In your super, you can choose pre-mixed investments, single asset class investments, or lifecycle investments. Each of these has different characteristics, and we will go through each of their benefits and downsides so you can decide what investment style is best for you.

Quick Links

Pre-mixed investment options

Pre-mixed options are ready-made, diversified investment portfolios made up of multiple asset classes, such as shares, property, cash and bonds. The amount of these asset classes in each investment option varies depending on on the risk profile of that investment option. For instance, the higher growth options have more shares and less bonds and cash, whereas the more conservative options have less shares and more bonds and cash.

There will be 3-4 of the following to choose from:

- High growth

- Growth

- Balanced

- Conservative balanced

- Conservative

And they typically include most asset classes:

Shares

- Australian shares

- International shares

Unlisted assets

- Property

- Infrastructure

- Private equity

- Credit

- Alternatives

Bonds and cash

- Fixed income

- Cash

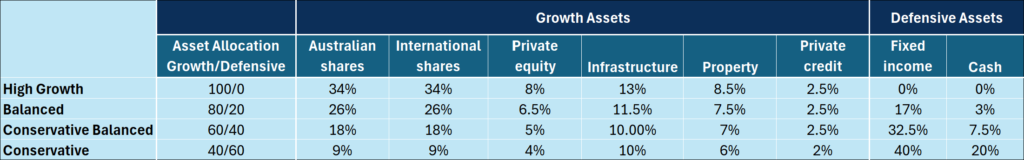

Here’s an example from one of the bigger super funds:

What high growth, high risk, and balanced means

With pre-mixed investment options, the words “high growth” and “high risk” (and balanced and conservative) don’t have quite the same meaning as those words do in regular conversations.

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss.

In investing language, high growth investments such as shares are called high risk because, in the short and medium term, the price goes up and down so much that you have a ‘high risk’ of (potentially large) short- and medium-term loss. But in the long term, they provide a higher expected return.

On the other hand, conservative investments such as bonds have very little short- or medium-term risk as the price does not fluctuate much.

So, in the pre-mixed investments, they refer to the options with most or all in stocks as ‘high risk‘ or ‘high growth‘, and those with most or all in bonds or cash as ‘conservative‘, and those in the middle ‘balanced‘.

But it is important to note that over the long term, bonds return much less, so even though they have less short-term volatility (i.e. what ‘risk’ refers to), they give you a much more significant risk of not earning enough money to last through retirement.

To learn more, have a read of the following:

Pre-mixed pros and cons

Pre-mixed investment options through super funds typically:

- include most or all asset classes

- are actively managed

- have a higher fee

- have the management and rebalancing done by the fund manager.

The upside of pre-mixed investment options is that you get a lot of diversification between asset classes, and with pre-mixed investment options, you decide on your risk profile, select one of the above options to suit it, and there is nothing more to do. No need to pay an adviser ongoing fees to manage it and no need to actively monitor your investments. It is a set-and-forget investment that lets you get on with your life – which is the way investing should be.

The downsides of pre-mixed investment options in super are that they:

- are actively managed

- have higher fees

- almost always hold unlisted assets.

Active management and fees

Pre-mixed investment options tend to be actively managed, which means they come with higher fees to pay for the investment managers who make these investment selection decisions, and while over any 1-year or 2-year period, an active manager may outperform the index, over 15+ years, less than 20% of active managers even match the index after fees.

In addition to the investment fees reducing performance, this can also be explained by the Pareto Principle (the 80/20 rule). Most of the future performance will come from a disproportionately small number of companies in the market1,2, and it’s much easier to miss some of these few companies, resulting in lower returns than just investing in everything. As a consequence, a disproportionately large number of fund managers underperform. So when you pick an active fund manager, you have a much higher chance (over 80% going by the SPIVA reports) of ending up with one that underperforms.

1. The 15-Stock Diversification Myth

2. Do Stocks Outperform Treasury Bills? — “4% of listed companies explain the net gain for the entire US stock market since 1926“

Fees

Fees have a bigger impact on your returns than you realise.

A 1% fee doesn’t sound like much, but what few people realise is that the 1% is based on your total assets invested, not 1% of your profit.

Historically, the stock market has returned 10% p.a., so right off the bat, 1% is actually 10% of your expected (or average) annual gain.

It gets worse.

Inflation eats away at your capital each year, so that 10% historical return included 4% inflation.[1] The after-inflation return (also referred to as the ‘real return‘) of 6% means that 1% in fees is 16.7% of your expected annual portfolio gains in real terms.

And it gets worse.

If you save and invest $1,000 each year for 40 years at 6% p.a., it comes out to over $150,000, even though you only contributed $40,000. The reason is that not only are there earnings on that money, but earnings on those earnings. And earnings on the earnings of those earnings. And so on. That’s what compounding is.

Well, it works the same way for fees, but in reverse.

You see, when fees are taken out, you don’t just lose the amount taken out. You also lose the earnings it would have generated. And the earnings on those earnings. And the earnings on the earnings of those earnings… you get the idea.

Over 40 years, those “just 1% fees” costs you a third of your retirement nest egg.

1% fees decimate returns, and pre-mixed investments in super tend to have fees in the 0.70%-1.00% range.

[1] The Australian Equity Market over the Past Century | RBA. Table 1 shows returns of 10.2% and inflation of 3.9%

Unlisted assets

Listed assets are assets that can be bought and sold on the stock market (i.e., they are listed on the stock market).

Unlisted assets simply refer to investments that are not listed on the stock market, so they must be sourced and bought outside the public stock market.

Funds with unlisted assets are actively managed, and the fees are much higher, often resulting in worse performance than simple, low-cost, index-based investments.

Besides the higher costs, other problems with unlisted assets include:

- being illiquid and difficult to buy and sell

- not being subject to any listing rules or ASIC’s ongoing market supervision

- are hard to accurately price without the market pricing it, and their information is very hard or to find, so you need to be an expert to know how to pick the sales and marketing from what you’re likely to get.

Now, if you trust the fund manager to be both competent and ethical in selecting investments that are in your best interest, that’s not a problem, and the upside of the diversification and the hands-off nature is likely to provide a benefit.

However, it is difficult-to-impossible to find out if a fund manager is both competent and ethical. What tends to happen is that fund managers typically take a cut and then invest in other funds that also take a cut, which then invest in unlisted assets, which also cost a lot to manage. So you are paying fees upon fees upon fees. If you could even get to the bottom of finding all the layers of fees, there is a vanishingly small chance of the investment being able to perform well enough to cover these fees and provide the same return as low-cost index funds that avoid all these costs and provide you with the market return.

Retail super funds are privately owned. They often have high-fee investments and there’s going to be a high chance you suffer from high fees, which go to the owners of the fund.

In contrast, industry super funds are not for profit and run only to benefit members.

It’s not too hard to tell which one you want.

The question is whether investment options that contain unlisted assets in industry funds (which are run for members) will be selected by those who are both competent and ethical in selecting investments that are in your best interest. If so, unlisted assets would be no problem. However, it is very difficult to analyse this. Even with industry super funds, the layers of fees being paid are difficult-to-impossible to find (usually impossible), and issues with unlisted assets include:

- Artificially inflated pricing — listed assets are marked to market, while unlisted assets are priced by whoever makes them up. This has been a major issue: link1, link2

- Transparency — you don’t know what you are getting with unlisted assets. You don’t know what the real price is, you don’t know the full information about the many layers of fees paid from bottom to top, and you don’t know how they selected their providers and assets and managers. You have to just trust them. On the other hand, listed companies have strict regulations by ASIC in Australia and the SEC in the US, where they must disclose a lot of information on a regular basis.

- Illiquidity within a legally required liquid structure — unlisted assets are illiquid by nature. Look at what happens in downturns as people head for the exits. Unlisted assets outside super can freeze redemptions (for many years) to avoid problems such as those leaving disadvantaging those who remain by them, either selling at an artificially inflated price with those remaining to have excess losses or forcing the provider to sell in a down market. In super, these problems still exist because super must be a liquid investment where people can leave an investment option at any time. If someone wants listed assets, they should strongly consider doing it outside super, or using an individual super account (SMSF, wrap).

Final thoughts on pre-mixed investment options

While there is an advantage with pre-mixed investment options of not needing to know anything about your investments and the increased diversification from unlisted assets, you need to trust fund managers – even those from industry super funds – to select investments that can beat the index, and the high fees of active management are difficult, and often impossible, to overcome.

It should be noted that there are a small number of funds that offer pre-mixed investments that do not contain unlisted investment options or active management. Vanguard Super is the main one, although at the time of writing, their fees are still high at 0.56%. Several funds offer low-cost ‘indexed balanced’ investments, which is appropriate for those nearing retirement, but not for younger investors. And a couple of funds offer low-cost indexed ‘high-growth’ options, but there is usually a high allocation to Australian equities despite the high concentration risk of having a large portion of your assets in the Australian equities market.

