. This is typically used to fund early retirement until you can access your super.

For capital you won’t need to access until preservation age (60), superannuation allows you to acquire a much larger nest egg due to the government chipping in with tax deductions, which will allow you to direct more of your funds outside super for an earlier retirement once you have built your super.

| Investment | Return | Investment time horizon | |

|---|---|---|---|

| Offset | Medium | Short | – 0-5 years |

| ETFs | High | Medium | – 10+ years |

| Super* | Very High | Long | – Until at least age 60 |

* Super in the above table refers to concessional contributions.

Special circumstances

- Paying off ‘bad’ debt provides a higher expected return than all of the above.

Bad debt is debt used to finance things that can be consumed. It is where you borrow to purchase items that lose value over time and do not contribute to your wealth creation. You pay ongoing interest, and in the end, it is worth less than what you paid. This includes credit card debt, personal loans, car loans, and payday loans. These debts often come with high interest rates, which makes it even worse.

The worst thing about debt is that it is a negative investment. Investments sit there and continually generate more wealth. Debt sits there eating away at your income every month before you even get to allocate it towards your lifestyle goals. Even worse, it takes from your after-tax income, so if you are on the 32% marginal tax rate, paying $100 in interest costs you $150 of your salary! As a result, the return on paying it off to avoid this is much higher than investing.

In case it isn’t clear yet, you should avoid bad debt like the plague. If you have any, you should be doing everything you can to get rid of it and build strategies to avoid going into debt again in the future.

- If you are unlikely to retire before 60, and have a remaining concessional contribution cap from the current and/or previous years, there is little use in ETFs, and you would use the offset for short-term access to capital and super for anything else. This is particularly relevant to those over 50 when deciding between the offset vs ETFs vs super.

- The First Home Super Saver Scheme (FHSS) is a special scheme where you can access your voluntary super contributions to purchase your first home. It is very useful and essentially free money. This is more relevant for those planning to buy their first home and not relevant to the decision of Offset vs ETF vs Super yet. However, it is worth mentioning in case anyone is reading this while planning what to do with their money once they have bought their first home.

Further Reading

Debt recycling

Redraw vs Offset

Pay off the mortgage faster or invest?

Should I debt recycle or leave my money in the offset?

How to invest your super