Last week I put out the first of a two-article pair that went through what an adviser does because if you go in blindly not knowing what you want, you could be an easy target to be sold things you don’t need – generally, a variety of unnecessary ongoing fees that eat into your nest egg.

This is the follow-up article, and it goes through ways to vet an adviser, including background checks, and then moves onto a detailed list of the more common sales tactics many financial advisers use so you have the highest chance of finding one that has your best interests. It ends with a summary you should keep in mind and use when questioning an adviser in the initial interview before engagement.

What do financial advisers do?

How to choose a financial adviser

How to choose a financial adviser

Before even starting: Avoid Free Advice

It will cost you a lot more than paid advice. When was the last time you worked for free? Never? Then why would you think someone else would do it? If someone is giving free personal or product advice, they are getting money out of you in a hidden, underhanded way, and this is not a person you can trust with your finances.

Background checks

1. Always check they are a registered financial adviser on the Financial Advisers Register and that they are currently licenced and have no remarks such as disciplinary actions against them. This one simple step eliminates most of the extreme cases where someone was scammed by a conman posing as a financial adviser. Checking for any enforcements is also a good idea.

2. Google them. When people have been scammed, it’s not uncommon for them to put up webpages or post on multiple finance forums out of frustration.

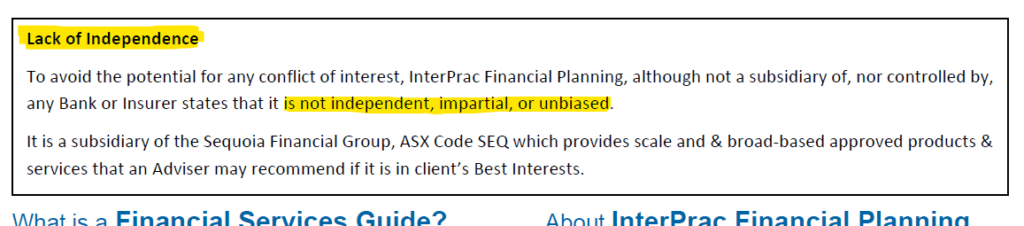

3. Read their Financial Services Guide (FSG). Usually you can find this on their website, and if not, email them to ask for a copy. It is a regulatory requirement now that the front page MUST tell if they are NOT independent, impartial, or unbiased. If they are not, ask them why. Here is an example of an FSG stating their lack of independence, as required by ASIC.

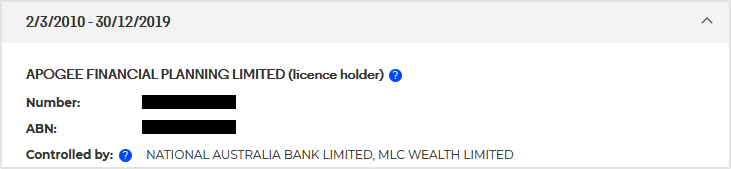

4. Check who holds the Australian Financial Services License (AFSL) and stay away from advisers who operate under a licence controlled by a financial institution.

If an adviser is tied to a financial institution, they will be bound by their terms and restricted to an approved product list (APL) provided by that financial institution. When being restricted to an approved product list from an institution that manufactures and sells financial products, the adviser might be inclined to ignore better insurance policies and better investments or superannuation funds because of incentives or in-house bonuses for recommending preferred products, which is a serious conflict of interest.

You want to stick with independently licensed advisers, which are typically small- to medium-sized businesses that have their own Australian Financial Services Licence (AFSL) or are licensed by an AFSL holder that has no ownership or affiliations with any products they recommend.

The first clue would be in the financial adviser register link above. Here is an example of an adviser operating under a licence jointly controlled by NAB and MLC.

If you don’t see anything there and get through to the interview stage, ask directly about their affiliations as part of their licence to financial institutions.