Luckily, it is easy to use single-asset-class investments to improve upon this.

Single asset class investment options

Single asset class investment options are simply the components of the pre-mixed investments, but you get to choose which ones and how much to use.

These typically include:

- Australian shares

- International shares

- Property

- Fixed interest

- Cash

Single asset class options allow you to be a little more hands-on in choosing how much of each asset class to use, so you can adjust the proportions.

However, to do this, you need to know how much of each asset class to use to build a diversified portfolio, whereas with the pre-mixed options, all you need to know is your overall risk profile and you’re away.

The real benefit of single-asset-class investment options is that several industry super funds offer low-cost index-based versions of these investment options, so you can easily create your own version of the pre-mixed investment option that is very similar, while avoiding the problems of active management, high fees, and unlisted assets.

The series of articles on Building a Passive Portfolio gives you an easy-to-understand learning guide on the concepts of designing a portfolio that is aligned to your own risk tolerance, and breaks down how to select single asset class options to create a portfolio based on your own situation.

Using single asset class indexed investment options within your super would result in the following benefits:

- It is in line with your personal risk profile

- It is broadly diversified through investments in dozens of countries around the world

- It is diversified by currency (a balance of Australian dollar based assets and international currency assets)

- It has no investment manager risk of making poor decisions, or issues around unlisted assets

- It is guaranteed to get market returns

- It has incredibly low fees to avoid loss of returns from active management

- It requires no ongoing management on your part or from an adviser.

It is important to note that this is not as diversified as the pre-mixed options, as it does not have unlisted assets, such as property, infrastructure, and alternative assets. However, as explained above, these come with their own issues. If you have contacted your super fund investment management team and have done due diligence (which very few people know how to do), and you trust them to earn a higher return than the market that more than makes up for the additional fees, and if you are comfortable with the issues of unlisted assets in a public super fund, a pre-mixed option may be suitable. I personally don’t want that risk, especially with the data showing that it fails to perform most of the time.

Lifecycle investment options

The last type of investment options in super are lifecycle investment options.

In the pre-mixed and single-asset-class investment options, I said it is set-and-forget with nothing more to do. This isn’t entirely true. At some points in your life, your risk tolerance will change, requiring a change in your investments to be less or more conservative. These happen a handful of times in your life.

Lifecycle investment options are pre-mixed investment options where the fund adjusts your investment option as you age. So, for instance, a young person in a lifecycle investment option might be placed into a high growth fund, then as they hit about 45, a portion is moved to the balanced fund each year to lower your risk as you get older, to match the risk profile of the average person. This makes it even more hands-off, which is usually a good thing.

Unfortunately, there are a couple of problems with this.

Firstly, these funds have all the issues of pre-mixed options, including active management, high fees, and unlisted assets.

Secondly, you are not the average person. You might have a higher need to take more risk even into your 40s and 50s to achieve your retirement funding goals. Or you may have more than enough assets and can afford to reduce the risk of your super sooner. Or you may have more conservative assets outside super, such as cash, which allows you to have a higher level of risk (and return) with your assets in super. A good example of this is someone who has saved assets outside super to bridge the gap in the last 10 years before they can access super. As these assets are used over a short time frame, they would be held in low-risk assets. This would allow you to balance it with higher-risk assets within super.

Final thoughts on pre-mixed vs single-asset-class investments

By now, you should understand the pros and cons of each of the three types of investments in your super fund.

Pre-mixed investment options are diversified, ready-made portfolios that require only one decision – what your risk profile is. There is nothing more to do once that is selected. For most of the population that has no understanding about investing, this offers the option to make one decision and have their investments grow without further input. Unfortunately, most people are put into the balanced fund, which is too conservative for most people under 50. These investments are also higher in fees, which eats into your nest egg over time.

Single-asset-class investment options allow you to re-create a portfolio using low-cost index investments and avoid the downsides of pre-mixed investment options, such as higher fees, active management risk, and the many issues around unlisted assets in super funds.

Lifecycle investments are intended to be even more hands-off where, even once you approach retirement, you don’t need to re-adjust your investments to your risk profile as it changes. This is a nice idea, but falls short due to the issues around active management, high fees, and the lack of personalisation of he asset allocation to you as opposed to the broader population.

Next up: How to invest your super