Passive Investing Guide

Featured Articles

Stock market risk

Get a deeper understanding of stock market risk, with an explanation of systematic risk, the risk premium, and de-risking vs diversification.

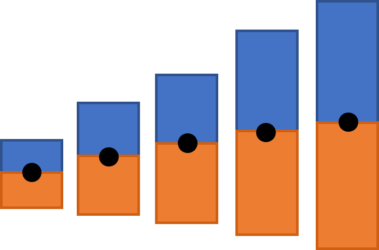

How much do I need to save every month to meet my retirement goal?

With this calculator, you can adjust the variables (savings rate, years, portfolio aggressiveness) until you find a combination that meets your retirement goal.

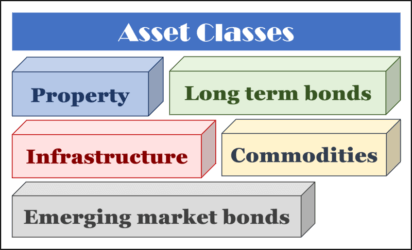

What about other asset classes besides stocks and bonds?

Investing outside the main asset classes of stocks and bonds has some challenges to be aware of. We go through a number of them, including property, infrastructure, and commodities.

What’s the deal with REITs?

REITs or Real Estate Investment Trusts are publicly-listed companies that invest in real estate. They are often targeted by investors seeking yield that seldom appreciate the risks.

Low interest rates – should I move to high dividend stocks instead?

What you need to know if you are thinking of moving your money into high dividend stocks to get a higher return than banks offer in this low rate environment.

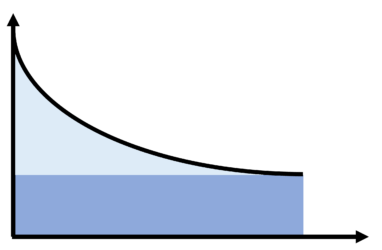

Risk premium explained

A risk premium is the additional expected return for higher risk asset classes. Find out the mechanics of why the risk premium exists and examples of it in action.