Tactics used by financial advisers to be aware of

Don’t make the mistake of asking what the standard industry practice is in terms of advisers’ pricing structure to base your decision on to get determine an appropriate fee because you will find that it is standard to make you think commissions, percentage-based fees, and ongoing fees are just the way financial advice works. Just because it’s standard doesn’t mean it’s in your best interest, and it rarely is.

1. Ongoing fees paid (and kept) regardless of the services provided

While virtually every other service industry charges fees based on actual services provided, the standard across the financial advice industry is ongoing fees that you pay for regardless of what services are actually used. It is essentially a retainer for services that may be provided, and with no refund when the service was not commensurate with the fee. And this is repeated year in, year out.

The reason they continue to get away with it is that their clients are seeking help because they don’t know any better. So when the adviser gives a quote which has per year after the dollar amount as though this is just the way financial advice is charged, they just go with it.

What’s worse is that because this is standard across the financial advice industry, if they interview another adviser, it’s likely they will get the same thing, reinforcing the idea that this is just the way of financial advice.

As mentioned during the royal commission, ongoing fees are often “an attempt to replicate the revenue stream that flowed from a combination of upfront and trail commissions”. For many unsuspecting clients, ongoing fees are nothing more than commissions in disguise.

Don’t fall for it. You’re the customer, and you’re in the driver’s seat. Unless you see a particular need for ongoing advice, you can state that you’re looking for a one-off financial plan and implementation without ongoing service fees. And when you say no to ongoing fees, there’s nothing stopping you from going back to them when your circumstances change, but for most people that doesn’t happen frequently enough to justify thousands of dollars each year in ongoing fees.

There are periods where ongoing fees are useful — generally when there will be a lot of life changes — but don’t just assume that because an adviser made yearly fees sound normal that you have to accept it. Look closely at the services provided by the ongoing service agreement and be critical in determining if there really is value to the tune of their ongoing service fee, because more often than not it’s just a sales pitch with very little work done after the first year to justify high ongoing fees.

Don’t automatically agree with what advisers say. Being a salesperson is a big part of the job for many advisers.

2. Creating an ongoing income stream from you for work that is either not provided or completely unnecessary

There are a range of ways that this is done.

A. Creating an income stream from your investments

The number one way advisers create their income steam from clients is by convincing clients to put their money into a platform that allows the adviser to manage their investments, creating an entirely unnecessary job that justifies being paid thousands of dollars a year.

To create an income stream from you, rather than setting it up in a way that you can easily manage yourself, advisers often make it seem like investing is very complicated and put you into a platform where they can manage your investments for you. They put you in 23 different funds with the entire goal being to make it seem too difficult to manage yourself, thereby securing their ongoing fee of thousands of dollars a year from you. For many advisers, complexity equals job security.

Tactics they use include:

- Promising or suggesting they can outperform the market. The chance of this happening is incredibly unlikely, and the data shows it. You need to be lucky for them even to match the performance of a simple, low-cost index fund.

- Saying there are more investment options. This is true but completely unnecessary. There is so much data showing that simple, easily accessible, low-cost index funds outperform the overwhelming majority of actively managed funds that these additional options usually provide nothing and are often detrimental. Notice the factual statement (that there are more options) leading you to the false conclusion that there is a benefit?

- Saying there is easier tax reporting. Again, true, but again, manipulative, because an accountant will cost a fraction of the cost of the platform and an adviser fee.

On top of securing an ongoing income by making it seem all too complicated to do it yourself, the result of putting you in a platform where they manage your investments is that they can charge you an ongoing fee that feels free because rather than being required to actively make the payment by funds transfer, cheque, credit card, or cash, it gets paid by painless extraction out of your investment account. They get you to agree at the beginning, and from then on, your investment returns are lower without you even noticing, being notified, or ever seeing a comparison of how much your investments would have been if not for the fees. Here is a detailed article on wraps and why advisers love them that everyone should read before seeking advice.

Your first question if they want to manage your investments should be whether they are using low-cost index funds, and if not, ask them to justify why not, and be very sceptical of the answers. If they are using low-cost index funds, their fee for managing it should be very low, certainly less than $1,000 per year.

