Stocks are valued by their estimated future profits based on what is expected in their own company, their industry, the local market, and the global market.

If a company develops a new technology, their future expected profits increase and buyers are willing to pay more for their stock, so the price rises as soon as the news of it is publicly available, long before profits actually increase.

If an industry is likely to profit due to some new legislation (e.g., if home builders get a government subsidy), the same thing occurs and buyers of that industry’s companies’ stocks will be willing to pay more for the higher expected profits — long before the profits actually come in.

It works the other way too. If a new technology has made a business or industry redundant, prices fall long before profits have fallen.

And it works on a national and global level, too. If there is a recession likely or if inflation is increasing, this is priced in to the value of stocks long before rates have changed.

This is what is meant by the phrase the stock market is forward looking — changes in future expected profits are accounted for in the price as soon as news of it is available to the public.

How are stock prices affected by rate changes?

Since most businesses use leverage, rate falls means less of their profits go towards loan repayments, which translates to more profit. Conversely, rate rises translate to less profits due to more of their profits going towards loan repayments. In fact, formulas for valuing a stock take in the official rate as a parameter. So the value of stocks move in the opposite direction.

However, due to the forward-looking nature of the stock market, stock prices adjust when news of a precursor to rate changes become widely known.

When inflation rises and it is likely interest rates will be increased to curb inflation, the value of stocks change immediately to adjust for the likelihood and magnitude of those rises in the future, long before interest rates have actually changed.

When the chance of recession increases and it is likely interest rates will fall in future, and the value of stocks change immediately to adjust for the likelihood and estimated magnitude of those rate falls long before interest rates have actually changed.

So the expectation of rate changes are priced in, and this occurs long before rates actually move.

How does that impact me?

We went through the Pay off the mortgage faster or invest discussion previously, but now that rates have risen aggressively, the response given so often is that to invest, you need to earn more than the interest rate on your mortgage — in fact, quite a bit more to compensate for the risk you are taking with investing compared to the guaranteed return of paying down the home loan.

However, this misses the important point that the interest rate you are using to compare is the present value, while stock prices are forward-looking.

A comparison between your current interest rate now and the long-term expected return from stocks is not a like-for-like comparison when making the decision of whether to use your surplus income to pay down the mortgage or invest and it often leads to rotating between those options.

Rotating into and out of stocks – a bad move

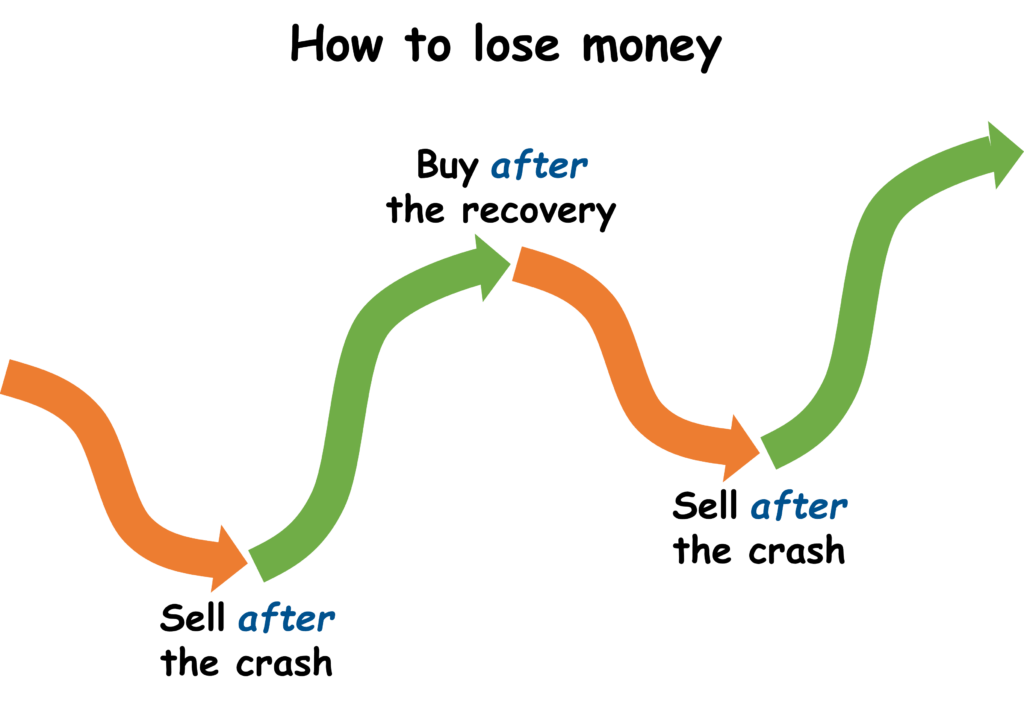

Most people are unaware of the concepts of forward-looking and pricing-in, and as a result, they decimate their long-term returns by rotating into and out of asset classes at the worst possible time.

