Passive Investing Guide

Featured Articles

Emerging markets is crap – should I leave it out?

Emerging markets have done very poorly this past decade. Should you leave it out of your portfolio? Here’s what to consider.

GHHF – The moderately leveraged ETF

One of the most innovative new funds was released in 2024 – GHHF.

GHHF is a leveraged ETF with a similar asset allocation to DHHF, but it differs from most leveraged ETFs in that it is moderately leveraged, making it more appropriate for long-term passive investing. However, while it is appropriate for long-term passive investing, it is still further up on the risk-return spectrum than an unleveraged fund.

Read on to learn more about how GHHF works, what it invests in, how much leverage it has, how it is rebalanced, how much it costs, and more.

Why you can ignore the index bubble argument

A breakdown of the index bubble argument and why it only makes in a world where people don’t like money.

Why not just invest everything in the Australian market?

There are a few reasons people use to justify investing mostly or entirely in the Australian stock market. We go through those reasons to see which ones are sound, which are dangerous, and why.

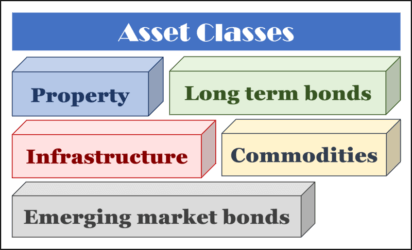

What about other asset classes besides stocks and bonds?

Investing outside the main asset classes of stocks and bonds has some challenges to be aware of. We go through a number of them, including property, infrastructure, and commodities.

Should I diversify out of VDHG?

We explore a question that often comes up from new investors whether they should diversify out of just VDHG and add other funds so they don’t have all their eggs in one basket.