Percentage-based fees

The platforms mentioned above allow your adviser to not only charge you in a way where your advice fee is extracted regularly without you initiating the payments yourself (or even see it occurring or be notified of it at the time it is taken), but they also offer a way for the adviser to charge fees based on a percentage of your assets invested. Over time you expect your assets to grow, yet the amount of work for an adviser to manage a $300,000 portfolio or a 3 million dollar portfolio is exactly the same, but with a percentage-based fee, they can get 10x the fee from you each year. ASIC banned commissions on investment products, but ongoing percentage-based fees are essentially commissions in disguise and are a loophole for advisers — and platforms enable advisers to get these ongoing percentage-based fees.

Percentage-based fees also influence their advice. If your adviser is faced with the decision to recommend paying down your mortgage or adding the money to an investment with a percentage-based fee, there is nothing stopping them from choosing the latter based on themselves getting more money out of you rather than making a decision that is really in your best interest. And while ASIC have a ‘best interest duty’ requirement for advisers, how would ASIC ever know the adviser’s real motives when the adviser can just pick one of several legitimate reasons why it is better for the client to invest the money?

You also need to know that advisers can get around saying it is a percentage-based fee by charging a flat yearly fee that just happens to be based on the size of your assets rather than the actual service being provided. I can’t tell you how many people have told me they went to one adviser (or even multiple advisers) where the yearly fee just happened to be 1% of their assets even when their situation wasn’t complex enough to warrant such a high fee. Someone with 800k of assets was quoted 8k per year from multiple advisers. Another with 1.2m quoted $12k per year. I can’t even imagine the complexity of advice someone would need to justify such high fees, but I hear of these types of fees with alarming regularity.

If the advice you require isn’t unusually complex (such as a lot of tax structuring/superannuation/pension/aged care advice), the average advice fee is around $3,500-4,500. If you have $600,000 and your situation isn’t particularly complicated, and they just happen to quote you $6,000 per year, be suspicious.

It’s a common sales tactic for advisers to make it sound like 1% is not much because to the uninformed person, it sounds insignificant. You need to know what a 1% fee really means, so if you haven’t read it yet, please have a read of how 1% fees cost you a third of your nest egg.

B. Creating an income stream from your super

This ties back into the previous point, except it is with your super instead of your investments outside super.

Industry super funds are low-cost super funds run only to benefit members, which means profits are returned to members, not shareholders. They also do not pay commissions to financial planners. Industry super funds are an excellent choice for your super, and most people don’t need to have a hands-on approach to their super beyond what is offered in industry super funds in terms of choosing investments, rebalancing every year, etc.

Advisers will use the same first couple of arguments as above to convince you why you should move out of an industry super fund to a wrap platform where they manage your money:

- they can outperform (highly unlikely)

- there are more investment options (true but doesn’t provide a benefit)

And they will throw in some additional arguments:

- super funds lack transparency – yep, again true! but you can get low-cost index options in super through industry funds which do the job. In fact, even the pre-mixed (active) options in industry super funds are likely to be better than the wrap after adviser fees.

- there are tax advantages of platforms in super – again, true, but again, that is only half the story because you can do the same thing through many industry funds using direct investment options minus the ongoing adviser fee eating away at your returns.

Be suspicious of an adviser trying to talk you out of an industry super fund.

C. Creating an income stream from your insurance

Thankfully ASIC has banned commissions on investment products, but commissions on insurance products continues to be allowed.

Paying advice fees via commissions has the same effect as paying via a platform, which is that it feels like you are not paying anything. As a result, you are likely to forget about it while it eats away at your income year after year.

In theory, there should be ongoing services with commission-based insurance, such as an annual review of the insurance policy, policy variations, and help with claims. Unfortunately, often there is little or no ongoing work done and this ends up being nothing more than a way for advisers to create an ongoing income stream from you as these fees sit there eating away at your income long after their initial service has been provided. With ongoing fees paid directly to your adviser, there are requirements to do something for the annual fees, but demonstrating that more than nothing is being done is a low bar. However, with insurance commissions, there is no requirement to do anything for the ongoing commissions they receive.

Clients mistakenly believe that, like almost all commission-based products, the commission comes from the company selling the product and not from the client. The reality is that the adviser has complete control over how much they inflate the commission amount, and the result is that the client is paying those commissions themselves through inflated premiums. An adviser can rebate future commissions after an agreed-upon fee has been paid, and while this is a big improvement, it still has the problem of aligning them only with companies that offer commissions, so the advice isn’t unbiased and free of conflict.

The commission-based adviser also gets paid more if you spend more on insurance, which is a conflict of interest. Insurance is often oversold by commission-based advisers because it’s in their interest – not yours. And for the same reason, a commission-based adviser is less likely to promote ways to reduce premiums (such as paying annually to get the annual discount, increasing your waiting period, and avoiding unnecessary extras) because that reduces their income.

Tactics used by advisers to justify commission-based insurance include:

- Making it sound like the insurance is free by saying you don’t need to pay anything to the adviser for their insurance advice. In reality, their advice fee comes directly from your inflated insurance premiums.

- Saying you get an annual review of the insurance policy and policy variations. Unfortunately, as seen in the royal commission, often there is little or no ongoing work done after the first year.

- Saying they offer assistance with claims at no extra cost. Unfortunately, they leave out the additional cost to you over time due to the inflated premiums.

The first thing to decide is if you even require ongoing advice for insurance. If you are not in a stage of life where you will be going through frequent life changes, such as growing your family, your situation is not changing as frequently as every single year. If you have determined that you require ongoing insurance advice, consider an ongoing service agreement that is fee-for-service instead of bundling it in with the insurance premium to remove the conflict of interest and make sure the fees are more transparent and obvious.

Commission-based insurance only makes sense when your cashflow isn’t enough to pay for the advice fee because commission-based insurance is better than being uninsured.

D. Creating an income stream from your bank account

A cashflow management system (or a budget) involves:

- downloading your expenses from your bank and imported into software

- seeing from your expenses how much you need for each expense group

- setting up automated payments to different bank accounts.

An adviser helping you set up a cashflow management system may offer to do this for you by ‘managing’ your accounts. I’ve read of advisers who charge up to $5,000 per year for this service. And while creating a cashflow management system can provide a benefit beyond that incredibly high fee, the reality is it can be easily done without the ongoing fee. Instead of giving them access to your accounts to set it up and manage it (and create an ongoing income stream from you to them), get them to help you set it up without any need for ongoing work.

3. Replacing products for their benefit, not yours

Any time you get a recommendation to switch products or super funds — especially out of low-cost index-based investments — be critical and ask lots of questions. Make sure they explain:

- why the recommended product is superior to your existing product

- the benefits/features gained by changing products (and critically assess whether you need all of the benefits/features gained)

- the benefits lost by changing products (and critically assess whether you need any of the benefits/features lost)

- whether your existing product really is not suitable for your situation (if the advice states it is not)

- in particular, if the fees are going up, a good reason why they are going up and specifically, how the recommended product better meets your needs, in order to justify the higher fees.

They may be doing it to create an unnecessary job for themselves so they can get ongoing fees from you, as explained above.

If they are aligned with a financial institution, they may be getting incentives or in-house bonuses for recommending preferred products.

And when evaluating recommendations for switching, don’t just look at the cost of the investment options. It’s not uncommon for advisers to spout the advantages of low-cost index funds, knowing that index funds have become more widely known, and then tack on a 1% p.a. advice management fee, making it sound like 1% isn’t much. Over decades, 1% p.a. reduces returns by hundreds of thousands of dollars.

Multiple people who work in the financial advice industry who critiqued this article noted the importance of this point. The reason ties back to the fact that you want your advice to be strategic in nature (achieving your goals), rather than product-focused (selling you on the advantages of changing your investment or insurance products, often so that they can get a benefit for themselves by way of commissions, asset-based fees, or bonuses from their licensee).

4. Not telling you in the interview what services you can expect from them and how they can help you

During the initial interview, a good financial adviser should explain clearly how they can add value to you. They need to justify why you should pay them for advice, what it is they add, and why what they add is suitable for your specific situation.

Some advisers won’t tell you much in the interview. They will make it seem like they have a super-secret investment or strategy that you need to pay for them to give the big reveal for. That is the oldest sales tactic in the world. It’s called FOMO (fear of missing out), and it preys on your emotions to get you to pay for something you otherwise would not have. You don’t want a person like that managing your money.

If they cannot explain clearly in the interview how they can help, move on to the next interview. It might take a few interviews to find someone, but there are some great advisers who are transparent and willing to show you how they can help you before you engage them.

5. Not quoting all the fees before engagement

If an adviser doesn’t quote all the fees for the advice, implementation, and any ongoing fees before you agree to sign anything, that’s a red flag. They may not be able to quote all the fees at the interview, but they certainly should before you are asked to agree and sign anything.

Transparency is crucial for someone who you will trust and rely on to assist with your finances. Ask them straight out before signing if that is all the fees, including advice, implementation, and all ongoing fees.

Summary

Financial advice can add real value to your life. However, keep the following in mind:

- Educate yourself beforehand. Don’t assume everything they say is correct and the whole story.

- Interview several advisers (minimum 3) until you find one that you feel comfortable with and who meets all of the criteria below.

- Ask about their investment philosophy – passive indexing vs actively managing your portfolio for high ongoing fees

- Beware of advisers selling you on their ability to generate higher investment returns by having them manage your investments. Most of the time you’re being sold something you don’t need, which not only doesn’t result in higher returns, but erodes your returns by their investment management fee.

- Good advice is not focused on investment products. It is focused on strategies that help you meet your goals such as cashflow management, debt management, tax planning, superannuation strategies, etc.

- If they suggest replacing any of your existing products, make sure they provide clear reasons and that it aligns with what you are trying to achieve and the type of advice you’re looking for.

- Ask how they structure their fees. Seek out an adviser who will provide you with one-off advice for a one-off fee, and have a meeting each year to see if any changes are needed rather than an adviser who gets paid ongoing fees, almost always by commissions and percentage-based fees, which not only are not commensurate with the work provided, but can influence the independence of the advice you receive.

- Check whether the adviser is properly licensed, including any enforcements.

- Ask about the ownership of the adviser’s business and assess how that might influence what they recommended to you. In particular, check whether it operates under a licence controlled by a financial institution instead of being independently licensed.

- During the initial interview, a good adviser should demonstrate clearly how they can add value, how they justify the cost of the advice, and why it is suitable for your situation.

- Consider an independent adviser who is a member of CIFAA, PIFA or an adviser from the ADF Financial Advice Referral Program. These advisers should not have remuneration conflicts of interest.

- Question every fee and know that fees can be negotiated.

- Know that you don’t need to pay for their ongoing services. Many people receive very little service after the first year but pay a lot year after year in the form of commissions and percentage-based fees. You can have them provide the plan and help in implementing it in a way that you can manage yourself. This will save you a significant amount in fees and you can then go back only when needed, generally when you have a change in circumstances, which happens infrequently.

Resources

Six Question to Ask A Financial Adviser

An overview of the financial advisor & retirement planning industry by Netplan (7 minute podcast)

How to find the right financial adviser for you – ABC News

How to Find a Financial Advisor You Can Trust – Aussie Doc Freedom

Profession of Independent Financial Advisers (PIFA)

List of Australian independent financial advisers — Super Guide

ADF Financial Advice Referral Program

Association of Independently Owned Financial Professionals (AIOFP)

Independent financial advisers and planners in Australia | Canstar

How much does financial advice cost? — Super Guide

Financial Advisor Fees — How Much Do They Cost? | Canstar

How 1% fees cost you a third of your nest egg

Wraps and why advisers love them