Not too long ago, rates were at their lowest in history, with home loan and high-interest savings account rates falling below 2%.

Many were looking for a better return on their money than putting it into a bank account or paying down their mortgage, and as what happens every time rates fall, people rotated into stocks, often high-yielding stocks.

However, by the time interest rates had fallen, stocks had already priced in the likelihood of that occurring, and the value of stocks had already risen. So they were rotating into stocks at a high point.

Then, as rates rose to their highest level in over a decade, the opposite occurred. People were asking why they are taking on stock market risk when they can get such a high (risk-free) return with cash (or by paying down their mortgage). They rotated out of stocks and into cash at the worst possible time.

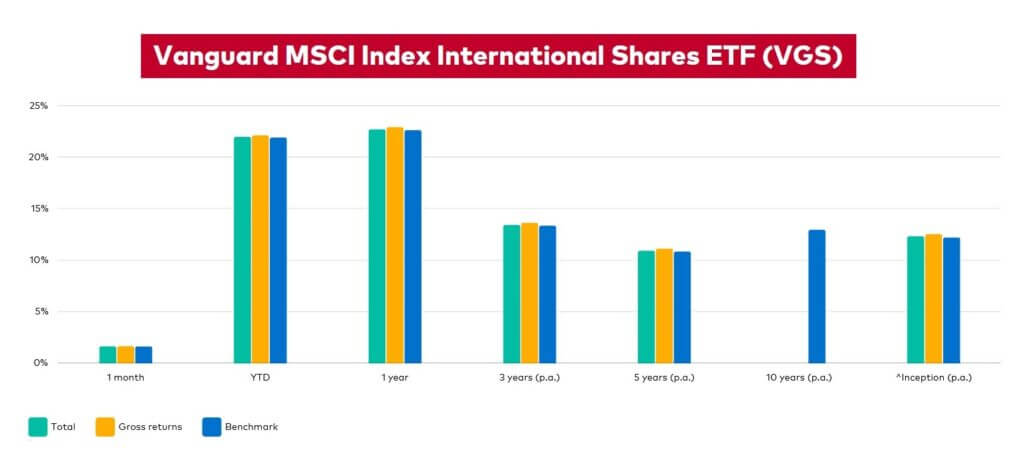

It seems few people have noticed that stocks have risen over 20% in the last 12 months on the expectation that, at some point, inflation will fall and all the mortgage stress is likely to lead to rates being lowered, providing a boost to company profits.

Those who moved money from the stock market to their home loan offset because they can get such high rates on their mortgage have missed out on this because they moved out of stocks at the worst possible time (a low point). When they rotate back into stocks, it will also be at the worst possible time (a high point).

This rotating back and forth at the worst possible time results in a buy-high-sell-low situation that decimates long-term returns.

The stock market is forward looking — so what is the solution?

If you have a mortgage and you are risk-averse or don’t like debt, paying down the mortgage is a perfectly fine option. On the other hand, if you wish to accumulate wealth faster, investing (using debt recycling) will lead to more aggressive wealth accumulation, which is also a perfectly fine option. But chopping and changing is likely to lead to a suboptimal outcome due to the forward-looking nature of the stock market.

The solution is to formulate a long-term plan based on your personal circumstances and risk tolerance and stick to it.

When interest rates have risen, ignore the news, and stick to your plan.

When interest rates fall, ignore the news, and stick to your plan.

When you hear of a pandemic, a monetary crisis, or a trade crisis coming, ignore the news, and stick to your plan.

When stocks, bitcoin, property, pork bellies, fine art, or second-hand cars have already boomed (which is when it will be in the news), ignore the news, and stick to your plan.

As Jack Bogle said,

“Stay the Course. No matter what happens, stick to your program. I’ve said “Stay the course” a thousand times, and I meant it every time. It is the most important single piece of investment wisdom I can give to you.”

This is assuming your plan was sound. If you put money into stocks that you need within the next few years, you may need to reconsider your plan. If you have a lower risk tolerance than you previously thought, you may need to adjust your asset allocation (just make it a permanent change so you don’t keep rotating back and forth at the worst possible time). But note that these things are based on a misunderstanding of your own circumstances, not on changing market conditions.