As a higher and higher proportion of people move to index funds, there is less analysis of companies, so, essentially the indexing bubble idea is that the market then becomes inefficient. For example, if Microsoft is overvalued and the whole world used index funds based on market-cap weighted indices, Microsoft would grow to be disproportionately higher than its fundamental value because nobody would actively underweight Microsoft shares relative to the market and drive down the share price.

Interestingly, this scenario would actually make it easier for active managers to outperform due to having more inefficiencies for them to exploit and make money from, so your first red flag should be to ask why on earth they are the ones complaining about the idea of an indexing bubble.

In reality, as the market becomes less efficient, more active managers would exploit these inefficiencies, making the market more efficient again. There will always be this back and forth, maintaining an equilibrium.

To believe the index bubble idea, you would have to believe that active funds would see these opportunities in an inefficient market and not make money out of them, which is absurd.

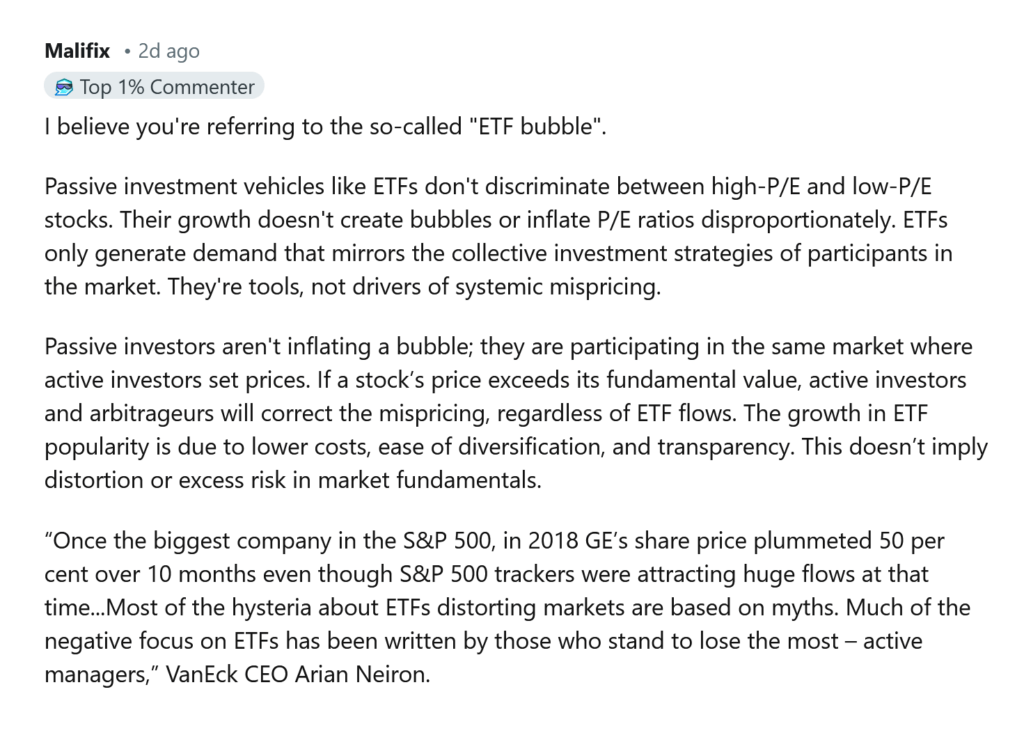

And as pointed out by a commenter on Reddit: